The Holiday Economy 2024: Retail’s Biggest Season Yet

The last quarter of the year is marked by festivities. It’s a time for gatherings with family and friends, but also a season of strong economic activity fueled by spending on gifts, travel, and party essentials.

The holiday economy in the U.S. is a significant force for commerce and services, primarily driven by Christmas, Thanksgiving, and Black Friday.

This period represents a large portion of annual sales for various sectors, especially retail, which generates more than $900 billion during this time.

This year, projections suggest a record-breaking surge in holiday spending. Let’s explore the data to uncover what’s driving this unprecedented growth.

Expected Numbers to US Retail

According to Statista Consumer Insights, over 80% of people plan to celebrate Christmas or the holidays. The entire country will be in celebration mode.

Many will take the opportunity to visit family or gather with friends. It's a time for relaxation and also personal spending.

Industry and commerce are optimistic about the holiday season. NRF Chief Economist Jack Kleinhenz says “Conditions are shaping up for a successful holiday retail season”.

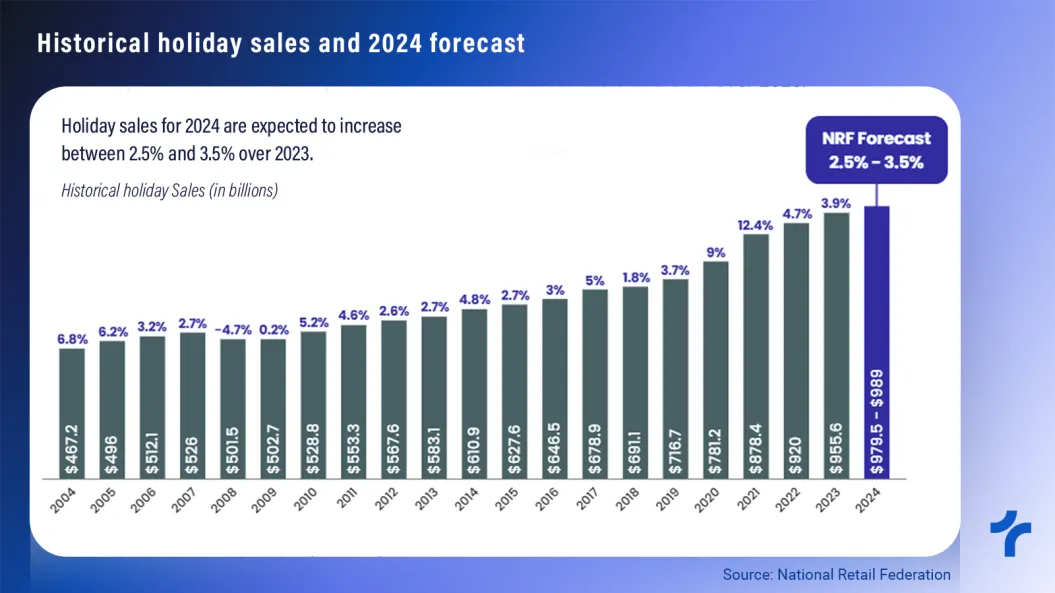

Last year was already a period of growth. Around $955 billion in retail sales were recorded for the 2023 holiday season (November to December), representing an increase from previous years, primarily driven by an 8-9% bump in online sales, according to the National Retail Federation (NRF).

In 2024, a further increase in sales is expected, this time between 2.5% and 3.5%, which would amount to somewhere between $979 and $989 billion.

On average, in 2023, consumers spent around $1,500 on gifts, food, and other holiday-related expenses. The past few years have seen a significant rise in online shopping, with nearly a quarter of last holiday season's sales occurring through e-commerce, totaling $230 billion.

The total value is extremely high, especially considering that only 19 countries have a GDP exceeding one trillion dollars.

According to Deloitte, the preferred retail types for consumers in 2024 are online retailers, followed by mass merchant retailers (a company that affordably sells large quantities of goods at reasonable prices) and department stores. This highlights that price remains one of the most important factors when making purchasing decisions.

With other data, BofA Securities projects that holiday spending consumers are expected to increase by 7% in 2024 compared to 2023, bringing their average anticipated spending to nearly $2,100.

A large portion of this spending is focused on gifts, with each person expected to spend over $1,000 on them. The increase in gift-related spending reflects a favorable economic situation, as the more money (or credit) available in a budget, the more people tend to spend on giving to others.

A 10% growth in these expenses not only provides insights into the current scenario but also reflects people's expectations. The greater the optimism regarding future income, the higher the spending, as Franco Modigliani introduced in his "Life-Cycle Theory."

What Will Boost the 2024 Numbers?

Both sustained economic growth post-pandemic and market optimism about the economy are strong drivers of increased sales during the holiday season.

This year, the S&P 500 rose by over 25%, the DJIA by more than 15%, gold increased by over 30%, and Bitcoin doubled in price. This reflects the strength of the markets in recent months and serves as an indicator of optimism for what lies ahead.

Wages have risen by about 4% over the past 12 months. The NRF said that household budgets have also been boosted by a rising stock market and housing prices, two factors that support higher spending habits.

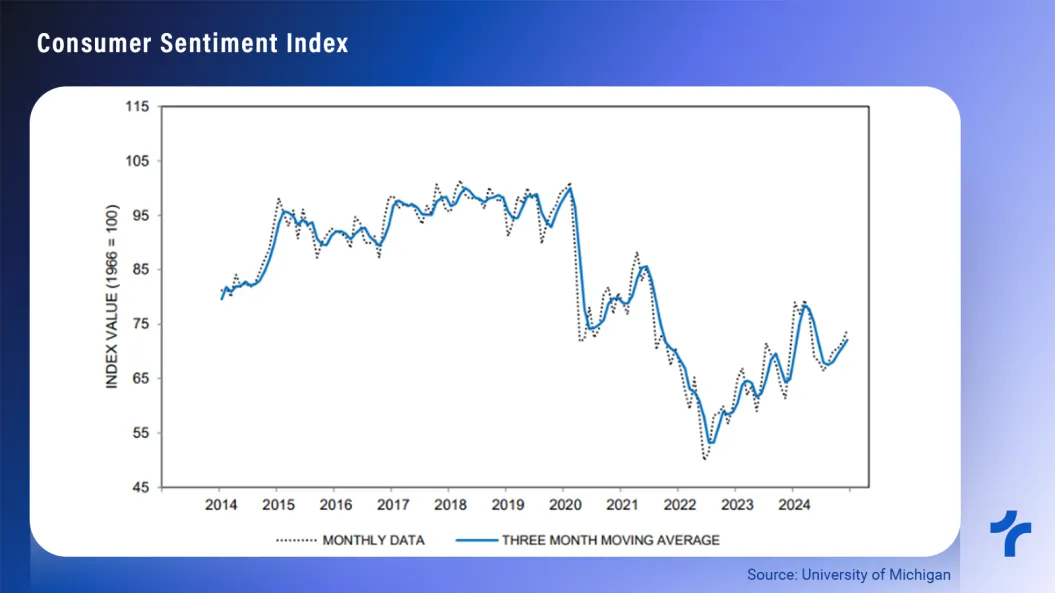

Another relevant indicator of confidence is the Consumer Sentiment Index conducted by the University of Michigan.

In December, the index reached 74. This represents an increase of about 20 points since its lowest point in 2022, 4.3 points compared to December 2023, and 3.2 points compared to December 2024.

A significant part of the rise in optimism over the past month is linked to statements made by President-elect Donald Trump regarding the economy, particularly on fiscal and regulatory matters.

Christmas Inflation

Overall inflation has risen. On December 13, 2024, the Truflation US Inflation Index indicated an inflation rate of 3.11% over the past 12 months, the highest level since September 2023. The situation is no different for Christmas-related items.

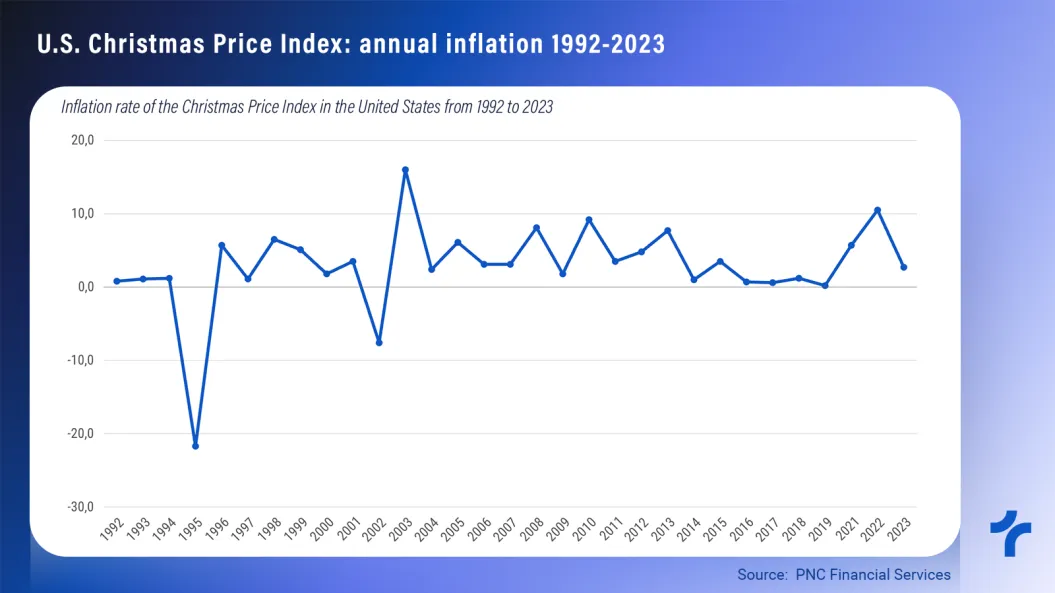

With a greater willingness to spend, it is natural for prices to rise, particularly for specific items, especially those related to food and seasonal gifts. One of the most common indicators is the PNC Christmas Price Index, which calculates the annual inflation of the 12 items mentioned in the song The Twelve Days of Christmas.

The items are:

- Partridge

- Turtle doves

- French Hens

- Calling Birds

- Gold Rings

- Geese A-laying

- Swans A-swimming

- Maids A-milking

- Drummers Drumming

- Pipers Piping

- Ladies Dancing

- Lords A-leaping

It is noticeable that these items experienced a significant increase in 2022. Another important point is that the 2020 variation is not included in the chart, as the pandemic drastically impacted the results.

According to USA Today, the index is expected to see a 5.4% increase in 2024. The largest price increases are anticipated for partridges (16%), drummers drumming (15.8%), and pipers piping (15.8%).

The rise in price levels is an expected trend, given the increase in household budgets allocated to holiday spending. A larger budget, not necessarily directed at a higher quantity of products, creates pressure on prices.

Final Thoughts

This holiday season is shaping up to be a strong one, especially for the retail sector. Budgets for holiday spending are on the rise, with online sales seeing large growth.

Retail sales in the U.S. are projected to approach $1 trillion between November and December, fueled by a combination of positive consumer sentiment and the current economic conditions. However, rising prices remain a challenge, with inflation for holiday-related products likely to outpace the broader economic average.

Prices play a central role in the economy, signaling the intentions of both buyers and sellers. Keeping an eye on inflation is key to understanding the market and refining investment strategies.

For real-time insights into price trends, follow the Truflation Inflation Index and stay ahead of the curve.

Truflation | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube