Truflation Secures Arbitrum Grant to Accelerate DeFi Innovation and Create RWA Hedge Index

Real-time financial data provider Truflation launched a Hedge Index for tracking Real World Assets (RWAs), powered by a grant from Arbitrum's RWA Innovation Grants Program (RWAIG). This two-month initiative, in partnership with Gitcoin, supports the development and integration of RWAs on the Arbitrum Layer-2 network. The program funds projects across three key areas, including building, research, and awareness.

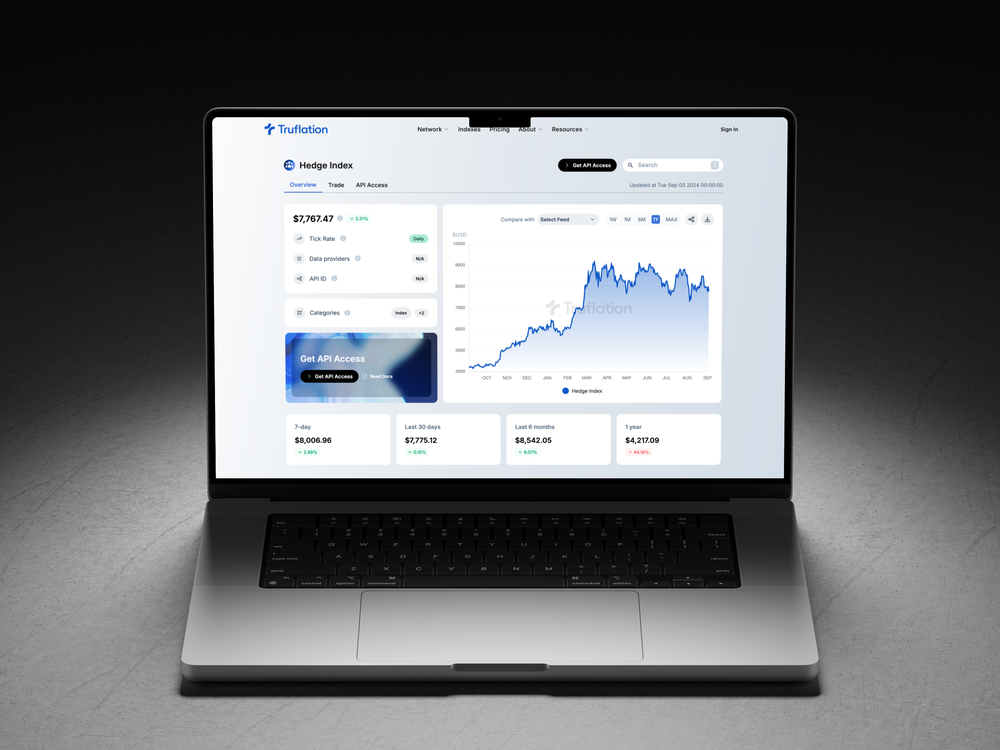

The newly launched RWA Hedge Index is designed to support DeFi protocols focused on RWA tokenization, including projects like Nuon Finance, Frax Finance, and Overlay Protocol. By tracking the performance of RWAs, the Hedge Index offers a valuable benchmark for assessing assets as a hedge against dollar-based investments. For example. the Truflation Electric Vehicle Commodity Index is now tradable on Overlay.

View the HEDGE Index

With the grant, Truflation has not only introduced the RWA Hedge Index but also plans to launch two additional indices later this month, further expanding its suite of financial tools. The Hedge Index incorporates a diversified weighting of precious metals, commodities, equities, and digital assets, providing a comprehensive measure of aggregate RWA performance over time.

"The Arbitrum grant is enabling us to innovate and bring the RWA Hedge Index to market. This index is a tool for DeFi protocols, offering a reliable benchmark for managing inflation risk and optimizing investment strategies in an increasingly volatile economic environment." says Stefan Rust, CEO of Truflation.

Arbitrum’s commitment to the development of RWAs on its Layer-2 network underscores its recognition of this sector's potential for substantial growth and institutional adoption. Tokenization of alternative assets is projected to generate an additional $400 billion in annual revenue for the industry.

Truflation’s decentralized data feeds, indexes, and oracles are widely used by DeFi applications for accurate, real-time pricing of a broad range of real-world assets. With data from 65 integrated partners, Truflation tracks approximately 18 million items, providing on-chain protocols with reliable and up-to-date information.

In addition to the RWA Hedge Index, Truflation also offers dedicated dashboards for calculating inflation in countries like the US, UK, and Argentina. These tools mark significant progress in advancing on-chain data and improving the accuracy of economic measurement. By providing alternative metrics that address the shortcomings of traditional indices, Truflation aims to enhance decision-making for individuals, businesses, and policymakers, contributing to a more informed and resilient economy.

Read More Here: https://truflation.ghost.io/truflation-launches-hedge-index/

View the Hedge Index Here: HEDGE Index on the Truflation Dashboard

About The Arbitrum Foundation

The Arbitrum Foundation, founded in March 2023, supports and grows the Arbitrum network and its community with secure scaling solutions for Ethereum. Arbitrum One—a leading Ethereum Layer-2 scaling solution initially developed by Offchain Labs—offers ultra-fast, low-cost transactions with security derived from Ethereum through Optimistic Rollup technology.

About Truflation

Empowered by Coinbase and Chainlink, Truflation stands as the foremost DRP (Definite Reference Point) for economic veracity, driving the tokenization of Real World Assets through the Truflation Stream Network: an independent, transparent, real time data oracle. Tracking over 18 million items, the TSN is completely decentralized and censorship-resistant, enabling decentralized applications (dApps) such as DEXs to unlock boundless markets.. From predicting orange juice and uranium prices, to facilitating BTC-denominated oil, gas, and corn markets, Truflation unlocks a diverse range of financial instruments, heralding a new era in the Web3 landscape.