US Q3 2024 GDP: Relentless Waves of Government Spending & a Demand-Driven Inflationary Market

By Oliver Rust, Truflation Head of Product

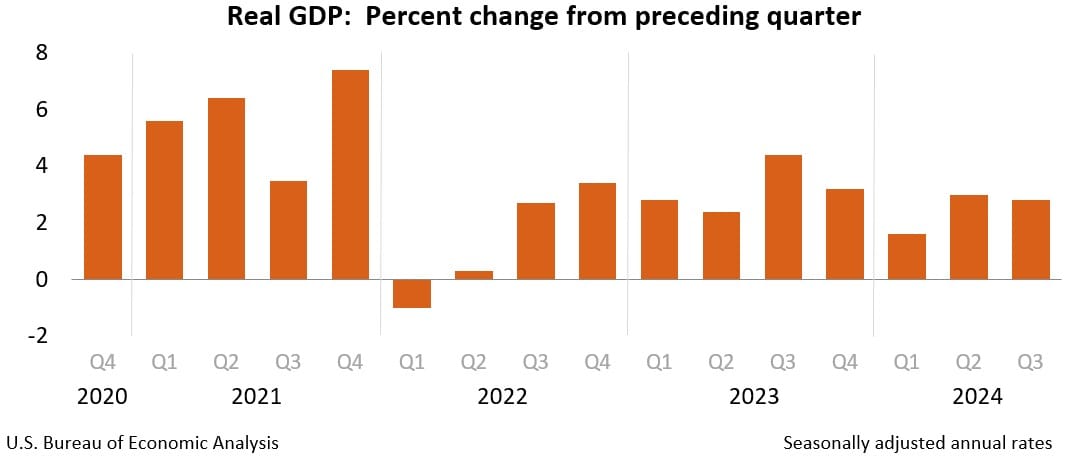

The US economy posted another solid period of growth in the third quarter, with gross domestic product (GDP) advance estimates coming in at +2.8%, marginally below expectations of 3.1%.

Consumer and federal government spending were the two biggest contributors propelling US Q3 GDP growth. This is on top of 3% in Q2, and the advance estimate confirms continued U.S. expansion despite relatively elevated interest rates and long-standing concerns COVID-19-fueled growth in fiscal and monetary stimulus (which carried the economy through) wouldn’t be ultimately sustainable.

Resilient consumer spending, accounting for about two-thirds of all activity, helped keep the economy moving combined with relentless waves of government spending that pushed the budget deficit to more than $1.8 trillion in fiscal 2024 alone. Personal consumption expenditures increased 3.7% for the quarter, the strongest performance since Q1 of 2023, contributing nearly 2.5 percentage points to the eventual total.

The other factor is federal government spending, which exploded, increasing by 9.7%, and driven by a 14.9% surge in defense spending. Fiscal spending at the federal level contributed 0.6 percentage points to US GDP growth. Combine this with ADP-reported private job growth, which grew by 233,000 in October (well above expectations), and it's easy to understand Truflation's position that the overall economy appears strong.

Our analysis is further reinforced by continued consumer spending likely impacting inflation given recent acceleration in the last couple of weeks.

If we add expected lowering of Federal Reserve interest rates (join us on X Spaces 7 November 2024 with Dr. Martin Hiesboeck of Uphold for Fed Decision Day: SET REMINDER) despite the seemingly strong economy ... the situation could quickly get frothy for the incoming US presidential administration Q1 of 2025.

In the meantime, another ominous sign involves consumers using savings and credit to help fuel their purchases, with personal savings rate reducing in the third quarter to 4.8%, down from 5.2%. Lower interest rates this cycle will help consumers in repayments, and likely fuel still-more growth in consumer spending especially given US labor market strength.

The US is now officially encouraging a demand-driven inflationary market.