Where Is Inflation Headed?

April was marked by great volatility in the markets, largely due to uncertainty about the outcome of the tariffs.

While the market negotiates news and expectations, it is important not to forget the concrete signs of the economy.

After all, all this volatility is caused by variations in GDP expectations and the inflation and interest rate duet.

We will update you on the main information about inflation, mainly because of what can be seen in the economy.

What the Latest Data Shows Us

Before forming any expectations, it is important to look at the concrete facts, the latest data on inflation.

The problem of inflation haunted the entire world after 2020, mainly due to the increase in the monetary base.

Gradually, with restrictive monetary policies, this problem began to be resolved. However, until 2024, there was a long way to go before American inflation would be completely under control.

In December 2024, our index still recorded inflation of 3.11%, considerably far from the FED's 2% target.

However, the scenario began to improve in 2025, with successive drops, reaching a low of 1.22%.

The highlight is the drop in utility prices, especially energy costs. In addition to the lower rate, it is important to note the continued downward trend.

One of the drivers of the drop in pressures is the decrease in government spending, and also the effect of the restrictive monetary policy, which also affected the level of employment. The unemployment rate went from 3.8% in December 2024 to 4.2% in March 2025.

Even though it is 45 days behind Truflation, the BLS is also already recording a drop in inflation. The CPI went from 3% (YoY) to 2.4% from January to March.

The PPI, in turn, went from 3.7% to 2.7% in the same period. In addition to the recent drop, two points can be highlighted:

- Reducing producer inflation eases inflationary pressure for consumers.

- Based on Truflation’s trend, the BLS may not show significant changes in upcoming publications; however, more data over the coming week will allow for a clearer and more accurate estimate.

Using Truflation data is the best way to stay ahead of the curve when it comes to inflation.

While the current trend offers some stability, there are some challenges ahead as we look to the future, and it’s time to explore them.

What lies ahead

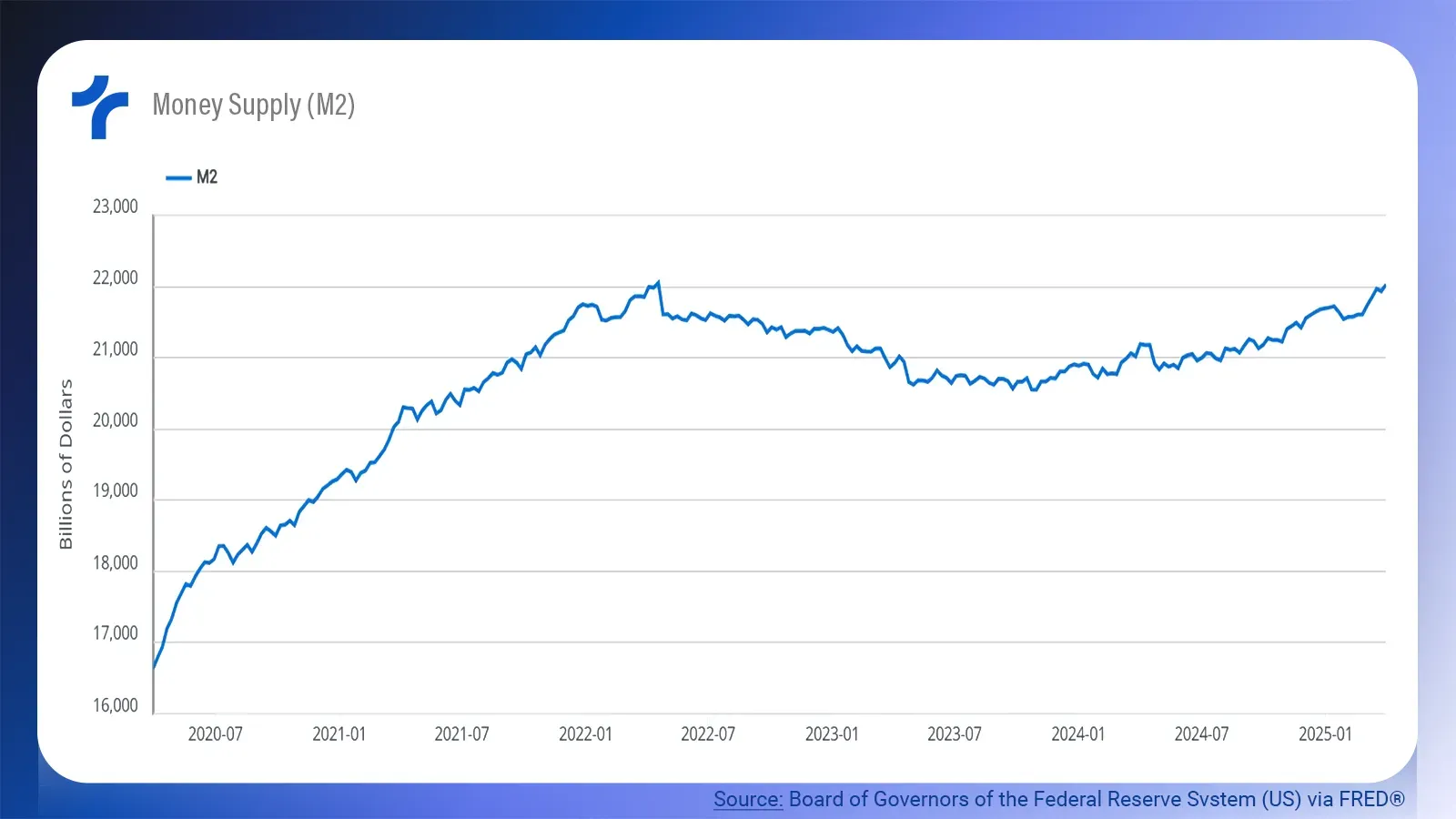

The current trajectory does not guarantee that inflation will stabilize in the coming months. An important factor is to analyze the money supply (M2).

The money supply is a key factor when analysing price levels. The greater it is, the higher the demand for goods and services tends to be, which in turn pushes prices up.

However, this effect is not immediate, it can take between 3 months to a year for the full impact of an increase in supply to be reflected in prices.

On the other hand, if the production, supply of goods and services increase, it can partially or fully offset this effect.

Over the past 12 months, we’ve seen around a 5% increase in M2, while in the past 3 months, the increase was roughly 1.5%. If economic activity continues to grow, this shouldn't become a major issue.

What’s more concerning, however, is the wildcard: tariffs, especially due to the uncertainty surrounding them. We still don’t know which deals will be reached or what the final rates will be.

In addition, it’s hard to anticipate how much American industry will be able to substitute foreign production, and what the total impact on costs will be.

Our team expects an inflation increase of around 0.8%. However, if the trade war escalates, supply chains could face more disruption. This price shock is also likely to occur quickly, with a noticeable month-to-month jump in inflation.

Another interesting point that could affect prices is the exchange rate. The DXY index has fallen 10% since January, which means that imports could become more expensive, regardless of the tariffs applied.

The positive side is that with possible agreements, the dollar could see a recovery in the coming months. To get an idea of how important this is, in 2024 imports were equivalent to 14% of GDP.

Why the Future of Inflation Matters

Inflation is one of the most important indicators of the economy, and on the one hand, it affects the general population.

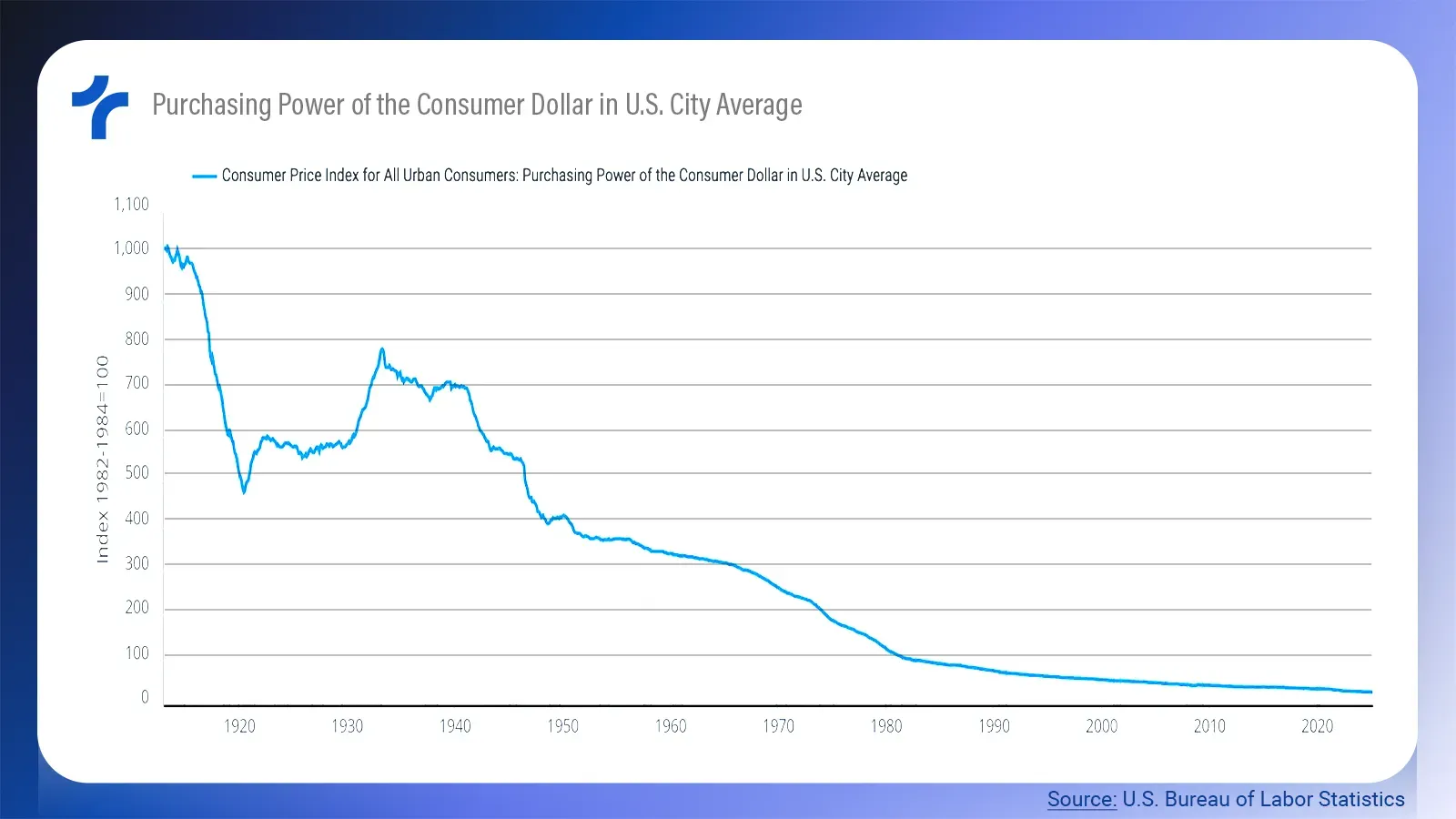

Increase in the cost of living, lower real wages, and even loss of purchasing power in invested capital. Perhaps the number of 2 or 3% inflation per year may not seem so harmful in the short term, but over time, it is enormous.

Since 1913, the purchasing power of the US dollar has fallen by 97%, according to the BLS. This implies a higher cost of living and often a drop in quality of life.

On the other hand, inflation determines monetary policy. If there is a significant shock to inflation, the FED may raise interest rates again or pause the cuts for a longer period. What does this mean?

Higher interest rates imply less consumption, less investment, higher mortgage rates, lower economic activity, and consequently lower profits for companies, affecting unemployment and wages.

This is one of the reasons why the market is so sensitive to the unpredictability that tariffs are bringing.

To understand economic dynamics, it is necessary to understand inflation, and Truflation keeps you updated on everything.

Final Thoughts

After a long period of high inflation, we are seeing a downward trend in the increase in the price level.

A controlled inflation would result in a reduction in restrictive monetary policy, mainly through a drop in interest rates, an important factor for both consumers and businesspeople.

However, the scenario is still challenging. Tariffs and the devaluation of the dollar against other currencies could lead to a new peak in inflation, and never forget that, even though the term “transitory inflation” is fashionable, the loss of purchasing power is permanent.

Understanding the dynamics of inflation is essential to understanding the markets, and with Truflation, everything becomes simpler. Stay tuned, there are more updates on the way.

Truflation | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube