Sober Truth: $76,623.74 is Bitcoin's Real All-Time High, Inflation-Adjusted

UPDATE 5 November 2024

🧵1/Bitcoin’s Real ATH is $76k +, Inflation Adjusted

— Truflation (@truflation) November 5, 2024

Back in early March, Truflation took $BTC price action as a teachable moment, pointing out how being denominated in USD had a distorting effect. pic.twitter.com/AOwGmJwmbZ

__

As of this writing, bitcoin (BTC) is more than $66,000 a coin. If fact, it shows little evidence of slowing such price action (spurred-on by retail buyers FOMOing via newly-allowed ETFs).

The world's first cryptocurrency is flirting with its all-time high (ATH), the psychologically significant November of 2021 number, $69,044.77. Bitcoin only has about 3.5% to go ... or does it?

Inflation Over 2+ Years

Enter the bugaboo of fiat, inflation.

And bitcoin, of course, is priced in US dollars (USD), so it only makes sense to take into account certain USD monetary realities.

READ Truflation Launches Electric Vehicle Commodity Index

Truflation found inflation since early November of 2021 totals just under 11%, 10.98% to be exact. This means the inflation-adjusted loss of USD purchasing power forces more greenbacks into chasing fewer BTC.

The sober truth, then, is bitcoin has another $10,000 to climb in order to reach its real ATH of $76,623.74.

Root Cause and a Main Bitcoin Raison D'Etre

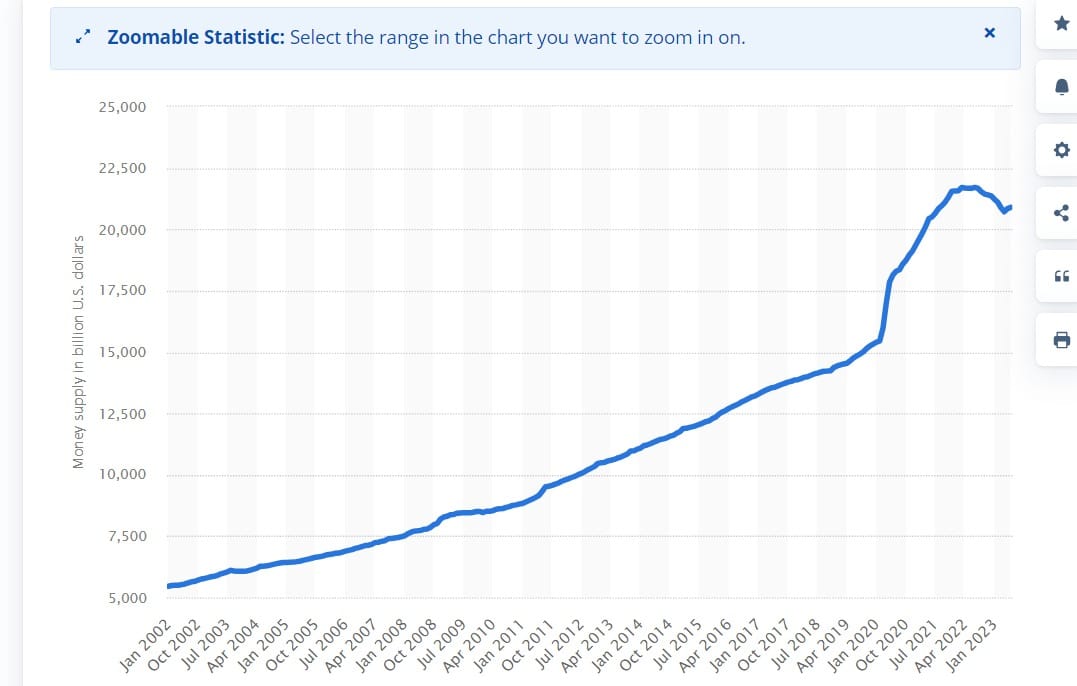

By December of 2021, the US M2 money supply hit 21.55T.

The amount of dollars created and put into circulation increased from $15347 billion in early 2020, to $21269 billion in late 2021. That's up 38.5% in a little under 2 years. Something like 40% of all money ever printed was placed into existence in a mere matter of months ... with little more than legislative finger snaps.

For sure, 2021 witnessed unprecedented growth in the US M2 money supply, but it's important to note that flood of filthy lucre was fueled by expansive fiscal and monetary policies aimed at mitigating economic fallout from the COVID-19 pandemic.

Understanding M2 Money Supply Growth

The M2 money supply encompasses currency, checking deposits, savings deposits, money market securities, and other liquid assets. It serves as a crucial indicator of the overall liquidity and financial health of an economy. Throughout 2021, the M2 money supply in the US experienced extraordinary expansion, driven by various factors.

- Fiscal Stimulus Measures: In response to the economic challenges posed by the pandemic, the US government implemented several fiscal stimulus packages, including the CARES Act and the American Rescue Plan Act (ARPA). These measures provided direct payments to individuals, enhanced unemployment benefits, and aid to businesses and state governments, injecting a significant amount of money into the economy and driving up M2.

- Monetary Policy Interventions: The Federal Reserve responded to the pandemic-induced economic downturn by implementing accommodative monetary policies. Interest rates were kept near zero, and the central bank engaged in large-scale asset purchases, commonly known as quantitative easing. These measures aimed to support lending, boost investment, and stimulate economic activity, contributing to the expansion of the M2 money supply.

- Changes in Banking Behavior: The uncertainty and volatility caused by the pandemic also influenced banking behavior and consumer preferences. Individuals and businesses sought to hold more liquid assets, such as deposits and money market securities, as a hedge against economic uncertainty. This increased demand for liquid assets further fueled the growth of M2.

READ Truflation Launches Big Mac Index for US & UK

Impact on Inflation

M2 money supply growth raised concerns about its potential inflationary impact on the economy. Increased liquidity can stimulate spending and aggregate demand, leading to upward pressure on prices across various sectors.

- Demand-Pull Inflation: As consumers and businesses had more money to spend, they competed for goods and services, driving up prices. The influx of liquidity from fiscal stimulus measures and accommodative monetary policies exacerbated demand-pull inflationary pressures.

- Asset Price Inflation: The expansion of the M2 money supply contributed to asset price inflation, particularly in financial markets. Low interest rates and ample liquidity incentivized investors to seek higher returns, leading to elevated valuations in equities, real estate, and other asset classes.

- Cost-Push Inflation: Higher input costs, such as labor and materials, resulting from supply chain disruptions and increased demand, also contributed to inflationary pressures. Businesses facing rising costs may pass them on to consumers in the form of higher prices, contributing to cost-push inflation.

The surge in M2 money supply growth in 2021, driven by fiscal stimulus measures, accommodative monetary policies, and changes in banking behavior, had significant implications for inflation in the United States and, it appears, for conventionally valuing bitcoin.

Want to be part of the data revolution? Join our Telegram to always be in the loop!