Where is Bitcoin headed next? A Signal hidden in Real-Time Data

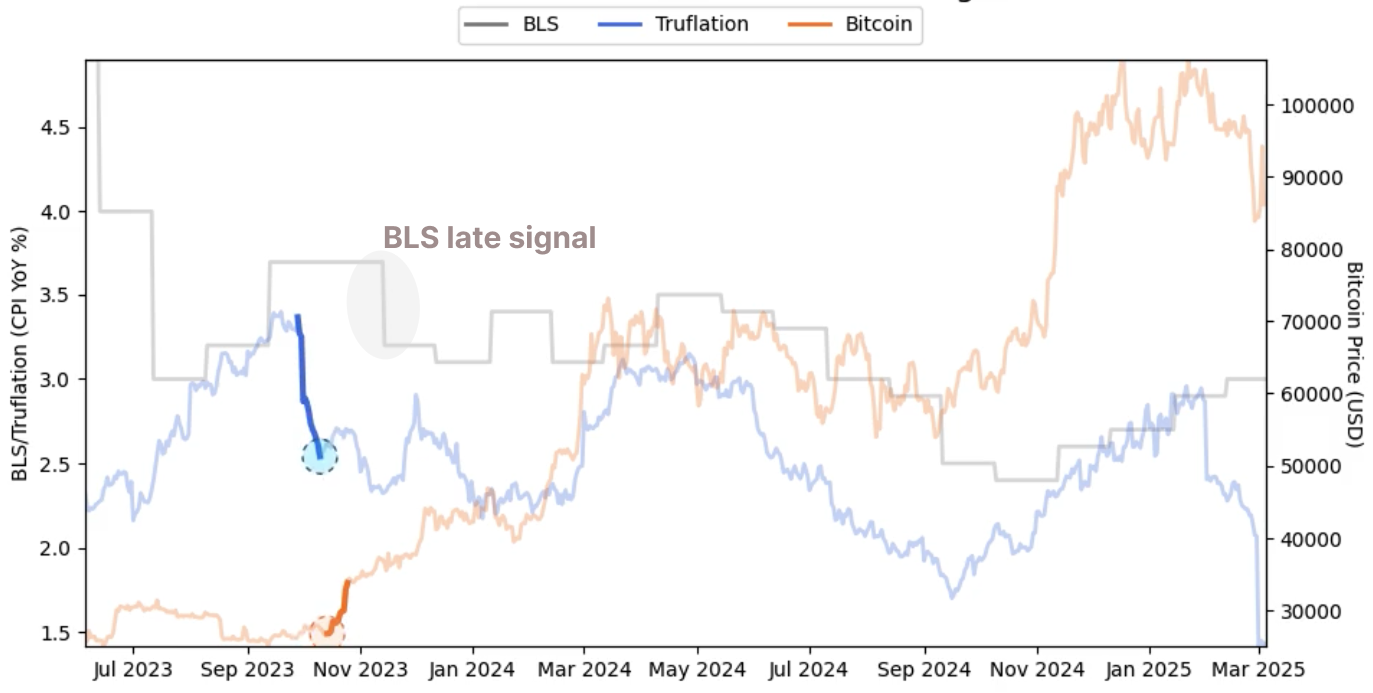

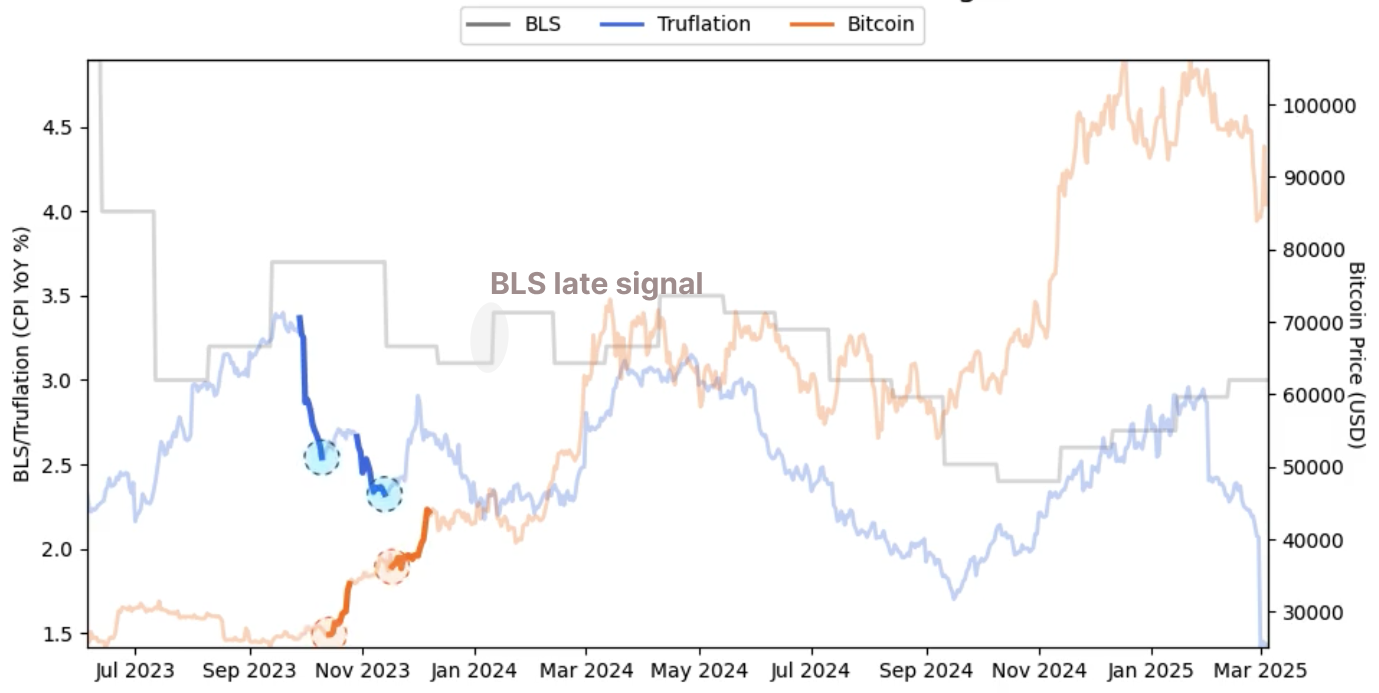

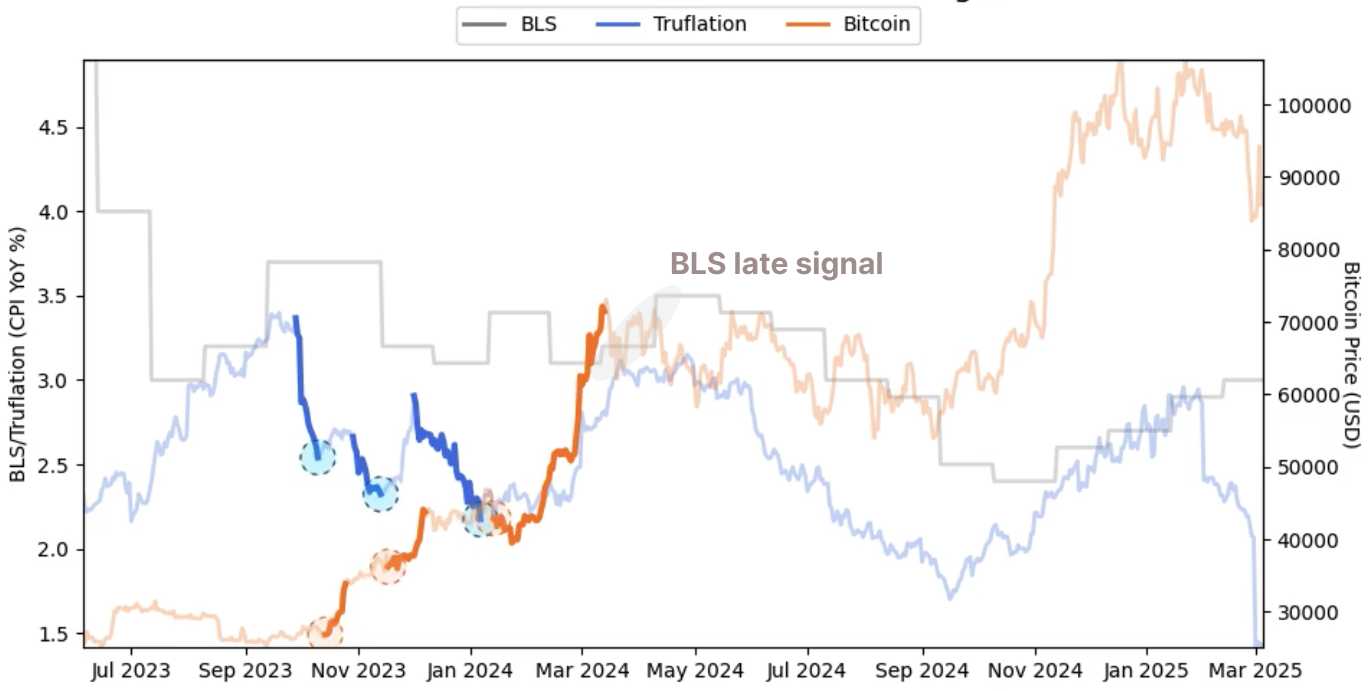

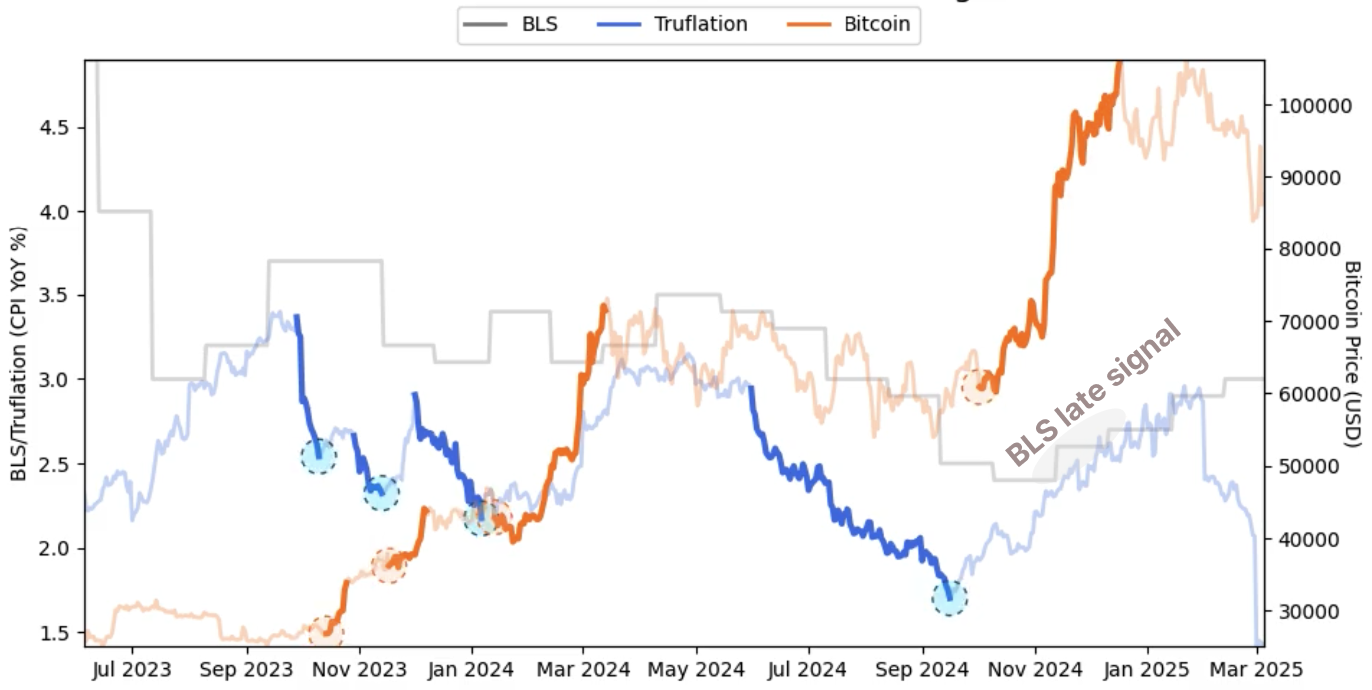

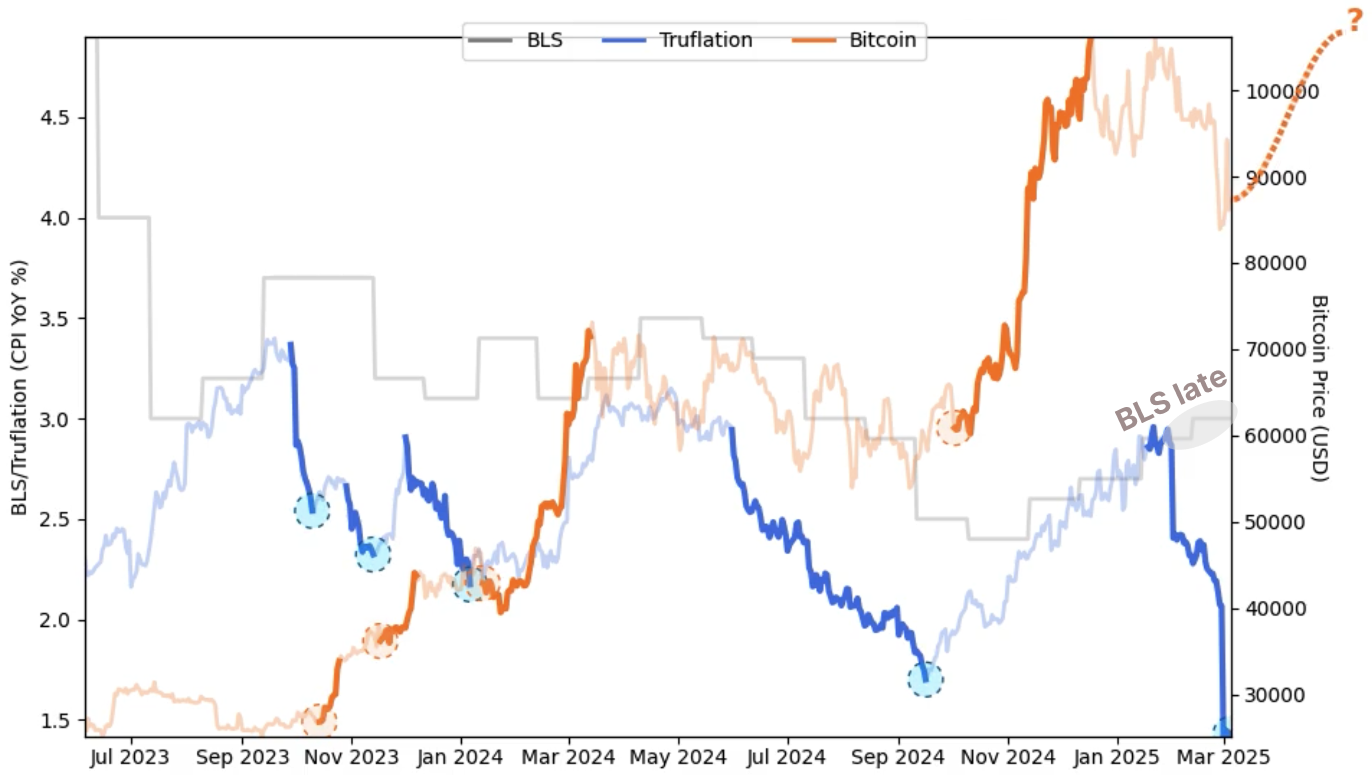

Since mid-2023, we’ve been tracking an intriguing pattern at the intersection of inflation expectations and crypto markets — one that centers around Truflation’s real-time inflation data and Bitcoin’s price movements.

And the more we observe it, the more one thing becomes clear:

When Truflation’s disinflation trend pauses or reverses, Bitcoin tends to rally shortly after.

This pattern has repeated a few times already — and if history rhymes, it may be unfolding once again soon.

Let’s dig into what we’re seeing, and more importantly, why it might be happening.

The Context

In the aftermath of COVID-19, the global economy was flooded with liquidity, and central banks slashed interest rates to zero. Unsurprisingly, this fueled a surge in inflation — but that same liquidity also helped drive Bitcoin to all-time highs in 2021.

To counteract the surge in inflation, the U.S. Federal Reserve began aggressively tightening monetary policy: hiking interest rates and rolling off its balance sheet (quantitative tightening).

- The Fed’s goal was clear: bring CPI back to 2%

As a result of these policies, Truflation bottomed at 2% in June 2023, followed by the BLS CPI bottoming at 3% in July 2023 (Truflation led the CPI by 45 days).

The period we’re focused on starts mid-2023 to now — essentially, the post-COVID inflation unwind, when bitcoin and other markets began wondering:

“Now that inflation has dropped ‘enough,’ when will the Fed start cutting rates?”

Truflation and Bitcoin

Since June 2023, Truflation has moved within an oscillatory range. From June 2023 to June 2024, that range held between 2.3 to 3.4%. After that, the lower bound extended, with Truflation reaching as low as 1.38%.

It is within this period that the relationship between Truflation and Bitcoin has presented a consistent pattern: Each time Truflation enters a downtrend (disinflation) that then pauses or reverses, Bitcoin tends to surge shortly after. Here are the periods where this phenomenon has occured:

- First Instance

- Truflation downtrend: Sept 28 – Oct 10, 2023

- Bitcoin rallied shortly after

- Second Instance

- Truflation downtrend: Oct 29 – Nov 13, 2023

- Bitcoin rallied shortly after

- Third Instance

- Truflation downtrend: Dec 01, 2023 – Jan 06, 2024

- Bitcoin rallied shortly after

- Fourth Instance

- Truflation downtrend: May 31 – Sept 16, 2024

- Truflation rallied shortly after 2025 (peaked at 3.10%)

- Fifth Instance?

- Current status: Since Jan 18, Truflation has dropped significantly to 1.30%, showing a new disinflation cycle.

Now we wait: Will Bitcoin rally again following this new downtrend?

What’s Really Going On?

We believe this pattern is not a coincidence. There’s a strong macro rationale behind it — rooted in how Bitcoin behaves in relation to monetary policy expectations.

Bitcoin is:

- Forward-looking

- Liquidity-sensitive

- And increasingly seen as a proxy for monetary easing anticipation

When Truflation shows strong disinflation, markets start to expect:

"The Fed is winning the inflation fight — the Fed has likely done enough tightening. Rate cuts may be on the horizon."

But when that disinflation slows or pauses (i.e., a “relief”), here’s what markets really hear:

“Inflation is still falling — but not collapsing. Recession fears are easing.”

That moment — when inflation isn’t re-accelerating nor falling into recessionary territory — becomes a sweet spot for risk-on assets like Bitcoin.

In short:

As of now (late March 2025), we’ve just seen another sharp Truflation downtrend — from 3.10% on Jan 19 to 1.30%, and it is slowly starting to go up, sitting currently at 1.80%. If the pattern holds, Bitcoin may be gearing up for another leg up!

Conclusion

Truflation offers a powerful informational edge — and Bitcoin appears to be reacting to that early signal, even before CPI data or the Federal Reserve catches up.

That said, Truflation doesn’t influence Bitcoin in a vacuum. No single data source ever does. But inflation expectations ripple across a wide range of markets — from equities to commodities — and especially into bond yields and forex markets. (We’ll be sharing more on how Truflation leads in those areas in upcoming blog posts.)

That’s why institutional investors rely on Truflation data to stay ahead of both macro and micro shifts. While we can’t disclose their proprietary models or trading strategies, we can share this high-level market insight — grounded in transparent data and observable trends.

If you’re interested in gaining the same informational edge as our institutional clients — with access to historical and daily real-time inflation data, broken down by category and subcategory — visit our subscription options.

You’ll be able to tap into the full depth of Truflation’s dataset and uncover signals that can help you stay ahead in today’s fast-moving markets.

Truflation | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube