Stagflation Creep: Hotter-than Expected PCE Raises Concern

“I don’t see the stag, or the inflation,” Fed Chair Powell doubled down during his recent, regular post-FOMC rate decision day press conference Q&A.

"I was around for stagflation. It was brutal. Ten percent unemployment. High single-digit inflation. And very slow growth. Right now, we have 3% growth. Which is pretty solid growth, I would say, by any measure. And we have inflation running under 3%. So, I don't really understand where concerns about stagflation are coming from."

And yet, organic April market prices plunged in response, and to their worst levels since Fall 2022. Powell continues to signal rates higher for longer.

A few months back, our Inflation Update for February asked:

Are we seeing the start of stagflation?

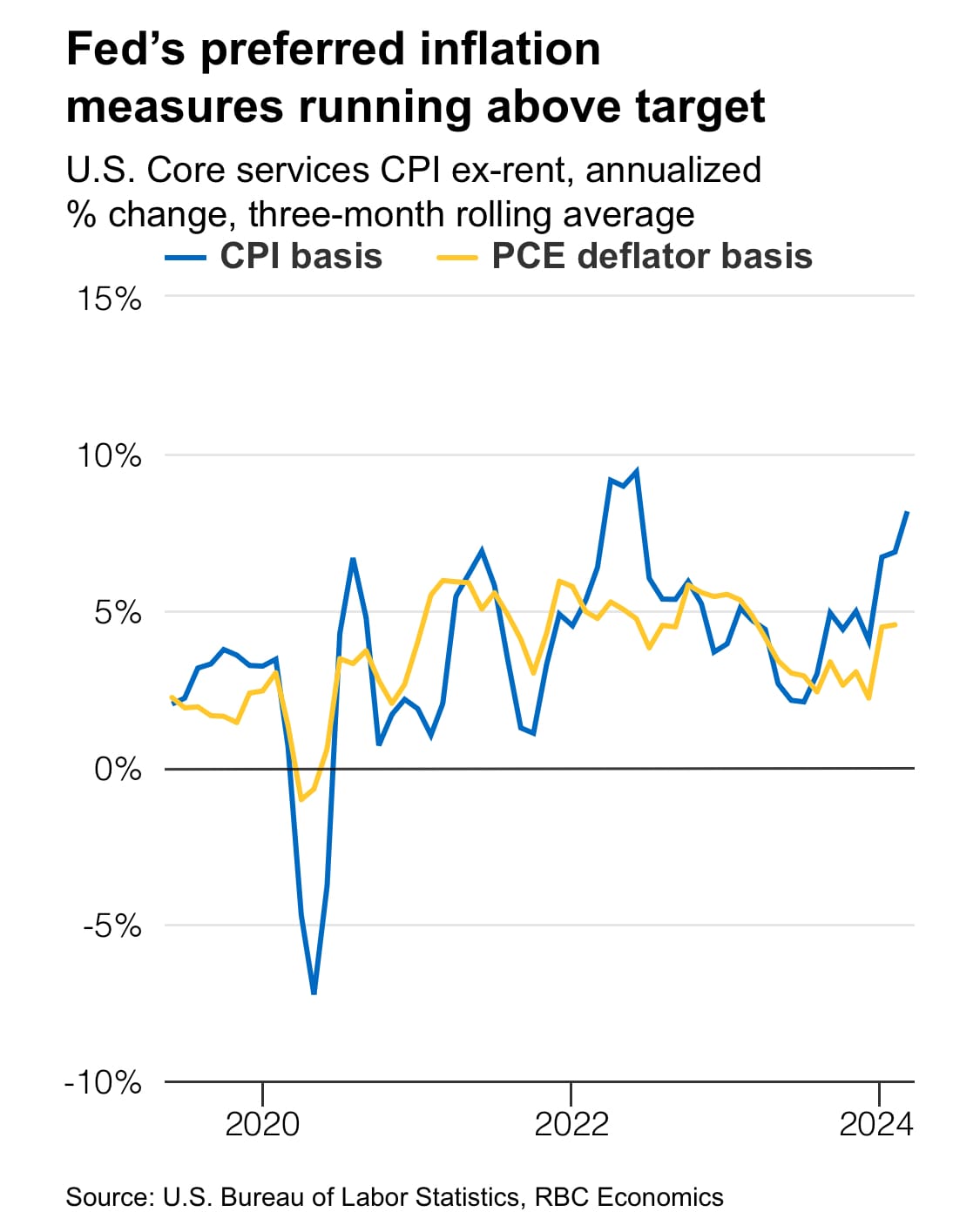

Recent signs of stickier inflation in the US have increased concerns that investors are perhaps too optimistic about the odds of a soft landing. The January PCE price index reading was in line with market expectations, while the CPI inflation figure came in hotter than expected. This highlights that the path to the 2% Federal Reserve inflation target is not going to be as smooth as hoped.

The major concern is that inflation could enter into an era of stagflation, where price increases re-accelerate while economic growth slows. Given the strength of the markets and the economy in Q4, it may be that investors are underestimating this risk for 2024, especially given the similarities between the path of the CPI in the 1970’s and what we are seeing today.

JOIN US FOR TRUFLATION SPACES, HERE

Perhaps it would be good to review and give a quick understanding of the crucial role personal consumption expenditures (PCE) have in interest rate determination.

PCE and the Fed

In the intricate world of economic policy-making, few indicators hold as much sway over decisions as Personal Consumption Expenditures (PCE). As a key metric tracked by the Bureau of Economic Analysis (BEA) and utilized by the Federal Open Market Committee (FOMC), PCE plays a pivotal role in shaping monetary policy, particularly in determining interest rates.

Importance

The FOMC, tasked with steering the course of monetary policy in the United States, relies on a multitude of economic indicators to assess the health of the economy and determine appropriate policy actions. Among these indicators, PCE stands out as a cornerstone of consumer spending, which accounts for a significant portion of overall economic activity. By scrutinizing trends in PCE, the FOMC gains invaluable insights into the behavior of consumers, their confidence levels, and the underlying strength of the economy.

Historical Data

Examining historical data unveils the profound impact of PCE on interest rate decisions. During periods of robust consumer spending, characterized by healthy PCE growth, the FOMC may opt for a tighter monetary stance to prevent overheating and inflationary pressures. Conversely, when consumer spending falters, signaling potential economic weakness, the FOMC might pursue accommodative policies, such as lowering interest rates, to stimulate borrowing and spending.

For instance, the aftermath of the 2008 financial crisis witnessed a sharp decline in consumer confidence and spending, prompting the FOMC to embark on an unprecedented path of monetary easing. By slashing interest rates to historically low levels and implementing unconventional measures like quantitative easing, the FOMC aimed to reignite consumer demand and bolster economic recovery.

Similarly, amidst the COVID-19 pandemic, PCE data served as a critical barometer of the pandemic's economic fallout. As lockdowns and restrictions curtailed consumer activity, PCE plummeted, necessitating swift and aggressive action from the FOMC. The committee swiftly lowered interest rates to near-zero levels and injected liquidity into financial markets to cushion the economic blow and facilitate a swift rebound in consumer spending.

Understanding PCE Calculation

To comprehend the significance of PCE, it is essential to grasp how it is calculated. The BEA computes PCE by aggregating expenditures on goods and services by households and nonprofit institutions serving households. This comprehensive measure encompasses a wide array of categories, including durable goods, nondurable goods, and services, providing a holistic picture of consumer spending patterns.

The calculation of PCE involves meticulous data collection from various sources, including surveys, administrative records, and economic indicators. Through rigorous methodologies and statistical techniques, the BEA ensures the accuracy and reliability of PCE estimates, enabling policymakers to make informed decisions based on robust economic data.

Personal Consumption Expenditures (PCE) wield immense influence in shaping monetary policy, particularly in determining interest rates. As a vital indicator of consumer spending behavior, PCE serves as a linchpin of economic analysis for the Federal Open Market Committee (FOMC), guiding policy decisions aimed at fostering economic stability and growth. By leveraging historical data, real-world examples, and an understanding of PCE calculation methodologies, policymakers can harness the power of this crucial metric to navigate the complexities of the modern economy effectively.

Maybe it's time for an updated version.