Truflation: July CPI Insights

Truflation Insights. July 2022. It's been a busy month for inflation in the news, with the Fed kicking their inflation-busting tightening up a gear with another 0.75%.

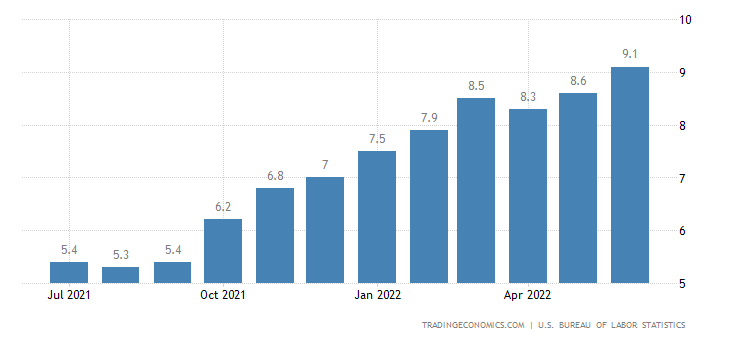

July 13, 2022, the BLS released a shockingly high CPI inflation for June 2022, at 9.1%. It's another 41-year record and beats the pre-release consensus and forecasts by 3%.

It's worth remembering that the official inflation data released in July relates to June 2022 and comes with a month and 13 days delay.

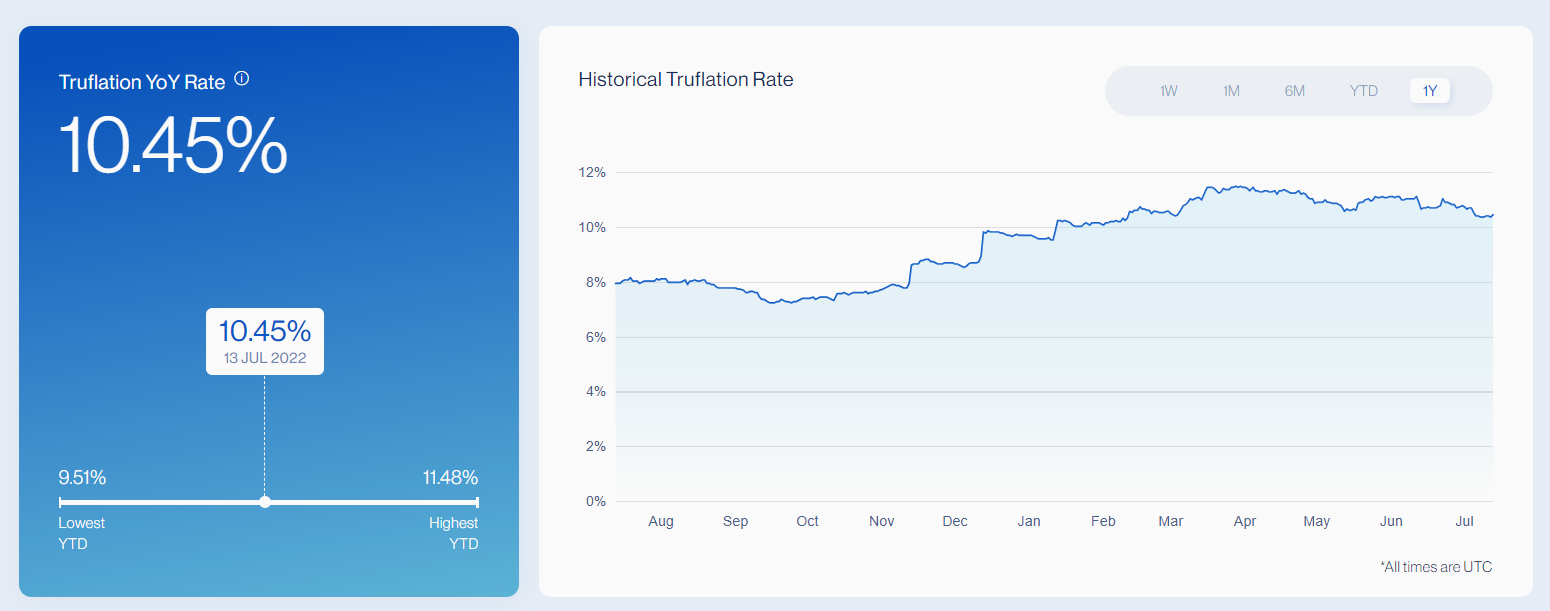

The official US CPI numbers do come closer to the data Truflation reported throughout June 2022, ranging from 10-11% YoY inflation. Unlike the CPI, the US Truflation rate comes out daily and provides a more accurate and less laggy information about price increases, based on +10million data points from actual commerce sales.

Since, we get our data early, here are some of our price insights for July 2022.

July 2022 Price Insights

It's been a busy month for inflation in the news, with the Fed kicking their inflation-busting tightening up a gear with another 0.75% increase expected in July, and market volatility made a comeback with equities bearing the brunt of the flight to safety. So what do we see in our data for the first half of 2022?

Here at Truflation, the overall US inflation rate has been holding steady/marginally dropping daily since mid-June, driven by:

- Food: Prices are holding steady in our price indexes, but the futures markets are seeing a decline in forward prices for agricultural products such as wheat and corn, even with reduced harvests expected for 2022.

- Transportation: Petrol prices at the pump are dropping in our prices indexes even with the 4th July US holiday weekend.

- Housing: Housing costs are marginally increasing, but the YoY rate of change is slowing significantly as mortgage payments increase considerably following the three Fed rate hikes we have seen so far in 2022.

What’s not contributing to higher food prices?

Finding a solution to rising food prices and stabilizing the food supply chain from the effects of inflation is becoming much more urgent since food prices are now a whopping 11.81% greater than on 11th July 2021. These prices significantly impact families because food is part of all spending categories in one way or another. Food prices are increasing for many reasons, including:

- Reduced yields/poor harvests (before Ukraine) due to unusual weather events in the US and Europe in 2021.

- Increased energy prices (electricity/natural gas/diesel) affect production and transportation costs for food.

- Upward pressure on wage costs to retain quality employees and source labor for harvest and transportation.

- Supply-chain disruptions/lack of additional resources (think lack of fertilizer production/availability as Russia was the world’s largest global exporter of fertilizer) and

- Changes to consumer buying habits after COVID-19.

For example, US consumers navigated higher food costs for 4th July BBQ, with meat prices up 18% YoY. These YoY changes represent significant increases in what consumers spent on food even beyond the COVID supply disruptions we saw in 2020 and 2021.

Knock-on effects driving transportation costs

Labor shortages are also driving up transportation costs. Many sectors of the economy compete for truck drivers, from shipping and agriculture to logistics companies such as amazon and grocery store chains. With record-low unemployment and record numbers of experienced truck drivers leaving the workforce during the pandemic, it is the perfect storm of high crude oil prices, higher demand for transportation of goods, and a national shortage of suitable, qualified drivers. These sectors of the economy are raising wages to retain employees and fill vacancies. This has a knock-on effect on transportation costs for the broader economy.

Crude Oil prices, which peaked this month, are still impacting transportation costs; however, demand has been dropping, easing prices at the pump, which have dropped since mid-June. Whether this drop in demand is because it is summer vacation and people are choosing to work from home more or because we have reached the point where the cost of filling up has made people reassess how much they drive? There is no clear answer. US gasoline prices are still 50.5% YoY higher than 11th July 2021! It will be interesting to see if prices at the pump continue to drop for the rest of July or stay at high levels throughout the summer.

Mortgages anyone?

In housing, home prices may have reached a crucial juncture where homes are coming to the market just as demand peaks due to higher interest rates. More housing units will be completed in 2022 than in any other year since 2006! This surge of new housing stock may come to market just as the slowdown in demand starts to adversely impact new home sales.

In our Truflation index, housing costs are still marginally increasing. The YoY increase is slowing as monthly mortgage payments increase following hikes in March, May, and June this year. Home mortgage applications were 21% lower than June 2021, and refinance demand was down 75% YoY. US home sales are down for the fourth straight month.

As markets price in further aggressive rate tightening by the Fed, the chance of engineering a soft landing (whereby inflation can be brought under control without slowing growth and causing a recession) seems to be slipping away. Whatever you believe, our future expectations around higher prices are fueling price and wage inflation across the economy. The Fed wants to change your expectations through interest rate hikes and qualitative tightening (reducing money supply). We will know soon if their expectation management strategy is working.

For a daily dose of US inflation data and price changes across 12 different consumer product categories, check app.truflation.com and follow us on Twitter.

Written by CeAnn Simpson

About Truflation

At Truflation, we believe in data and methodology, not sentiment and surveys. Check our Truflation Dashboard. We created Truflation based on real market price data collected from 30 different data sources daily to deliver crucial business intelligence around inflation. We provide a daily, unbiased, data-driven, real-market US inflation rate and other on-chain economic metrics to DeFi products and Web3 applications.

Our mission is to offer the most objective, decentralized, and current economic and financial information alternative in the form of on-chain price indexes to enable a new generation of blockchain products. We help developers create tools that help people maintain their purchasing power, navigate their portfolios through a challenging macroeconomic landscape, and propel the DeFi space into the new era of an inflation-proof and blockchain-powered economy.