Truflation UK Data Insights: November 2022

The ONS will announce the UK CPI for October on Nov 16, so let’s dig in to see how the UK inflation is fairing across Truflation’s data.

Since Rishi Sunak took over as Prime Minister on Oct 25, 2022, the British gilt remained below 4%, and the GB stabilized against the dollar. The UK markets put some trust in the country's new leader while the dollar weakened against other currencies after the US FOMC meeting, helping foreign economies recover.

However, inflation and the cost-of-living crisis perpetuated across Great Britain. The inflation reached double digits again last month, the second time since July, with the UK CPI for September at 10.1%, up from 9.9%. The CPIH, which includes additional homeownership cost, was 8.8%, up from 8.6% in August.

On Nov 10, the US CPI announcement surprised the markets, coming in colder than expected at 7.7% for October. Truflation’s predictions based on our independent data aggregates of prices for over 10 million items came in closest to the mark at 7.8-7.9%, closer than the markets, the Cleveland Fed, Kalshi, WSJ, and the majority of the banks.

CPI ESTIMATES FOR TOMORROW

— GURGAVIN (@gurgavin) November 9, 2022

CREDIT SUISSE 7.8%

BARCLAYS 7.8%

BANK OF AMERICA 7.8%

GOLDMAN SACHS 7.8%

NOMURA 7.8%

JP MORGAN 7.9%

GURGAVIN CAPITAL 7.9%

JEFFERIES 7.9%

TD SECURTIES 7.9%

BMO 8%

CIBC 8%

MORGAN STANLEY 8%

STANDARD CHARTERED 8%

WELLS FARGO 8%

SCOTIABANK 8.1%

Tomorrow, Nov 16, the ONS will announce the UK CPI for October, so let’s dig in to see how the UK inflation is fairing across Truflation’s data.

The Truflation UK index rose from 16% at the end of September (with a 16.4% peak mid -September) to our all-time high of 17% on Oct 22 and then decreased slightly to 16.84% by the end of October 2022.

The upward trend in our data has been mainly driven by the increase in the following categories:

- Utilities increased from 83.3% in September to 87.4% in October, as all energy costs skyrocketed across Europe. The index is now back to the 83% range in November, likely thanks to the energy caps introduced by PM Truss and confirmed by the UK's Finance Minister, Jeremy Hunt.

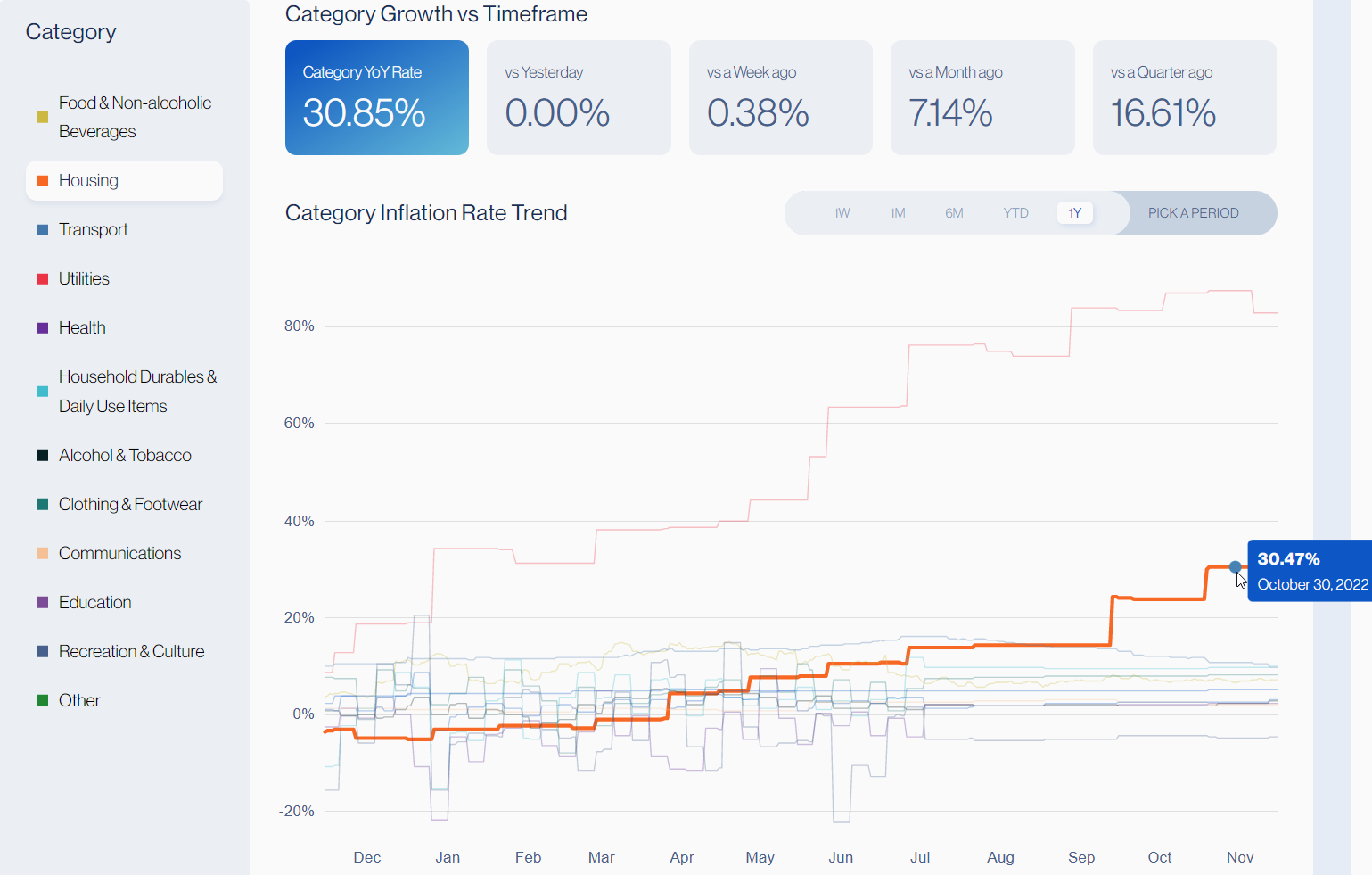

- The Housing category that includes owned dwellings, rented dwellings, and other lodging increased from 23.7% at the end of September to 30.5% at the end of October and 30.85% as of Nov 15, 2022. The category increased due to higher rents and mortgage rates, which reached 5.4% in October for the first time since 2008.

- Transport, which includes vehicle purchases, gasoline, fuels, and motor oil, other vehicle expenses, and public transport, decreased from 12% at the end of September to 10.8% at the end of October, and on Nov 15 was 9,8%. At the beginning of October, RAC reported the lowest gasoline and diesel prices at the pump since May 2022: 162,7p and 180.2p, respectively, which since then, unfortunately, edged back up a bit.

- Truflation's Food index experienced the most price fluctuation. It decreased slightly from 7.14% at the end of September to 6.8% at the end of October and back up to 7.2% in November 2022.

"According to the preliminary forecast models based on our data, we estimate that the official UK CPIH should come in at around 9.1% tomorrow while the CPI remains in the double digits" - said Oliver Rust, Truflation's Project Lead and Data Expert.

The Truflation forecasting model predicts that the CPIH, currently at 8.8%, will go up to 9.1%, and the CPI will remain on par or above the current 10.1%.

For our UK index, we aggregate prices for over 8 million items with data from 10 major commercial data aggregators. The Truflation index is similar to the CPIH in that it includes costs of owning a home, maintenance and services costs, as well as mortgages and mortgage rates not included in the CPIH. In that, our index might be running a tad higher due to the BoE tightening policy.

At the same time, Truflation is using independent data weights based on 2021 consumer trends, which is likely causing our UK index to run lower than the situation on the ground because the major categories: Utilities and Housing, have quickly become a much higher percentage of the average households’ budget in 2022 that the families have no choice but to pay. The ONS also uses the 2021 trends.

About Truflation

Truflation is an economic data aggregator serving independent, unbiased, real-time data on-chain and off-chain. Truflation’s mission is to help individuals, investors, companies, and institutions make more informed decisions by accessing independent and unbiased economic information.

Written by Natalia Nowakowska