Truflation US Inflation Update for November 2024

As the year winds down, Truflation CEO Stefan Rust and data analyst Oliver Rust shared exclusive insights into inflation trends, consumer behavior, and the economic outlook for 2025 in a detailed conversation. Let’s dive into the highlights from their discussion, offering a comprehensive view of the economy and what lies ahead.

Remember, you can watch the full interview on our YouTube channel for even more insights and details. Additionally, you can download the complete presentation file of the report at the end of this blog.

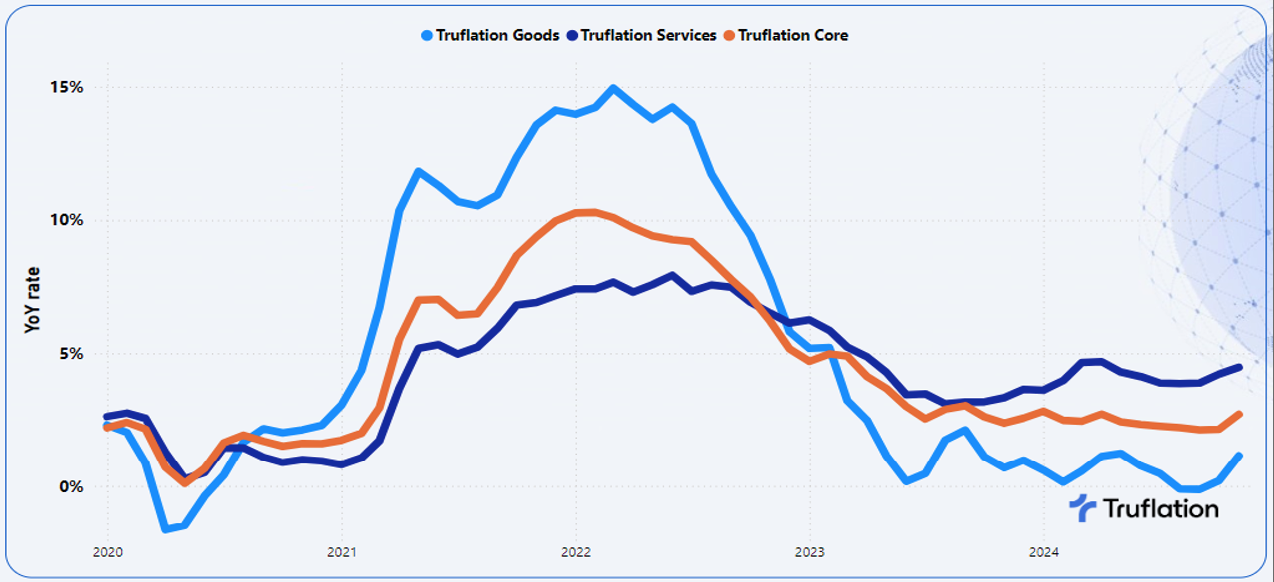

Inflation is Rising

Truflation forecasts the Bureau of Labor Statistics (BLS) will report November inflation at 2.7% on December 11th, consistent with its real-time daily updates. Unlike the government’s lagging two-week reports, Truflation provides daily insights.

- Core Inflation Growth: Core inflation, which excludes food and energy, is accelerating. This reflects sustained upward pressure across the economy and indicates that inflation is not going away.

- Looking Ahead: Inflation is expected to rise further in Q1 2025, fueled by tight labor markets, wage growth, and policy shifts under the Trump administration.

What’s Driving Inflation?

- Healthcare: Insurance premiums and medical costs continue their steady rise, driven by labor shortages and an aging population.

- Household Durables: Items like TVs and refrigerators are increasing in price as consumers anticipate future hikes.

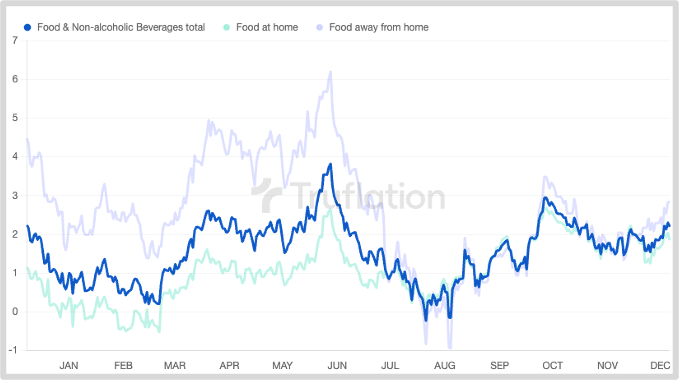

- Food: Groceries and dining out costs are rising across the board due to commodity price increases, transportation costs, and labor challenges.

On a brighter note, gas prices declined in November, offering relief to transportation costs.

Consumer Spending and Debt

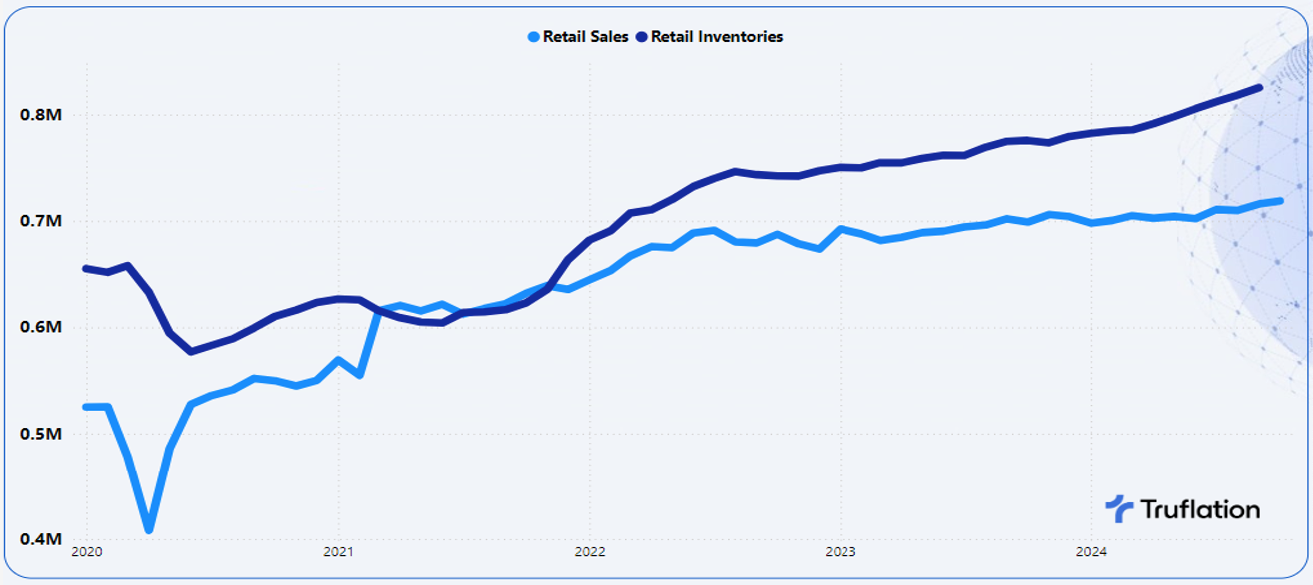

Spending Patterns:

- Consumer spending grew 0.4% month-over-month, with the holiday season boosting activity further.

- Savings rates rose to 4.4%, reflecting improved household finances.

Debt Trends:

- Household Debt: Total debt reached $17.9 trillion, but credit card delinquency rates are down, suggesting better financial discipline.

- Government Debt: The U.S. added $750 billion in two months, raising concerns about long-term sustainability as total debt exceeds $36 trillion.

Projections for 2025

Opportunities:

- Consumer Confidence: Higher wages and asset appreciation are fueling optimism and spending.

- Wealth Generation: Rising stock prices and strong crypto markets are driving increased household wealth.

Challenges:

- Debt Management: High levels of household and government debt remain a critical concern.

- Policy Impacts: Deregulation and labor policy changes could reshape key sectors like energy, healthcare, and crypto.

Looking Ahead: Key Dates

- December 11th: The BLS will release November CPI data, with Truflation forecasting 2.7% inflation.

- December 18th: The Federal Open Market Committee (FOMC) will decide on interest rates, with a 25 basis point cut widely anticipated.

Closing Thoughts

As we head into 2025, the U.S. economy shows resilience with strong consumer spending, growing savings, and GDP growth. However, challenges like rising debt and persistent inflation demand attention.

Stefan summarized it best: “Make America Wealthier.”