Truflation US CPI Dips Below Fed Target: Danger Ahead?

Thursday, 4 April 2024 saw Truflation.com print its daily US CPI below 2%, 1.96% to be exact. It's a mostly psychological number, of course, but it is also not meaningless – especially if trends continue dramatically downward. Let's examine the curious and counterintuitive cases of when low inflation becomes dangerous.

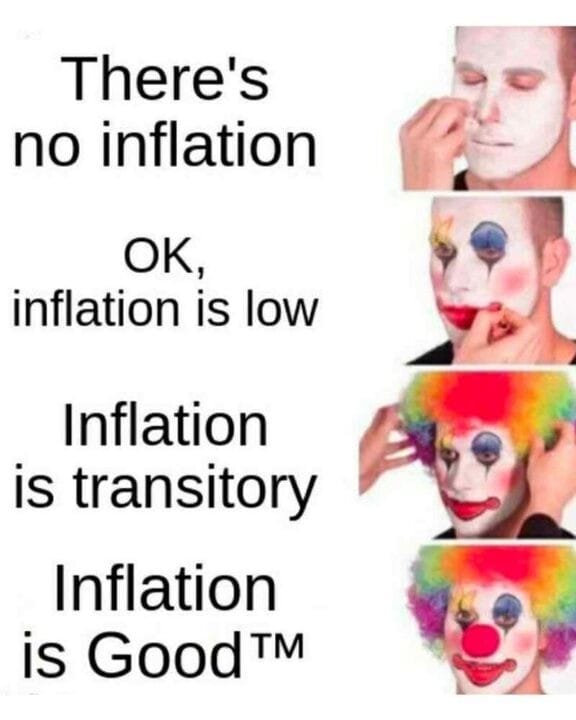

Inflation, the gradual increase in the price level of goods and services, is a crucial indicator of economic health. For decades, central banks, including the Federal Reserve in the United States, have aimed to maintain inflation at a moderate level to foster economic stability and growth. However, recent trends have shown inflation dipping below the Federal Reserve's target of 2%, sparking discussions about its implications for the economy.

READ Shrinkflation: Sneaky Strategy in Times of Inflation

Historically, the United States experienced periods of both high and low inflation. There has been a notable trend towards inflation falling below the 2% target set by the Federal Reserve. While low inflation may seem like a positive development on the surface, it can have significant implications for the economy.

Several factors contribute to low inflation. One key driver is subdued consumer demand, often resulting from economic downturns or recessions. When consumers are hesitant to spend, businesses may lower prices to attract customers, leading to a decrease in the overall price level. Additionally, advancements in technology and globalization have facilitated increased productivity and lowered production costs, contributing to subdued inflationary pressures.

Deflation

While low inflation may initially appear benign, it can have far-reaching consequences for the economy. One of the primary concerns is the risk of deflation, a sustained decline in the general price level of goods and services. Deflation can lead to a downward spiral, as consumers delay purchases in anticipation of lower prices, further dampening demand and economic activity. This phenomenon can exacerbate unemployment and debt burdens, posing significant challenges for policymakers.

READ Danielle DiMartino Booth: The US is Already in Recession

Moreover, low inflation can hinder the effectiveness of monetary policy. Central banks rely on interest rate adjustments to manage inflation and stabilize the economy. However, when inflation remains persistently low, central banks may struggle to stimulate economic growth through conventional monetary policy tools. This dilemma, known as the "zero lower bound," limits the central bank's ability to lower interest rates to spur borrowing and investment.

Global Impact

The impact of low inflation extends beyond domestic borders, affecting the global economy. In an interconnected world, fluctuations in one country's inflation rate can have ripple effects on trade and financial markets worldwide. For instance, persistently low inflation in major economies like the United States can contribute to a deflationary environment globally, dampening demand for exports and weighing on economic growth in other countries.

Counterintuitively, falling inflation can pose risks to the economy, even when it remains above zero. Japan provides a poignant example of the perils of prolonged low inflation. Since the 1990s, Japan has grappled with a prolonged period of low inflation, often bordering on deflation. Despite the Bank of Japan's efforts to stimulate inflation through monetary easing measures, the economy has struggled to escape the deflationary trap. Persistent low inflation has contributed to stagnant growth, declining consumer spending, and a mountain of government debt, highlighting the challenges associated with combating deflationary pressures.

To address the risks associated with low inflation, policymakers must employ a multifaceted approach. Monetary authorities can utilize unconventional monetary policy tools, such as quantitative easing and forward guidance, to bolster inflation expectations and stimulate economic activity. Additionally, fiscal stimulus measures, such as government spending programs and tax cuts, can complement monetary policy efforts by boosting aggregate demand.

While low inflation may seem benign at first glance, its implications for the economy can be profound. The recent trend of inflation falling below the Federal Reserve's target underscores the importance of understanding the drivers and consequences of low inflation. By implementing appropriate policy measures, policymakers can mitigate the risks associated with low inflation and foster sustainable economic growth.

Want to be part of the data revolution? Join our Telegram to always be in the loop!