Public Peek: Truflation US Inflation Update for February 2025

The following is a public peek at our exclusive monthly Truflation CPI update, available in full by subscription, here.

Executive Summary

President Trump has pledged to unshackle the economy, but his trade policies, especially the tariffs on key trading partners like Canada, Mexico, and China, have sparked concerns about the future of economic growth. These tariffs challenge the framework of globalized trade, which has been a cornerstone of U.S. economic expansion for decades.

The tariffs mean that American consumers are facing higher price, especially on everyday items like vegetables, wheat, toys, and t-shirts, which are particularly burdensome for consumers, who have already faced a relatively high level of inflation. The imposition of these tariffs will likely add between 0.5% to 1.0% on the current inflation rate. This would compound existing inflationary pressures, making goods more expensive for American consumers. In addition to this Trump’s policies on immigration could exacerbate the problem, potentially leading to a stagflationary shock.

The sentiment within the manufacturing sector is weakening, signalling potential concerns about future growth. This may be due to the uncertainty caused by tariffs, trade disruptions, and the broader economic climate. The recent trade deficit has increased significantly, in part due to businesses stockpiling goods in anticipation of tariffs.

At the same time, there are cuts to the federal workforce and reductions in government spending. This may further slow economic activity, as public sector cuts typically reduce overall demand for goods and services in the economy. Tightening of immigration policies is creating concerns about labor shortages, especially for industries that rely on immigrant workers.

Given all these factors, investors are now predicting that the Federal Reserve will lower interest rates by about three-quarters of a point by the end of 2025. However the expectations of the upcoming meeting on March 19th is that interest rates will remain unchanged. Policymakers will be looking for more trends in the data before making any major changes in the short term.

- Personal spending fell by 0.2% from December to January, marking the largest drop since early 2021... (...)

(...)

Truflation is forecasting a continued decline in CPI reading for February ... (...)

(...)

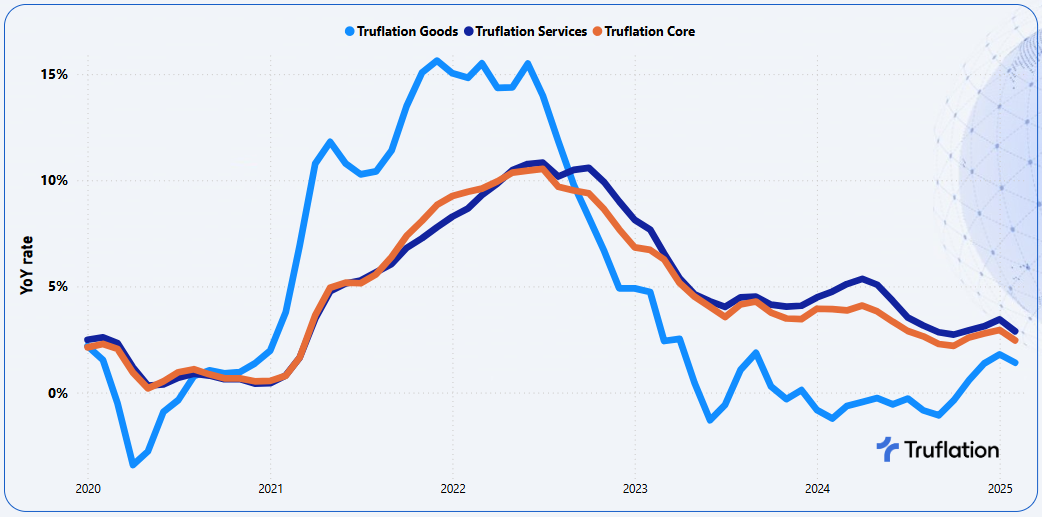

Exhibit 2 – Truflation key inflationary metrics: Goods vs Services vs Core Inflation

(...)

The above is a public peek at our exclusive monthly Truflation CPI update, available in full by subscription, here.

Truflation Website | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube