WEB3 and RWA: How Technology Can Revolutionize the Economy

Technology is one of the main pillars of economic growth, as it can quickly increase a country's productivity.

This was evident with steam engines during the first phase of the Industrial Revolution, with electrification and combustion engines during the second phase, and more recently with computers and the Internet.

Today, advancements can be observed on two fronts. The first concerns the rise of Artificial Intelligence and its effects.

The second relates to Web3 and RWAs, let's explore the size of this market and how it could influence economic development in the coming years.

What Are WEB3 and RWA?

Although the names may seem complex, the concepts are simple. They impact more than just productivity, they are about how businesses operate, shifting much more power to the user/consumer through decentralized systems.

Web3

Web3 is the evolution of the internet, built on blockchain, decentralization, and digital ownership. Unlike Web2, which large corporations control, Web3 aims to give users more control. There are some essential features of WEB3:

- Decentralization: Resource and data transactions are peer-to-peer, so there is no need for an intermediary institution beyond the network itself.

- Digital Ownership: Users have full control over their digital assets, such as NFTs and cryptocurrencies.

- Interoperability: Applications and assets can be used across different platforms without barriers.

- Autonomy & Governance: Protocols enable active user participation through DAOs (Decentralized Autonomous Organizations).

Real World Assets (RWAs)

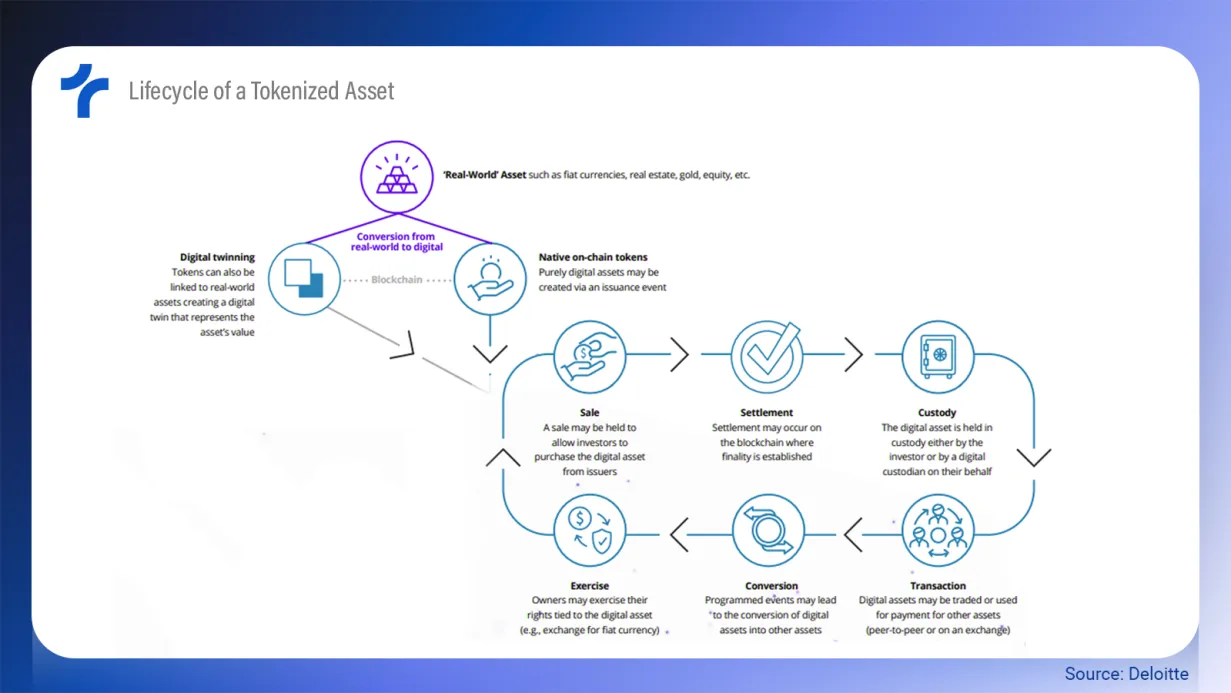

RWAs are real-world assets that are tokenized and brought onto the blockchain. This includes real estate, commodities, stocks, government bonds, and other traditional financial assets.

Tokenization allows these assets to be traded, fractionalized, and integrated into the decentralized finance (DeFi) ecosystem, increasing liquidity and accessibility. the main benefits of RWAs on the Blockchain are:

- Liquidity: Enables fractional trading of previously illiquid assets.

- Accessibility: Democratizes investment opportunities that were once limited to large institutional players.

- Efficiency: Reduces intermediaries and operational costs.

- Transparency: Blockchain ensures traceability and security in transactions.

There is a key distinction to be made: Tokenization is not crypto. Tokens reflect the fair value of the underlying assets they represent.

Opportunities and Challenges

The digital representation of traditional assets could enable new financial products and services to be introduced. For example, tokenizing exchange-traded funds (ETFs) could lead to the creation of digital funds, making traditionally illiquid assets more accessible.

Additionally, new digital assets, such as non-fungible tokens (NFTs), could be introduced through tokenization.

By enabling fractional trading, tokenization has the potential to attract new investors and unlock access to previously restricted markets. This applies to assets like real estate, artwork, and other high-value collectibles, making investment opportunities more inclusive.

Beyond accessibility, tokenization enhances operational efficiency by leveraging blockchain technology and smart contracts. These automate and streamline asset trading while facilitating programmable fund flows, reducing friction in financial transactions.

Moreover, tokenization could help modernize legacy financial infrastructure, improving efficiency and transparency across the industry.

On one hand, it is possible to solve pending issues in financial assets such as ETFs, bonds, as well as commodities and repo operations.

The main challenge is connecting blockchain ecosystems, especially across different regulatory frameworks.

How Big Is This Market?

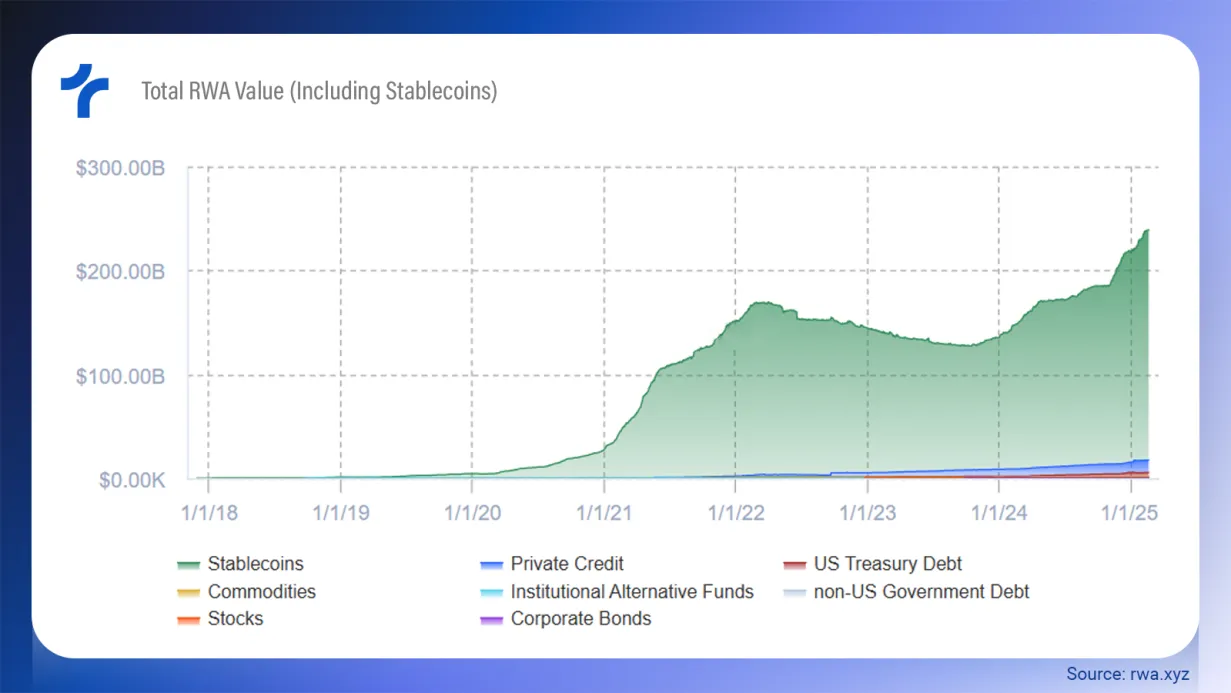

Today, the RWA market is heavily concentrated in stablecoins, primarily tokens backed by the U.S. dollar.

The website RWA.xyz reports a market of over $200 billion in tokenized financial assets. This is largely driven by the high concentration of USDT and USDC tokens, which are primarily used for international transactions and operations within the crypto asset market.

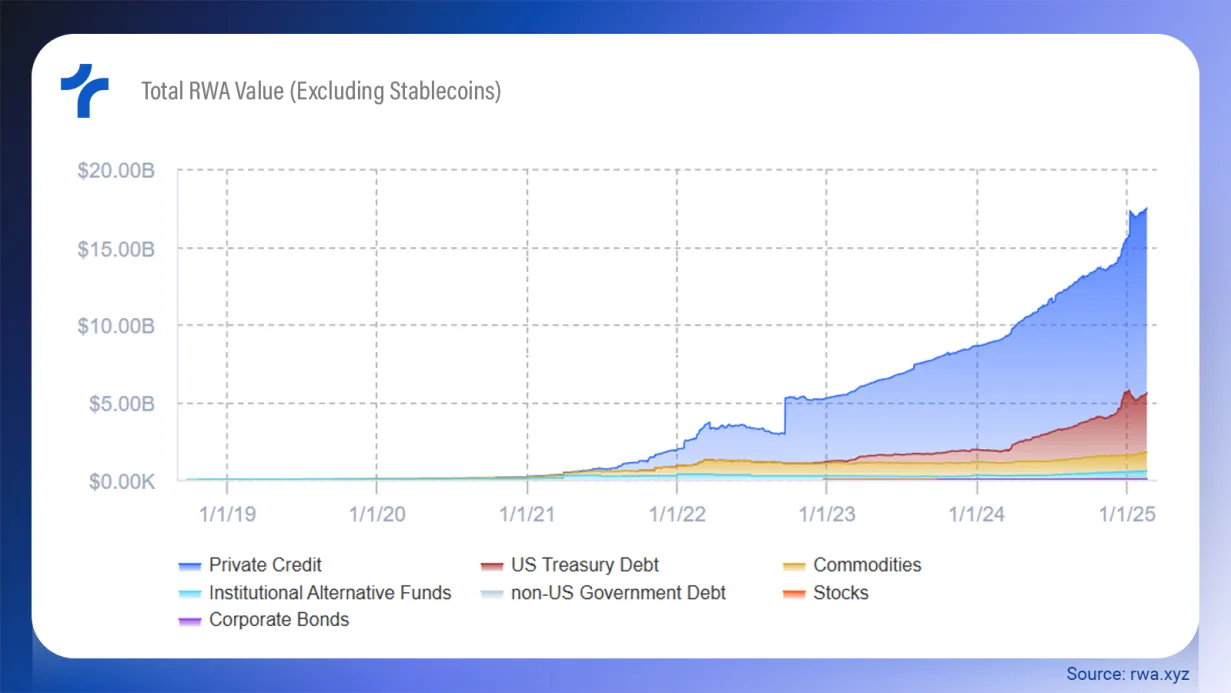

When looking at other financial assets, tokenization remains highly limited, mainly due to uncertainty and regulatory differences across jurisdictions.

Once clear regulations are established, this sector will be able to expand much more easily, enabling a borderless, 24/7 financial market.

This evolution does not necessarily depend on intermediary projects—treasuries and stock exchanges themselves could execute transactions directly on blockchains.

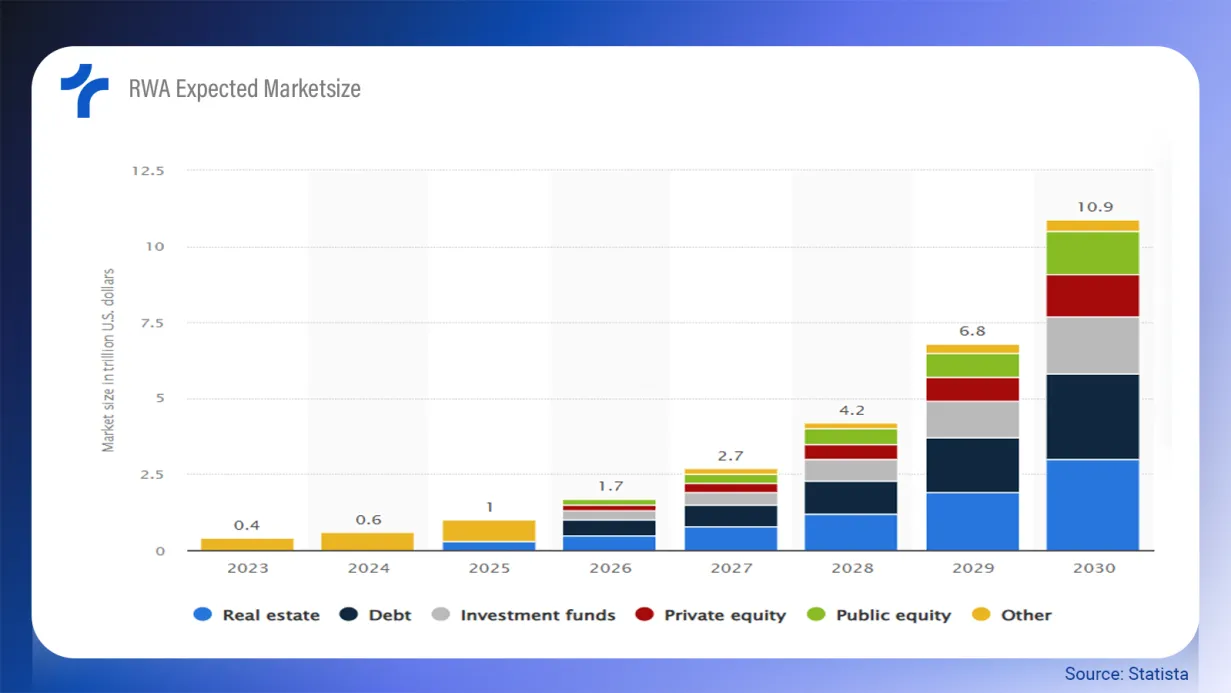

Today, we are witnessing the prelude to this market, but projections indicate rapid growth ahead.

From 2025 to 2030, the RWA market is projected to grow 10x. One of the key areas expected to expand significantly is real estate tokenization.

This transformation streamlines transactions, enhances property authentication, and significantly reduces costs and processing time when transferring ownership—all while maintaining security.

Blockchain technology has the potential to optimize these processes, and Web3 solutions can drastically cut costs while improving integrity and transaction speed. This ultimately means better financial accessibility and improved conditions for the general population.

Applicability: What’s Being Done

Web3 has the potential to transform multiple sectors of society, impacting both public administration and private enterprises.

The three main pillars of development in this space are:

- Property Rights Authentication – Ensuring ownership legitimacy through blockchain.

- Transparency in Public Institutions – Enhancing trust through immutable records.

- Fast and Efficient Transactions – Reducing time and costs in asset transfers.

Since this is a relatively new solution, the regulatory journey is complex, often causing delays in the implementation of early projects.

How Countries Are Adopting Web3 and RWAs

Although decentralization and P2P transactions are core principles of Web3, many tokenization projects still require validation from governments or legal entities.

For example, tokenizing real estate is only effective if the legislation recognizes tokens as proof of ownership. Without regulatory approval, such tokenization efforts remain experimental rather than legally enforceable.

Several countries are leading this transition by establishing legal frameworks and blockchain-based property registries. Let’s take a look at some of the key players in this space.

Estonia (e-Residency and Digital Identity)

Estonia is one of the pioneering countries in adopting blockchain for digital identity. Its e-Residency program allows people worldwide to establish companies and access government digital services remotely.

The system is built on blockchain technology, ensuring:

- Secure Authentication: Citizens and residents can access government services using a digital ID card.

- Electronic Signatures: Documents can be digitally signed with full legal validity.

- Data Security: Information is protected through encryption and immutable record technology.

Beyond e-Residency, Estonia has also integrated blockchain into its governmental infrastructure through KSI Blockchain, ensuring the integrity and authenticity of citizen data.

Sweden (Lantmäteriet)

Lantmäteriet, Sweden's National Land Survey, has been testing blockchain for property registration since 2016. The goal is to make real estate transactions faster and more secure, eliminating paperwork and increasing transparency. The main benefits are:

- Increased Efficiency: Reduces the time needed to complete property transfers, which typically involve multiple institutions (banks, brokers, and land registries).

- Transparency and Security: Blockchain records each transaction in a public and verifiable way, reducing fraud and disputes.

- Fewer Intermediaries: Enables direct transfers between buyers and sellers, minimizing bureaucracy.

The project is still in an experimental phase, but tests have shown that blockchain can significantly lower costs and speed up real estate transactions.

Dubai (Dubai Blockchain Strategy)

Dubai has an ambitious plan to become the first fully blockchain-powered city by 2030. As part of this initiative, the government has implemented blockchain to store official records, including:

- Business licenses

- Birth, marriage, and death certificates

- Government contracts

- Academic records

The Dubai Blockchain Strategy aims to eliminate paperwork and bureaucracy, allowing documents to be securely accessed and shared digitally. With this approach, Dubai expects to save billions of dollars in administrative costs, through:

- Less Bureaucracy: Instant access to records eliminates the need for multiple manual verifications.

- Fraud Reduction: Blockchain-stored documents cannot be falsified or altered without traceability.

- Global Accessibility: Citizens and businesses can access records from anywhere in the world.

This model is being closely watched by other countries seeking to digitize public services in a secure and efficient way.

Market Solutions

Beyond the directions chosen by governments, there are countless possibilities that the Web3 market offers to users.

Let’s explore some innovative projects that have transformed the market and provided investors with additional financial opportunities.

Truflation: The Revolution of Transparency in Economic Data

In a world where financial and political decisions rely on economic data, transparency and accuracy are crucial. Truflation emerges as a revolutionary alternative to traditional inflation metrics, providing real-time, unbiased, and publicly accessible economic data.

Currently, inflation indices like the Consumer Price Index (CPI) are provided by governments and centralized institutions.

These figures not only suffer from delays in reporting but are often adjusted to serve political interests, masking the real loss of purchasing power for the population. This outdated system has consequences like:

- Ineffective monetary policies based on outdated data.

- Distorted financial markets reacting to incomplete information.

- Unprepared consumers and investors struggling to deal with real inflation.

The lack of an independent, decentralized, and real-time inflation index creates distrust and weakens global economic planning.

Truflation transforms this reality by offering a decentralized, daily-updated inflation index, based on real-world data.

Truflation operates through real-time data collection, aggregating prices from millions of sources, including food, fuel, rent, and services, rather than relying on government statistics.

It leverages blockchain technology to ensure transparency and immutability, while decentralized oracles allow its data to be integrated into smart contracts, enabling the creation of financial assets that adjust automatically to real inflation.

Transparent economic data is essential for consumer empowerment, allowing individuals to make better investments, savings, and spending decisions based on real inflation rates.

It also promotes government accountability, preventing manipulation of inflation figures and ensuring more transparent and efficient policies. In financial markets, DeFi and stablecoins can be indexed to real inflation, protecting purchasing power.

Truflation represents a new era of financial transparency, shifting economic power back to individuals and markets

Index.fun – Democratizing Tokenized Investments

Index.fun is a platform that enables the creation and trading of tokenized financial indices, allowing users to invest in baskets of assets within the blockchain ecosystem. It provides:

- Simplified Access: Anyone can invest in indices without managing multiple tokens or assets separately.

- Easy Diversification: With just a few clicks, investors can gain exposure to entire sectors of the crypto economy, such as DeFi, GameFi, and NFTs.

- DeFi-Powered Automation: The platform automatically restructures and rebalances indices, maximizing efficiency and reducing costs.

By simplifying index investing in the Web3 space, Index.fun opens new opportunities for users of all experience levels, making decentralized finance more accessible than ever.

Nuon Finance – The Revolution of Inflation-Pegged Stablecoins

Nuon Finance has developed the world’s first positive stablecoin, Nuon, which is pegged to a decentralized inflation index instead of a fiat currency. This means:

- Inflation Protection: Unlike traditional stablecoins, which maintain parity with inflationary currencies (such as the U.S. dollar), Nuon preserves purchasing power by adjusting to real inflation.

- An Alternative for Unstable Economies: Users in high-inflation countries can store value without suffering the devaluation caused by weak national currencies.

- DeFi Innovation: Nuon unlocks new opportunities for smart contracts, enabling applications such as loans and investments that automatically adjust to inflation.

By rethinking stablecoins, Nuon Finance introduces a more resilient financial tool, helping users preserve value in a world of constant economic uncertainty.

Final Thoughts

Web3 and asset tokenization (RWA) have the potential to boost the economy, not only by increasing efficiency and productivity but also by introducing a new social paradigm, where individuals regain power instead of institutions.

Countless projects are being developed, and with a 10x projected growth over the next six years, the opportunities in this sector are enormous.

From financial instruments to property records, the world is rapidly shifting toward an on-chain structure. This means leveraging technology for society’s benefit and allowing the market to explore innovative solutions.

Stay ahead by using Truflation’s real-time inflation data, and don’t forget to protect your money.

Truflation | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube