Truflation: US Inflation Update June 2023

Last month saw another marked decline in US inflation, from 4.9% in April to 4% in May, as the Federal Reserve’s monetary tightening continued to pay off. This trend is widely expected to continue, with CPI edging ever closer to the Central Bank’s 2% target.

Truflation real-time index shows that US inflation is in fact much closer to this target than official numbers suggest. As of July 10, 2023, the truflation CPI index is sitting at 2.44%. Despite the discrepancy, however, we are pleased to see that the data from the Bureau of National Statistics (BLS) is finally catching up with truflation’s more up-to-date measurement.

Last month's strong decline in inflation prompted the Federal Reserve to put the brakes on its rate-hiking cycle, leaving the Federal Funds rate unchanged at 5%-5.25% at its last FOMC meeting in June. At the press conference, Chair Jerome Powell indicated that this was just a “skip” in the rate-hiking cycle. Thanks to this and the subsequent release of the meeting minutes, the market fully expects another 25 basis point hike, driven by a tight labor market and concerns over an expected wage increase of 5% by the end of the year.

However, given the CPI’s continued downward trajectory and historical precedent, there will be a great deal of pressure on the Central Bank to continue holding rates at current levels.

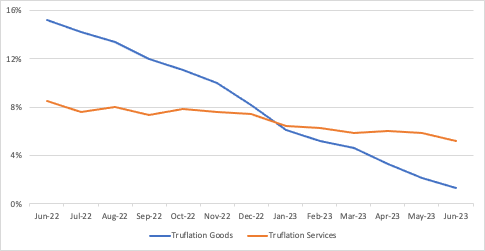

When inflation first began edging up in 2021, it was primarily driven by supply pressures. However, as the tightening cycle that began in 2022 pummelled consumers’ purchasing power, this narrative shifted toward more demand-driven inflation. As such, we are facing stronger downward pricing pressures from goods rather than services today.

In particular, sectors responsible for this shift are utilities, gasoline, and food – reflected in the decline of the Producer Price Index. Meanwhile, although prices in the services sectors are also on the decline, they are slowing at a significantly lower rate and remain higher due to the lingering tightness of the labor market.

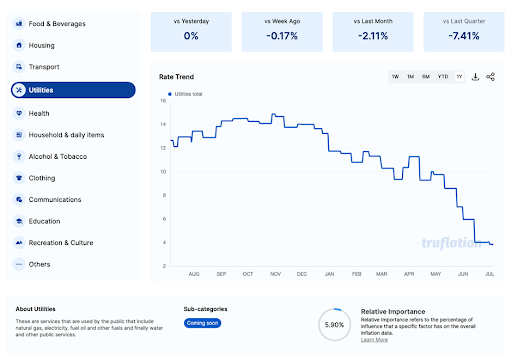

Truflation highlights the biggest downward movement in utilities, clothing, car purchases, communications, and health. This trend reinforces truflation’s expectation of a further significant drop in the June CPI number. However, it’s important to note that while inflation is dropping on an annual basis, prices are still rising month-over-month (MoM). Until we start seeing monthly declines, we cannot declare the battle against inflation truly won.

Truflation's mission is to provide the most accurate inflation measurement in the market by leveraging 30+ data sources and over 12 million price points for goods and services. Truflation is not designed to measure BLS numbers as that index is based on 80,000 items and uses a different methodology to ours, but we can reliably predict the BLS inflation estimate.

Recent inflation trends

After a significant drop of 0.9% to 4% in May, the CPI as reported by the BLS is set to continue its swift decline in June. Market expectations range from 2.9% to 3.4%, and truflation’s model shows that this figure will come in at 3.1%.

The market expects the Fed to increase interest rates by another 25 basis points at its next committee meeting on July 25-26 in a bid to hit its 2% target. Although significant progress has been made toward this goal, other economic indicators that the Central Bank watches continue to show strength – particularly the tight labor market.

On 7 July, the Department of Labor (DOL) reported another marginal decline in the unemployment rate from 3.7% to 3.6%. This came hot on the heels of the wage increase data released a day earlier, up from 5.58% to 5.74%. In particular, wages are on the rise in the service sectors, especially restaurants and bars, as the pool of employable talent continues to shrink.

The Fed expects the labor market to remain tight for the rest of the year, having reduced its end-of-year unemployment forecast from 4.1% to 4%. In addition, The DOL expects economic growth to come from small and medium enterprises, which is contrary to market expectations and certainly compounds the pressure on the Federal Reserve.

However, it’s worth noting that the unemployment rate as reported by the DOL is a lagging indicator. Looking at other employment indicators, such as dailyjobcuts.com, we see a significant increase in news and activity around layoffs as small businesses shut down. The Opportunity Insights Economic Tracker shows a 35% decline in business and professional job postings.

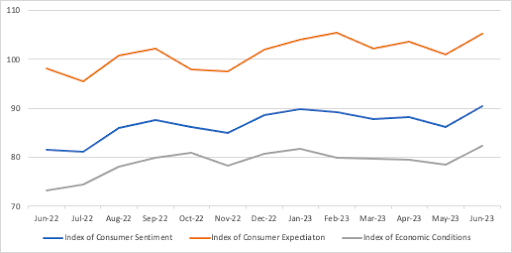

Given the tight labor market, consumers also appear to be expecting an improvement. Truflation shows consumer confidence improving by 5% since last month and 11% versus a year ago. This reflects the improvement in economic conditions, despite a raft of recent layoff announcements, while a belief in the availability of jobs is fuelling a positive outlook for business conditions. As inflation continues to fall, Americans expect an improvement in their personal financial situation and an increase in their disposable incomes.

This is also reflected in the YOY rise in retail sales combined with an increase in monthly spending from $623bn in January to $722bn in May. This may be partly explained by the fact that consumers’ purchasing power is improving as salary increases (5.7% YoY in May) continue to outstrip inflation.

In June, we saw the third and final revised estimate in the GDP forecast for Q1, which has improved again from 1.3% in the second revision to a final reading of 2%. However, this number remains below the 2.6% recorded in Q4 2022, while the upward revision can be attributed to the continued inflationary effect. In July, the first estimate for Q2 GDP growth is set to be released, and growth will likely continue slowing. This, no doubt, will add food for thought to the Federal Reserve's interest rate decision.

Key drivers of lower inflation

Over the past month, we have seen downward pressure on inflation from the utilities, clothing, car purchases, communications, and health sectors, primarily as a result of easing supply concerns and consumers being more frugal with their spending. Much of this pressure is driven by demand rather than supply, which also explains why goods are seeing a more pronounced price drop than services.

With oil prices holding relatively stable at $71.46 per barrel (as of July 6, 2023) and with natural gas commodities following the same pattern, it is no surprise to see truflation’s prices in the utilities sector down 1.1% MoM in June. Given the effect of the previous months’ drop in oil prices and the seasonal drop in usage over the summer months, we expect this trend to continue over the next two months.

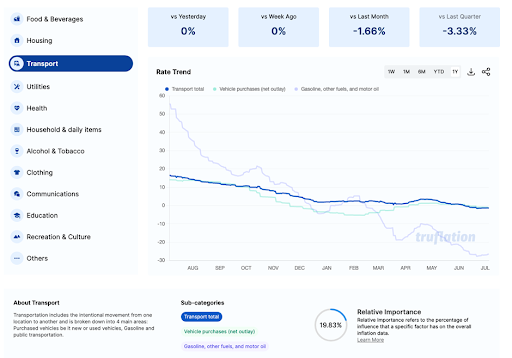

The recent drop in oil prices is also pushing down the cost of filling up with gasoline, which is 26% cheaper YoY (though MoM inflation is holding steady). This trend extends to all gas grades and is likely to reduce overall transportation costs to pre-pandemic levels.

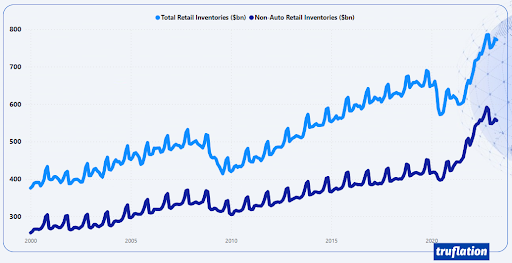

In addition, demand for new and used cars has significantly waned since early 2023 as financing costs have soared. This has placed downward pressure on car prices in the last three months as dealers look to shift excess supply.

The one exception here is the electric vehicles (EV) market, which is still growing and is projected to make up 7% of the total market share by year-end, up from 5% in 2022.

It is hardly surprising that vehicle prices are falling, given the jump in sales in Q1 and the pressure of rising interest rates. With inventory levels currently outstripping demand, prices can be expected to continue falling for the next quarter before they see a rebound. The latter will depend on consumer confidence and future economic expectations.

Prices are also falling in the health category, according to truflation data, with a 0.1% drop MoM. However, they still remain 1% higher than this time last year. While health insurance and medical services costs are coming down, drugs and medical supplies are becoming more expensive, most likely driven by price increases by pharmaceutical companies. Another major driver of deflation in the sector are the enhanced subsidies introduced in 2021 under the American Rescue Plan Act, which have been extended until 2025 in an effort to fight inflation.

Other sectors seeing deflationary trends include communications, down 0.3% MoM on the back of increased competition in the cellular phone market; and apparel, where prices are down 0.5% MoM despite increasing sales, suggesting that consumers are downgrading their purchases. The increased competition for consumer wallets has forced retailers to start seasonal sales earlier than usual.

Prices that are remaining sticky: Housing & food

The two main outliers in the overall deflationary trend are housing and food prices. Despite a slowdown in housing prices from mid-last year, truflation data is showing a second monthly increase of 0.67% in June. The upward pressure is coming primarily from owner dwellings, where the total number of house sales is up from a low of 567,000 in September 2022 to 763,000 in May 2023.

However, the recent rise in mortgage rates is likely to finally curb demand for new homes, as 30-year fixed-rate mortgages reach a new high of 7.31%, and the market expects further hikes from the Federal Reserve. The average property sales prices have dropped from $562,400 in March to $487,300 in May. Soaring tax premiums have also put pressure on the owner property segment.

In addition, the number of newly completed residential properties has reached a two-year peak of 1.5 million, while new residential building permits and starts have also reached an all-time high. This soaring supply will place prices under pressure for the first time in a long while.

This trend will be exacerbated by the increase in Airbnb and Vrbo listings and availability, with a 7%-15% annual fall in revenues in May reported in certain cities, including Orlando FL, Sevierville TN, Austin TX, Panama City FL, and Seattle WA. With an increase in vacancies, price reductions are sure to follow.

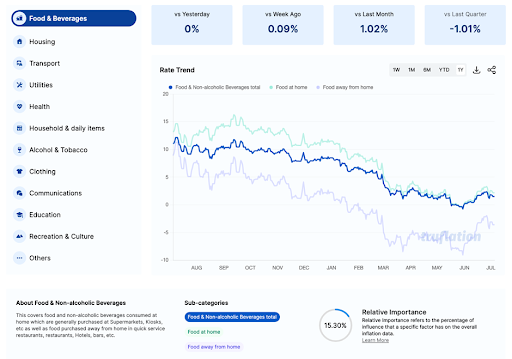

Food prices are still on the rise from already elevated levels, with annual food price inflation reaching 11% last year. We are expecting to record another 0.6% monthly increase in June, representing an 0.8% YoY rise in a reversal of the previous downward trend. A similar trend is evident in the prices of alcohol and household items.

There are multiple reasons for this annual increase: tariffs on imports, a 4.1% rise in food production costs so far in 2023 (according to the Department of Agriculture), lower crop yields in the US as a result of droughts and wildfires, and supply bottlenecks resulting from the ongoing war in Ukraine. This is hitting consumers hard. While the average transaction growth in food and beverage stores is down 1.4% in May, actual spending has increased by 0.9%.

Food prices away from home have also increased, up 0.4% MoM in June and 3.3% on an annualized basis. This is consistent with data from the Census Bureau, which shows a 3.8% monthly increase in food services and drinking places retail sales, while the Fiserv SpendTrend Report revealed that the average transaction size and spending in restaurants are 1.8% and 4.2% higher, respectively. This points to a rebound of confidence as the US heads into summer.

Consumers, however, are still eating more at home as the cost of living crisis bites, as noted by the CEO of General Mills in a recent interview with CNBC, who pointed out that on average dining at home is three times cheaper than eating out. In fact, 86% of food occasions are now happening at home, a 4% increase since the pandemic.

While we expect to see some cooling of food prices, a concerning trend is the tendency for consumers to destock their pantries and dip into their “just-in-case” supplies in an attempt to maximize the reach of their dollars. As such, it’s too early to expect deflation in this category.

Long-term inflation forecast

We see inflation coming down towards the Federal Reserve’s 2% target in Q3, before rising again to 3%-3.5% by year-end.

In the short term, this will be driven by strong wages and employment data, which we expect to last until the end of 2023. We anticipate the biggest increases in the non-white collar industries, while white-collar employment is down, with many high earners in the finance and tech industries losing their jobs. Regardless of employment numbers, consumers are likely to remain cautious in the short term, resulting in lower prices.

By the end of the year, however, a tight labor market and rising house prices will push inflation up to 3%-3.5%. Combined with de-stocking efforts coming to an end, demand will return to equilibrium.

This leaves the Federal Reserve in a difficult position. The market expects another 25 basis point interest rate increase, but with inflation continuing to fall, the pressure to hold at this month’s meeting will be immense.

About Truflation

Truflation provides independent inflation indices based on 30+ different data partners/sources and more than 12 million product prices across the US. The indices are released daily, making it one of the most up-to-date and comprehensive inflation measurement tools in the world.

Truflation has been leveraging this measurement tool to predict the BLS CPI number. Since truflation initiated coverage, two predictions were spot on, with all but one other deviating by no more than 20 basis points. However, truflation’s own US CPI index is currently much lower than the government’s reported inflation figure.