Truflation Fed Update: inflection point?

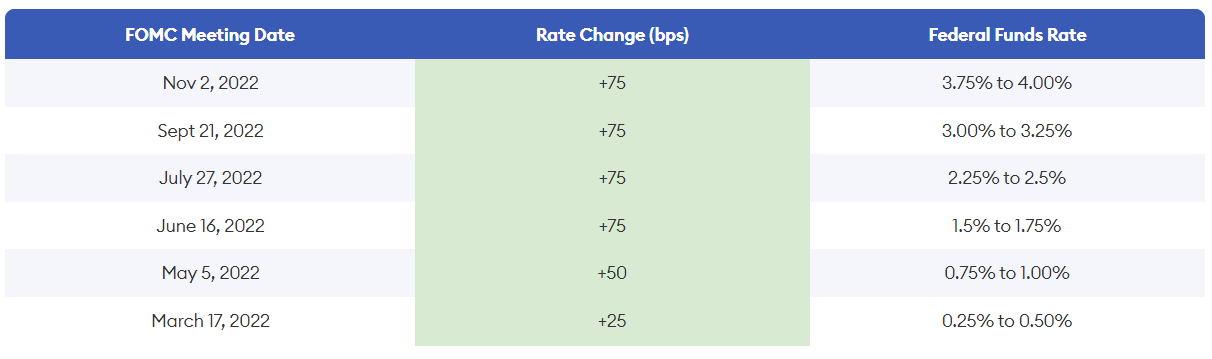

Nov 2, 2022, the Federal Open Market Committee made its fourth rate rise this year, bringing the federal funds rate to a target range of 3.75% to 4%. This 0.75% rate rise has been expected, even if the stock market continues to anticipate an FOMC pivot and then be disappointed when reality bites.

Nov 2, 2022, the Federal Open Market Committee made its 6th rate rise this year, bringing the federal funds rate to a target range of 3.75% to 4%. This 4th consecutive 0.75% rate rise has been widely expected, even though the stock market continued to anticipate the 'Fed pivot' and got disappointed yet again.

Volatility has also come back over the past two months as markets trimmed risk exposure, readjusted to a ‘bear’ world, and disappointing Q3 earnings. Let’s look at the data and where the US economy, brought to you by the Federal Reserve, is heading in Q4:

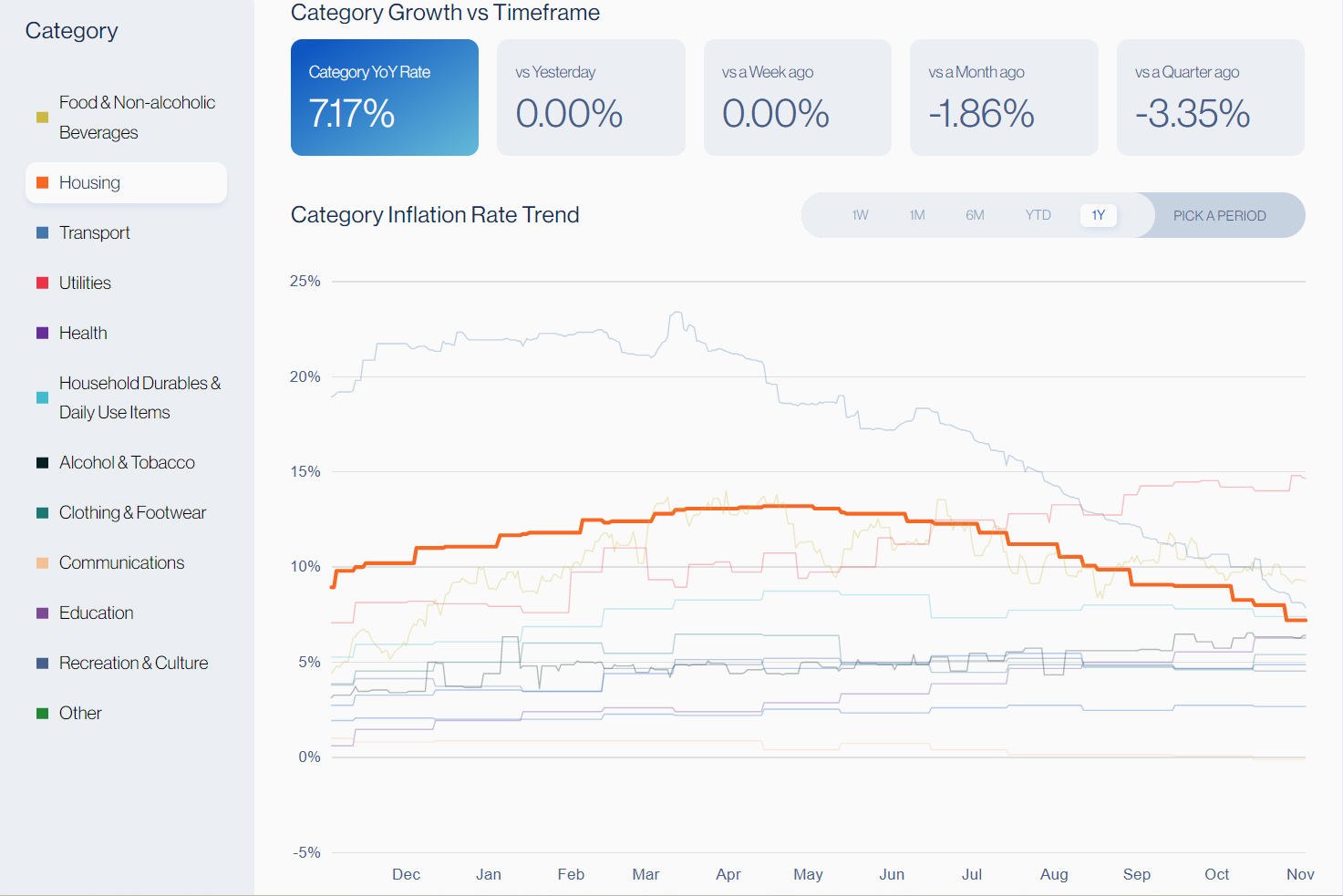

At Truflation, our US inflation index decreased by nearly 1% over the last month to 7.5% (at the time of writing, 3 November 2022). Our other datasets show inflation is slowly decreasing in November. The largest decline over the last month was in Transportation, which decreased by 2.6% due to prices at the pump continuing to drop, with President Biden tapping the Strategic Petroleum Reserves again.

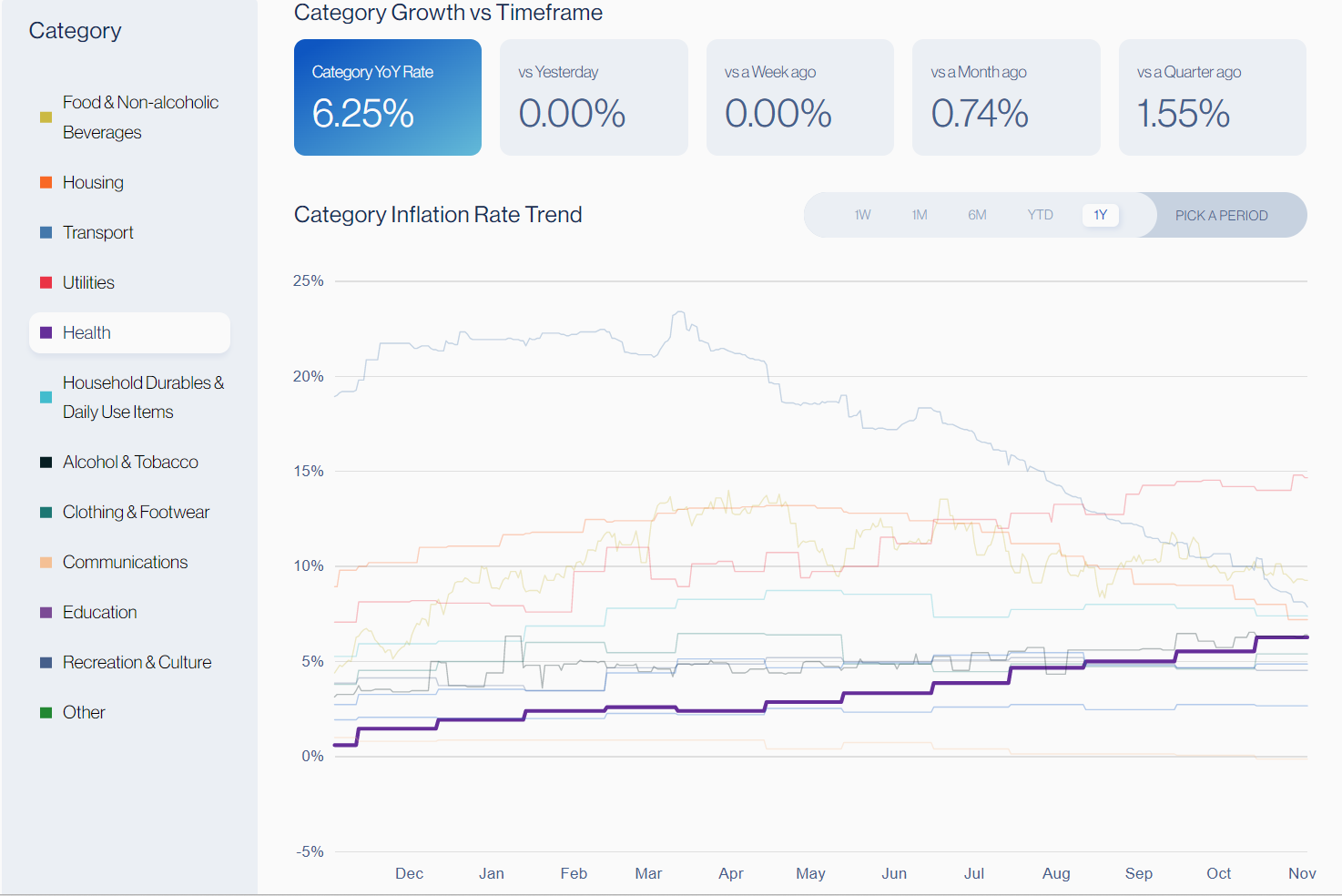

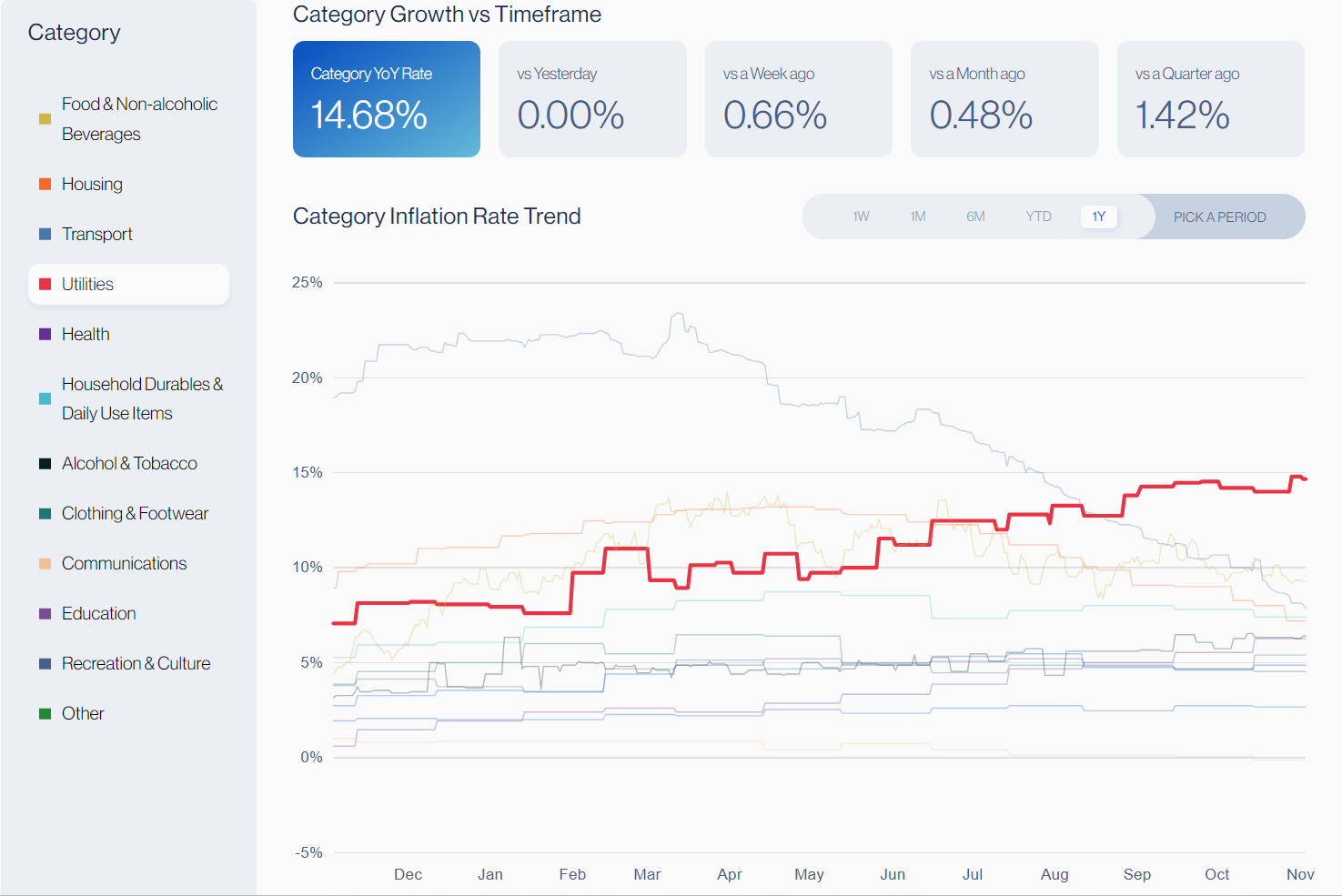

Healthcare was the main category to buck the trend this month, rising by 0.7% over the last month at Truflation, followed by Utilities rising by 0.5% mainly to high electricity and natural gas prices.

Our Truflation housing index decreased by 1.9% from October to November. Mortgage rates reached nearly 7% in the US, a level not seen since the 1980s. The National Association of Realtors reported a 1.5% drop in existing home sales and a 10.5% decline in pending home sales.

In other news, weekly US jobless claims increased in October, but only by a small weekly amount, and the US unemployment rate decreased to 3.5% in September. There seems to be no relationship between the economy slowing and employment data or jobless claims yet. However, the 10-year/3-month yield curve recently inverted, which has in the past predicted recessions infallibly (data from the St. Louis Fed):

The inversion means that short rates have been pushed very quickly to a level above long rates. If short rates are higher than long, money costs so much that it slows growth. This is needed to reduce demand and bring down inflation in theory. But with Mr. Powell’s speech, we may have entered a new phase in the Fed’s battle against inflation.

The Federal Reserve reiterated much of its current messaging rhetoric around inflation, but instead of 'higher for longer,' the mantra seems to have shifted to 'slower and higher for longer,' They signaled that although the pace of increases may slow down, the estimate of the peak rate was higher, which means this tightening cycle might be longer than markets have predicted. Given the drop in the markets after his statement, there is a real risk that the markets have underestimated how long the peak rates will be sustained or what that means for economic growth, profits, and margins.

That said, one inflation metric has not been following the trend in measuring inflation: the New York Fed’s underlying inflation gauge or UIG. Unlike the CPI or PCE, the UIG’s real value is forecasting inflection points: when inflation changes its direction. It correctly anticipated the high inflation we are now observing (it started to rise in 2021). Interestingly, it has been dropping since March 2022, when the Fed started raising the benchmark rate (as was the Truflation's metric). Both the Core CPI and PCE strip out components with the largest changes in prices to ‘smooth’ out the index, but it is these large price moves, up or down, which could signal inflation is changing directions.

Whichever metric you use to measure inflation (we prefer Truflation), inflation remains far above the Fed’s target. Monetary policy works with long and variable lags, and there is a danger that overtightening could make the coming recession longer and deeper than it needs to be, but under-tightening could unleash hyperinflation. The Fed is committing to winning the battle. Slower and higher interest rate hikes may have one silver lining: they could lower market volatility and allow markets to get used to the ‘new normal’ of higher rates. Either way, the road ahead is not going to be pretty.

For more macro insights, sign up for Truflation's weekly newsletter.

Written by CeAnn Simpson

About Truflation

Truflation is an economic data aggregator serving independent, unbiased, real-time data on-chain and off-chain. Truflation’s goal is to help individuals, investors, companies, and institutions make more informed decisions by accessing independent and unbiased economic information.