Truflation Deadlift Index: Empowering Investors with New Performance Metrics

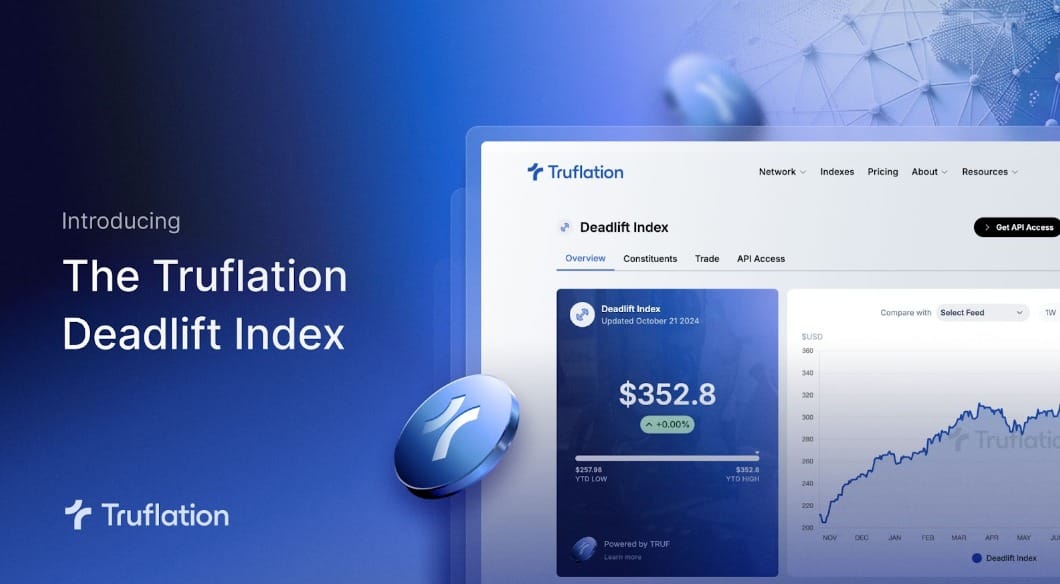

Truflation, a leading provider of real-time financial data, is excited to announce launch of The Deadlift Index, based on research done by Pieter Levels on X (@levelsio) which stipulates that CEOs who lift outperform those who don’t on the S&P 500.

The Deadlift Index merges fitness, trends, finance, and corporate performance. Based on research collaboration, the Deadlift Index highlights a surprising correlation: CEOs who lift weights—particularly those who deadlift—best those who don’t or won't grab steel, squat and grunt.

The Deadlift Index offers a fresh approach to tracking not only traditional Real-World Assets (RWAs) but also company performance based on unique, non-financial indicators. This makes it a one-of-a-kind tool for investors seeking creative and alternative ways to analyze markets. This will also be tradable (more information coming soon).

In a financial world grappling with rising inflation and volatile markets, Truflation allows users to create their own indices tailored to their specific investment strategies. Investors can curate indices that measure the aggregate performance of RWAs, sectors, or even personal values. For instance, users have already expressed interest in developing specialized indices such as a Vegan Index, measuring the performance of companies aligned with sustainable and ethical practices, or a Millennial Index, targeting firms with millennial leadership or innovative business models.

READ Truflation Launches Real-Time AI Index

"At Truflation, we’re focused on empowering users with the tools they need to navigate an ever-changing economy. The Deadlift Index, along with our new user-created indices, brings unprecedented freedom and flexibility to financial analysis," said Stefan Rust, CEO of Truflation. "By leveraging our decentralized data network and our 80+ global data partners, we’re offering real-time insights on everything from company performance to the value of wine as an investment asset."

Index Customization: A Hedge Against Inflation

With inflation driving up the costs of goods and services, many investors are seeking new methods to protect their portfolios. Truflation’s customizable indices serve as a strategic hedge against potential losses. Investors can craft indices that reflect their personal values or anticipate trends, while also guarding against inflation. These indices will be tradeable and updated in real-time, reflecting live market fluctuations, providing investors with up-to-date, actionable data.

For example, in the current inflationary environment, a customized AI Index tracking artificial intelligence (AI) stocks or sustainable energy companies may offer a hedge against traditional assets, which may underperform as costs rise. The soon to be launched Wine Index, which measures the value of fine wines as an asset, has seen increased attention in recent years, demonstrating the growing popularity of alternative assets.

The Future of Finance, Real-Time and Decentralized

Unlike traditional indices that often update at the end of a trading day, Truflation's indices are powered by real-time data feeds, providing live price updates on underlying components. Investors can monitor shifts in their portfolios minute-by-minute, giving them a real-time pulse on the economy.

You can compare The Deadlift Index against the S&P 500, where it routinely outperforms the benchmark, making The Deadlift Index another one of many creative and customizable indices available on Truflation. As the financial landscape becomes increasingly complex, Truflation is leading the charge toward more dynamic, real-time tools that help investors make informed decisions and protect their assets. More to come, and soon.

READ Truflation Big Mac Index: A Global Economic Indicator

Expanding the Horizons of Inflation Tracking

Truflation continues to lead the charge in bringing real-time, decentralized data to the forefront of financial decision-making. With dedicated dashboards that calculate inflation metrics for the United States, United Kingdom, Argentina and soon India, Truflation is setting new standards in how inflation is measured and understood. These alternative metrics address the limitations of traditional indices, offering a more nuanced and comprehensive view of economic conditions. This data is not only valuable for investors but also for businesses, policymakers, and individuals seeking to navigate an increasingly volatile economic landscape.