The Good, The Bad and the Ugly: What History Tell Us About Tariff Strategies

Tariff policies have become one of the most controversial topics of the new American government. Let's understand the impacts of these policies and what has been announced so far.

Tariffs can have a broad scope, affecting almost all sectors of the economy, to address trade balance issues.

Alternatively, they can be targeted at specific goods and services to develop a particular sector and even promote the country's self-sufficiency in that area.

Throughout history, tariffs have had both positive and negative outcomes, making policy adjustments essential for success.

At this moment, all indications suggest that the implementation of this policy will be more focused on countries rather than specific products (with some exceptions), thus taking a more comprehensive approach.

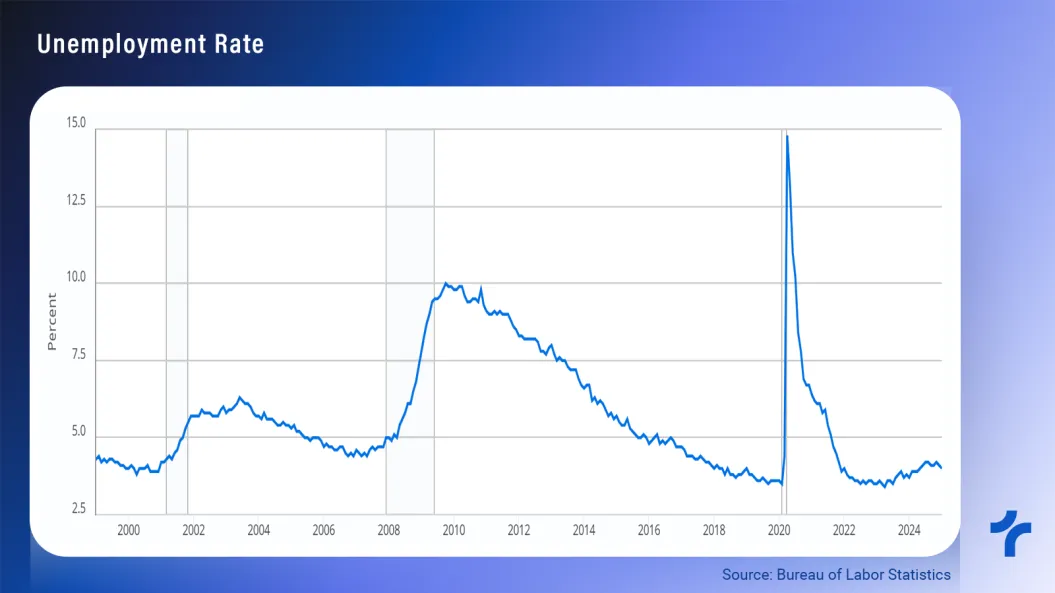

Unemployment

When discussing large-scale tariffs, one essential factor to analyze is unemployment. If the goal is to increase domestic production, two key elements come into play: capital goods and labor.

The creation of new jobs leads to higher income within the region. However, if unemployment is already low, this can result in inflationary pressure.

The current situation is one of low unemployment (4%), a factor that significantly limits the impact of tariffs. With a limited labor supply, wages are likely to rise, which could, in turn, lead to higher prices.

If there is not enough investment to boost productivity, rising wages may ultimately make the economy less efficient—precisely the opposite of what the policy originally intended to achieve.

What History Tells Us

In this section, we will look at two historical cases. The first focuses on the United States in the 19th century, illustrating a successful example of tariff implementation.

On the other hand, we will analyze Argentina in the late 20th century to understand how tariffs failed in that context.

By examining these two cases, we can better grasp the pros and cons of this policy and identify the necessary adjustments to make it effective.

Success Story: United States (Industrial Tariffs in the 19th Century)

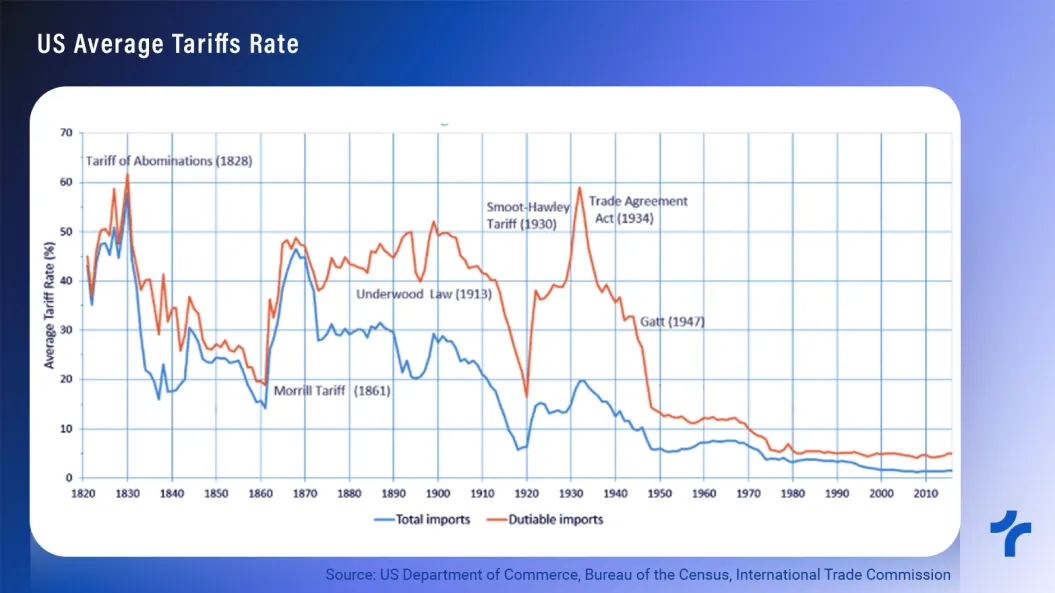

In the 19th century, the United States implemented protectionist tariffs primarily to support its emerging industrial sector.

The first significant tariff was introduced in 1816, sparking discontent in the southern states, which were largely agricultural and heavily reliant on imports and exports.

A second wave of tariffs came in the 1860s, starting with the Morrill Tariff (1861) and continuing with post-Civil War tariffs (1865–1890), which were also aimed at fostering industrial development.

This was crucial for American economic development, as the country's share of global GDP grew from 2% in 1820 to 19% by 1900.

Additionally, it boosted per capita GDP growth, positioning the United States as the leading global power in this metric by the end of the 19th century.

Between 1865 and 1898, coal production rose by 800 percent and railway track mileage by 567 percent. By the middle of the 1880s, the United States had surpassed Britain as the world’s leading producer of manufactured goods and steel.

The data clearly show that the primary focus was industrial development, as this sector generates the highest added value. Moreover, tariffs were temporary, remaining in place only until the industry became competitive on a global scale.

Another crucial factor was population growth, which provided enough labor to support sustainable economic expansion. During that period, the U.S. population grew by approximately 20% per decade, whereas today, that number is closer to 7.5%.

It is undeniable that tariffs played a key role in America's industrial growth, which was fundamental in establishing the country as a global economic superpower—making it more productive and self-sufficient.

Failure Case: Argentina (1980s–2000s)

On the other hand, it is important to examine cases where tariff policies did not produce the desired results.

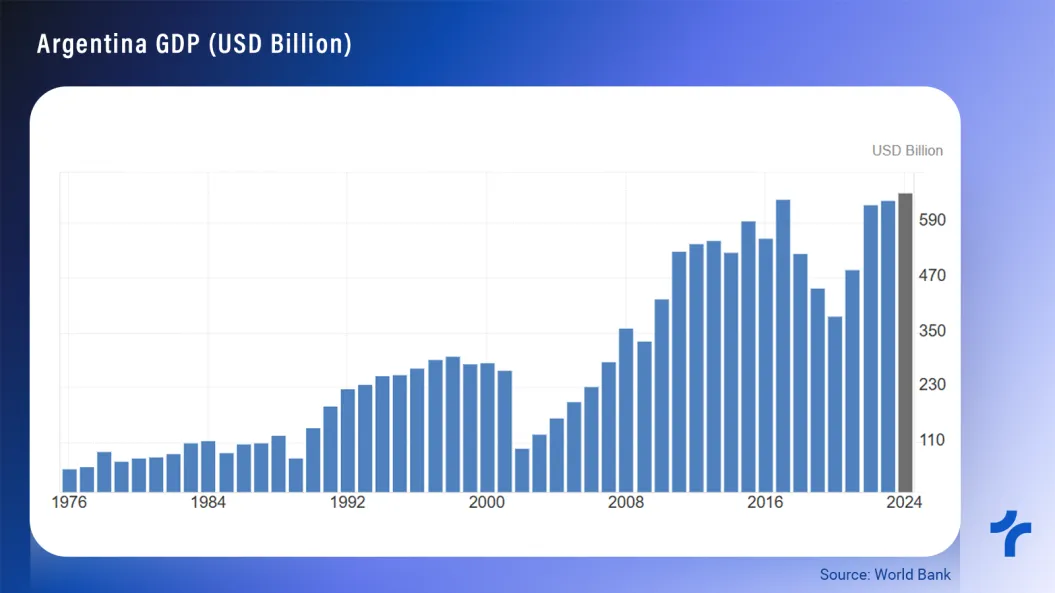

After the military government (1976–1983), Argentina implemented protectionist policies aimed at supporting certain industrial sectors.

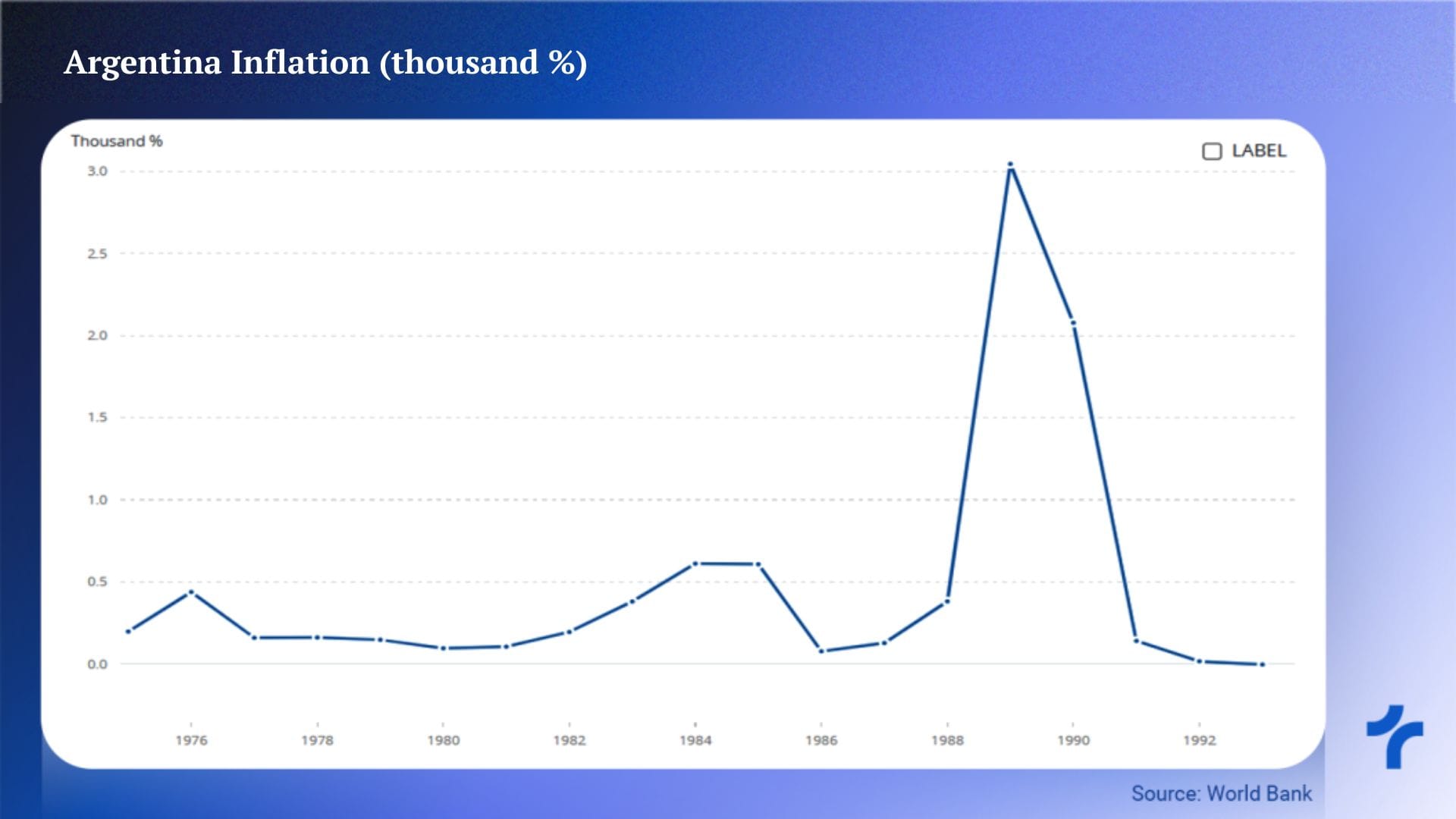

However, the outcome was economic stagnation, hyperinflation, and a trade deficit. This is evident in the GDP, which remained nearly stagnant from 1983 to 1988.

By the 1990s, with economic liberalization and integration into Mercosur, the economy began to recover—although the local industry suffered significant losses.

When a country isolates itself from international competition, it limits market rivalry and risks becoming inefficient over time. This is why tariff policies must be implemented cautiously.

This is precisely what happened in Argentina—low innovation and declining productivity compared to global markets led to economic stagnation.

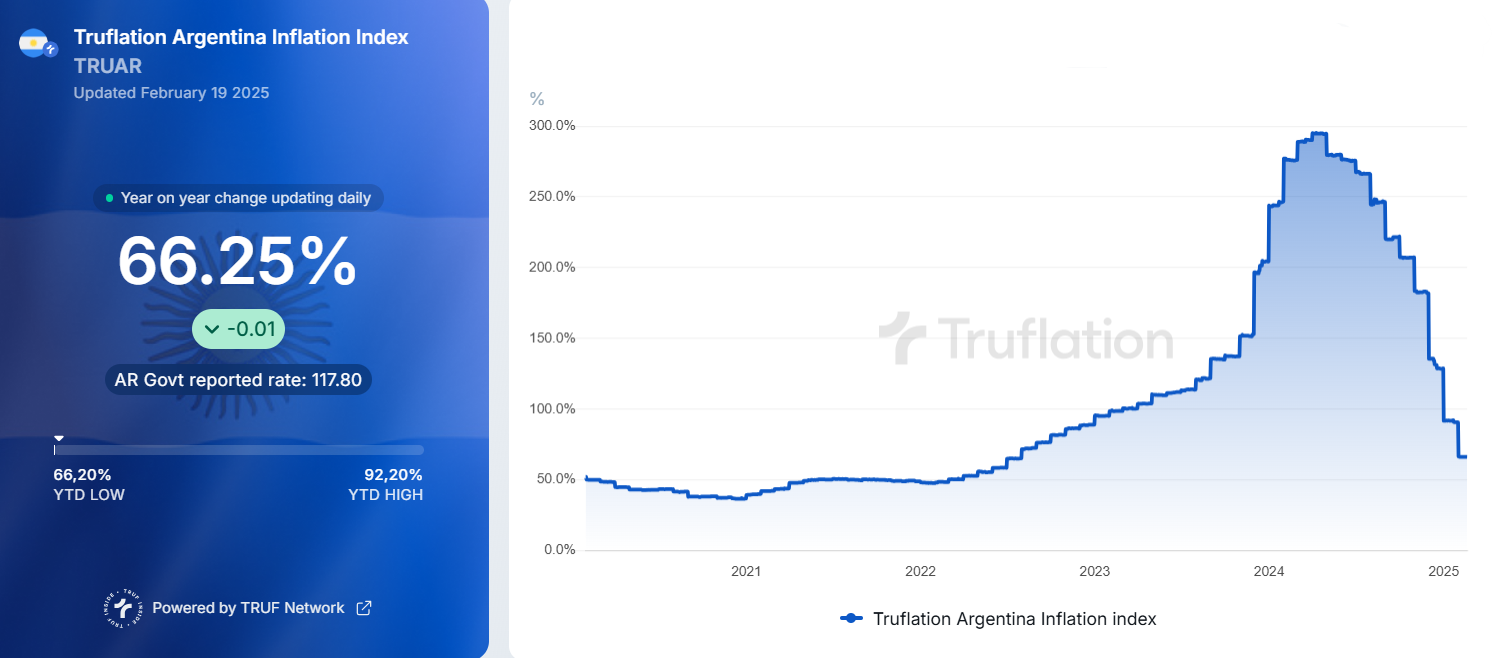

As a result, the country experienced hyperinflation, both in the 1980s and 1990s, with inflation rates surpassing 3,000% per year at their peak.

The Argentine government has repeatedly shifted its economic policies since the 1980s, alternating between extended periods of high tariffs and subsequent trade liberalization.

This fluctuation exposed the fragility of Argentina’s protectionist approach—its industry became uncompetitive on a global scale, relying on continued protection to survive. However, this protectionism resulted in higher prices for Argentine consumers.

If companies fail to develop efficiently while tariffs are in place, the economy can face serious long-term challenges, including stagnation and dependency on trade barriers.

Remember that Truflation is currently tracking inflation in Argentina and although inflation has decreased in recent months, hyperinflation has become a problem again. You can see this transparently and in real-time on the Truflation website.

What Is Happening in the U.S.?

First and foremost, it is essential to understand the reasons behind the U.S. government's expansion of tariff policies before clarifying what has been announced so far. Trump’s plan has three main objectives:

Ensuring U.S. Self-Sufficiency:

- The pandemic exposed the vulnerabilities of supply chain disruptions and their impact on the economy.

- Additionally, global geopolitical conflicts have raised concerns about the stability of international trade.

- In response, the U.S. aims to reduce its dependence on foreign economic inputs and strengthen domestic production.

Balancing Trade Relations with the Rest of the World:

- As previously observed, U.S. tariffs are currently below 10%, while some countries impose much higher tariffs on American goods.

- This lack of reciprocity makes it difficult for American products to compete in certain foreign markets.

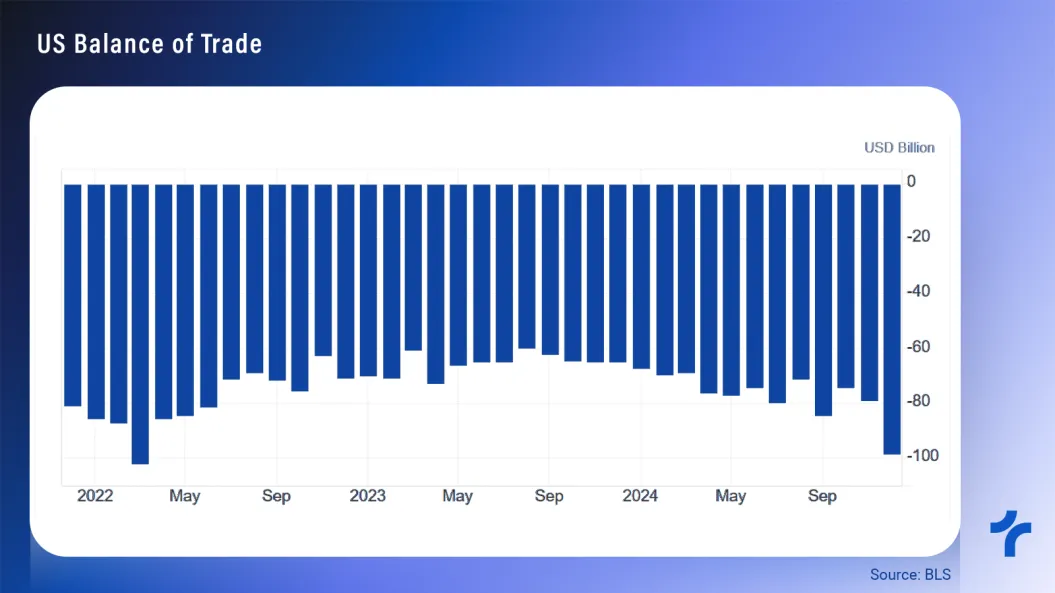

- One reflection of this imbalance is the U.S. trade deficit, which nears $100 billion per month.

Strengthen the local economy

- Bring industries back to the U.S., stimulating job creation and higher wages for American workers.

- This concern is a central part of Trump’s Agenda 47, which emphasizes domestic manufacturing and economic independence as pillars for strengthening the U.S. economy.

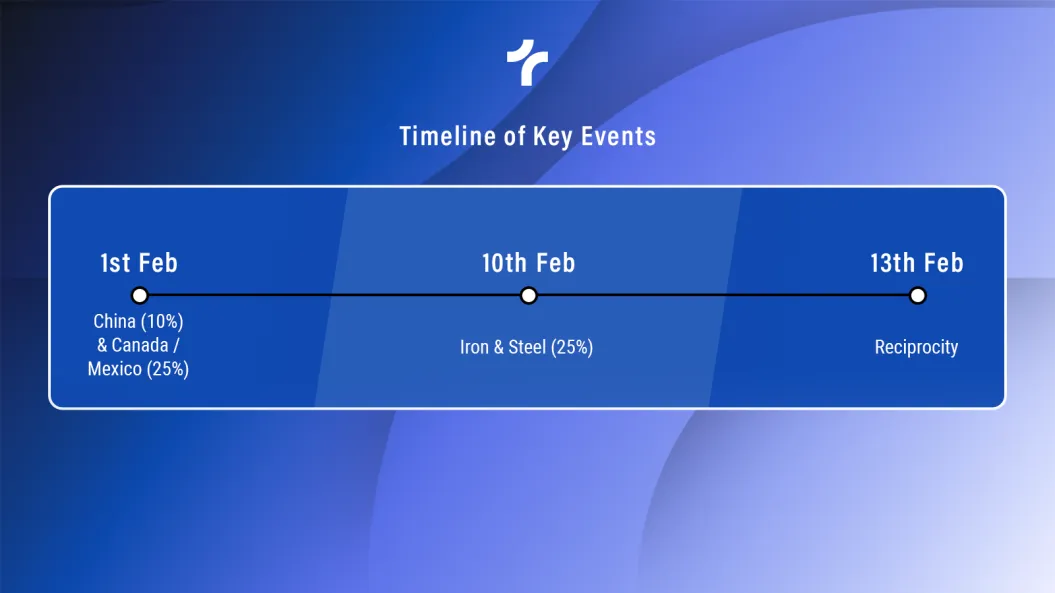

So far, several key tariff measures have been announced by the Republican president, focusing on:

Countries: China (10%), Canada, and Mexico (25%, except for Canadian energy imports, which will have a 10% rate).

Products: A 25% tariff on all imports of steel and aluminum.

Reciprocity: Implementation of reciprocal tariffs, meaning the U.S. will impose the same rates that other countries apply to American products.

The goal is to ensure fair trade relations and pressure foreign markets to lower trade barriers on U.S. goods.

This policy affects the entire world, and there is no doubt that much more is yet to happen. Countries will likely take one of two paths: the first involves seeking agreements and closer ties with the U.S.

Another possibility is pursuing trade retaliations against the tariffs as a response to the American president. The key issue is that each country will face a unique situation, and the future remains uncertain.

Trump's pick for Commerce Secretary, Howard Lutnick, said his team would be ready to hand a plan to the president by April 1. Let's stay attentive to the next steps.

Final Thoughts

Given the data presented, it is important to highlight that the outcomes of tariff policies remain uncertain and largely depend on external factors.

If a broad tariff policy is implemented, close monitoring of the labor market will be crucial to prevent excessive inflationary pressure.

It’s also worth noting that policy changes are likely—tariffs could be reduced if agreements are reached, or trade tensions could escalate if other countries retaliate.

Regardless of the outcome, tracking price fluctuations will be essential to assess the true impact of these measures.

And when it comes to inflation, you can always rely on Truflation for real-time, accurate data.

Truflation | TRUF.Network | X | Linkedin | Telegram | Github| YouTube