Tariffs: The Impacts of Liberation Day

Last week, Trump announced his plan for tariffs, which are set to take effect on Wednesday (the 9th). Although a lot can still happen, we can expect some impacts on the American economy.

The results will differ between sectors, according to the supply chain and production capacity.

Understand this impact on US inflation and stay up to date with Truflation.

The Inflationary Impact of Tariffs on US Trade

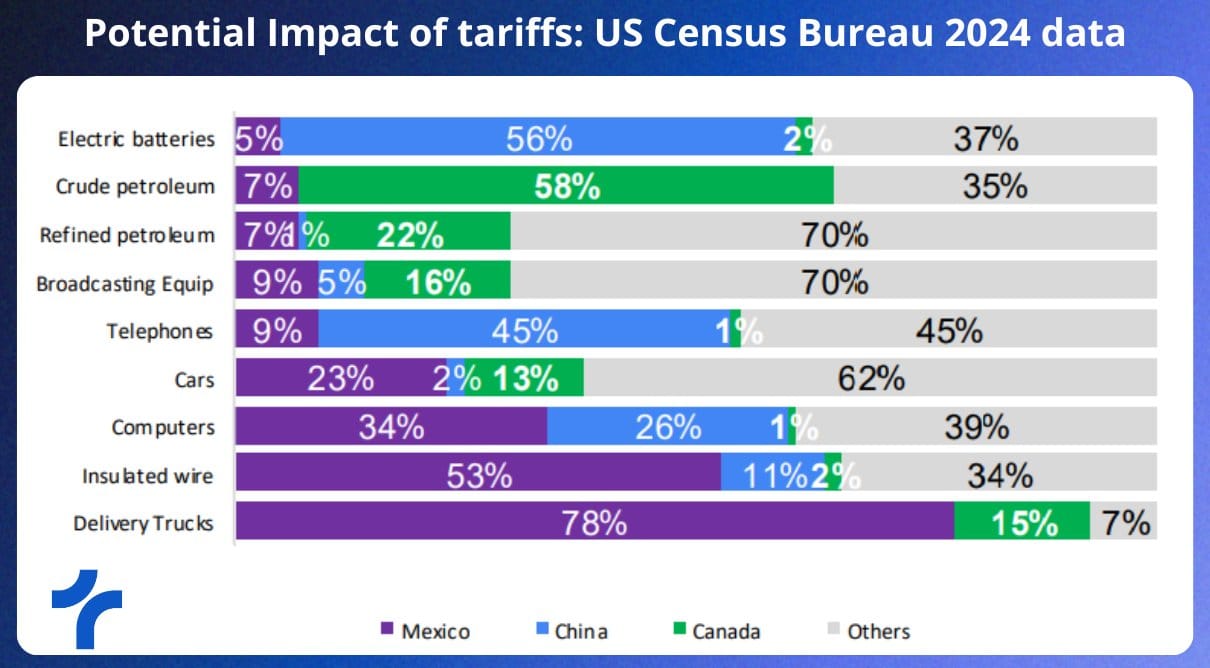

As global trade dynamics continue to shift, tariffs imposed on imports from China, Mexico, and Canada are poised to have significant repercussions on the US economy.

Based on recent analysis, we estimate that these tariffs could contribute to a 0.5%-1.2% increase in inflation, depending on various factors.

This projection underscores the importance of understanding how key sectors and products will be impacted by these trade policies. Let's explore the key sectors affected.

Automotive

The automotive industry faces substantial challenges due to tariffs. According to TD Economics, vehicle prices could rise by approximately $3,000 as a result of parts crossing borders multiple times during assembly.

This is particularly significant for brands like Audi, BMW, Ford, General Motors, and Honda, which rely heavily on cross-border supply chains with Canada and Mexico.

Tesla emerges as a potential beneficiary, given its domestic production model that shields it from these disruptions.

Fuel Prices

Canada is the largest foreign supplier of crude oil to the US, accounting for 61% of oil imports between January and November 2024.

While the US has ample oil reserves, its refineries depend on heavier crude oil from Canada and Mexico to optimize gasoline, diesel, and jet fuel production.

Tariffs could disrupt this supply chain, potentially driving up fuel prices.

Housing

The housing market is particularly vulnerable to tariffs on softwood lumber and steel. The US imports about one-third of its softwood lumber from Canada—a critical construction material.

Steel tariffs further exacerbate the issue, as the construction industry is the largest consumer of steel in the US. Rising costs could delay new housing developments, reducing inventory and pushing prices higher.

President Trump’s investigation into additional tariffs or incentives for domestic lumber production may further impact affordability for first-time buyers.

Maple Syrup

Canada’s billion-dollar maple syrup industry produces 75% of the world’s supply, with 90% coming from Quebec. While consumers might opt for domestically produced goods, many rely on Canadian inputs—leading to price increases even for US-made products.

Avocados

Mexico dominates the US avocado market, supplying 90% of avocados consumed in America. Tariffs could make this staple more expensive for consumers who rely on imports from Mexico's favorable growing conditions.

Canned Food & Carbonated Soft Drinks

Approximately 70% of the steel used in the US for food cans is imported—primarily from Germany, the Netherlands, and Canada—and is not produced domestically.

Combined with aluminum tariffs, grocery prices for canned foods and carbonated beverages are likely to rise.

Beer, Wine, Whisky & Tequila

Tariffs could significantly impact popular beverages like Mexican beer brands Modelo and Corona.

For spirits like tequila and Canadian whisky—which are recognized as distinctive products that can only be produced in their respective countries—supply chain disruptions may lead to higher prices for US consumers.

Broader Implications

The products listed above represent just a fraction of key imports from China, Mexico, and Canada that are likely to be affected by tariffs in 2025.

These changes will ripple through industries and consumer markets alike, driving up costs across essential goods and luxury items.

As traditional financial systems adapt to these shifts in trade policy, businesses and consumers must prepare for an era marked by higher costs and evolving supply chains.

Understanding these dynamics is crucial for navigating the inflationary pressures ahead.

Final Thoughts

Many factors can affect the outcome of tariffs, such as the ability of American industry to substitute the supply of these goods, as well as the agreements that can be made.

Mexico, Canada, and China play important roles in trade with the US.

While the results remain uncertain, follow Truflation and find out everything that is happening.

We continue analyzing the economic impact of these tariffs and exploring strategies to mitigate their effects.

Join us and be one step ahead!

Truflation | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube