Public Peek: Truflation US Inflation Update for January 2025

The following is a public peek at our exclusive monthly Truflation CPI update, available in full by subscription, here.

It really has been a volatile beginning to the year with these tariff changes. The temporary pause for Mexico and Canada may offer some short-term relief, but the broader tension with China is likely to cause ripples throughout the global economy. With the additional 10% tariff on top of the 25% from the previous administration, China is clearly making a point of responding to the US’s moves, and can only complicate relations further. It is likely to affect the prices of everyday products for U.S. consumers, making things like electronics, clothing, and various household goods more expensive.

President Trump has shifted his position on interest rates, especially after previously advocating for immediate rate cuts. His agreement with the Federal Reserve’s decision to leave rates unchanged signals a potential recognition of the broader economic factors at play, and it could indicate a more measured approach moving forward.

The final GDP release of the last three months of 2024 highlighted that economy growth slowed a bit more than expected. The economy grew 2.3% annualized inflation adjusted, while economists were expecting an increase of 2.5% after a growth of 3.1% in the third quarter. It closes out 2024 on somewhat of a downbeat note, though growth held reasonably solid. The full year GDP accelerated 2.8%, compared to 2.9% in 2023.

Growth continued to be held up by the consumers who continued to spend briskly despite the ongoing burden of high prices on everything from homes to cars to eggs at the supermarket. While inflation is dramatically lower from mid 2022, it remains a burden for households particularly those on the lower end of the income scale. Consumer spending rose a strong 4.2%, and as usual, amounted to about 2/3 of all activity. Government spending also provided a boost, accelerating at a 3.2% level.

In other economic news, job growth slowed more than expected in January after robust gains in the prior two months. Health and Social Services were the biggest industries for job growth. The unemployment rate came in at 4.0%, which is not 100% directly comparable to December 4.1%, due to the new population controls. In addition to this we have seen strong wage growth with hourly earnings surging by the most in 5 months, which will no doubt keep consumer spending supported.

(...)

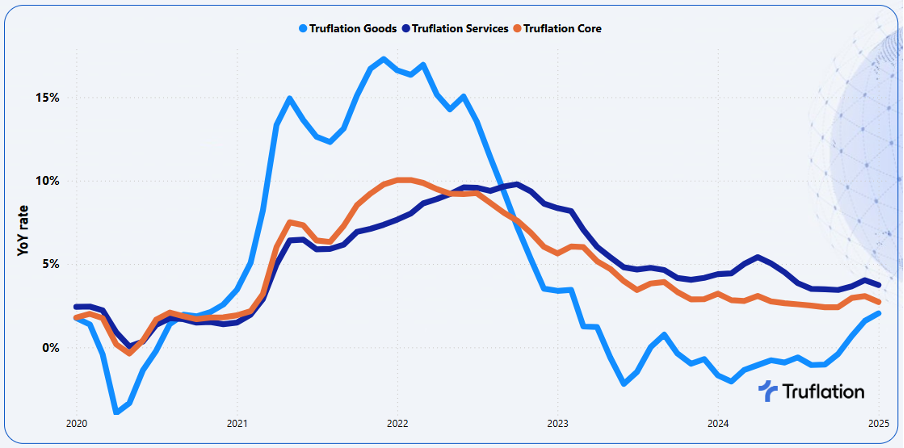

Exhibit 2 – Truflation key inflationary metrics: Goods vs Services vs Core Inflation

(...)

The above is a public peek at our exclusive monthly Truflation CPI update, available in full by subscription, here.

Truflation Website | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube