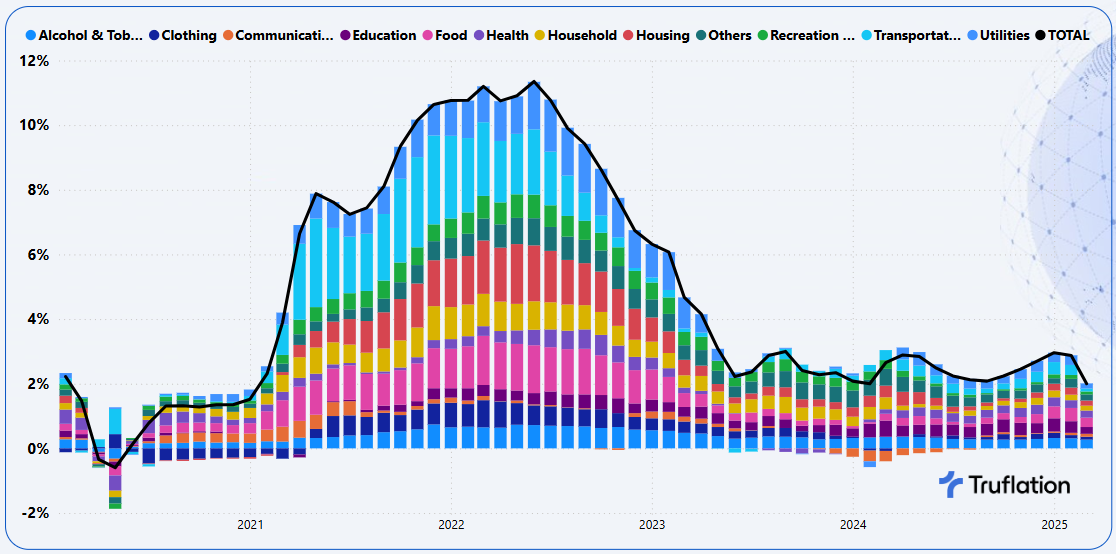

Public Peek: Truflation US Inflation Update for March 2025

The following is a public peek at our exclusive monthly Truflation CPI update, available in full by subscription, here.

Executive Summary

Recent tariffs have sent everybody scrambling to revise their economic forecasts. With at least 10% tariffs on most countries and with higher rates for other major trading partners, they are likely to have a complex and long-lasting effect on the economy.

The latest GDP forecasts are suggesting a significantly lower rate than previously projected. The US economy expanded 2.4% in Q4 2024 with Q1 forecasts ranging from 0% to 0.9% in Q1 2025. The outcome is uncertainty as the policy has broadened the spectrum of potential growth outcomes. Nomura expects inflation as measured by core PCE inflation to run at 4.7% at the end of the year, up from 3.5% in their previous forecast and the current 2.8%.

JPMorgan forecasters have raised their risk of a global recession up from expected 40% to 60% in March. Recession could be short-lived, but if the tariff hikes are maintained, they will permanently reduce the real GDP and real living standards for the average American. As much as these tariffs can be an effective for achieving economic and strategic objectives of the current administration, the latest data sends a message of uncertainty:

- Rising Disposable Income & Retail Sales: The continued growth in disposable income and increase in savings rates are positive signs. Retail sales however have seen a modest growth of 0.2% MoM, which was driven by food and ecommerce while the other remaining categories experienced declines. This reinforces the growing uncertainty over the economy.

- Savings Rate: According to the Bureau of Economic Analysis the savings rate has continued to increase from 3.3% in Dec to now 4.6%. It seems that consumers have started to save again against the rise of uncertainty.

- Consumer Confidence: Truflation’s Consumer Confidence declined for the 4th consecutive month in March as consumer expectations remain pessimistic as households fear a resurgence in inflation from tariffs.

- Labor Market: This shows continued resilience but tariffs and DOGE are set to bite in the coming months. Unemployment remains little unchanged at 4.2%, having remained in the 4.0%-4.2% range for the past 10 months.

- Wages: Wage growth continues to slow down to 3.8% YoY growth in March combined with the increase in savings rate supports that consumers are preparing for what is to come.

All this raises the question of whether the Federal Reserve is actually going to cut rates again in May. According to the CME FedWatch the market is split as to whether there will be a rate cut at the next meeting with 48% expecting a 25 bps reduction. Jerome Powell has stated last Friday that he expects the tariffs to raise inflation and lower growth and indicated that the central bank won’t move on interest rates until the Fed gets a clearer picture on the ultimate impacts. The Fed faces an uncertain outlook due to the new reciprocal levies but believes the economy is strong.

(...)

Exhibit 2 – Truflation key inflationary metrics: Goods vs Services vs Core Inflation

(...)

The above is a public peek at our exclusive monthly Truflation CPI update, available in full by subscription, here.

Truflation Website | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube