Public Peek: Truflation US Inflation Update for April 2025

The following is a public peek at our exclusive monthly Truflation CPI update, available by subscription, here.

Executive Summary

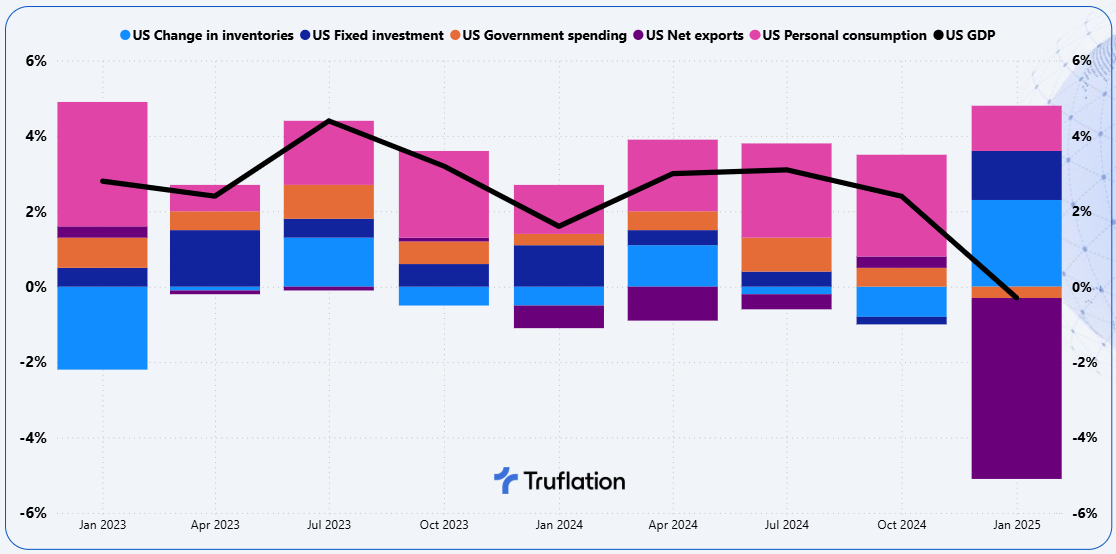

The US economy contracted at an annual rate of 0.3% in the first quarter of 2025, the first time in three years. This was primarily due to an astonishing 41% increase in imports (at an annualized rate) and is largely attributed to front loading in anticipation of tariffs. Assuming all else is equal, it is likely that the GDP growth will catch up as inventories are used up and the consumer continues to spend. However, given the dependency on overseas goods, this approach is only sustainable on a shorter horizon. Otherwise supply gaps will start to occur combined with increases in prices.

Exhibit 1 - US contributions to GDP growth, percentage points

The job market on the other hand continues to remain resilient with employers adding 177,000 roles in April, even with a 9,000 drop in government jobs. Nearly 55% of industries added workers, showing demand was pretty broad based. Average hours worked rose, reversing previous downtrend and the labor force participation rose as well. Unemployment remained stable at 4.2%.

However, the number of job openings is now below 7.2 million and is likely to continue to drop (pre pandemic levels averaged between 6 to 7 million). The ADP’s measure of private payroll rose by 62,000 only for April. The ISM manufacturing employment gauge is still contracting, and it seems that employers are repositioning themselves and prioritizing resilience, digital scale and operational efficiencies over raw headcount growth.

(...)

Recent inflation trends

(...)

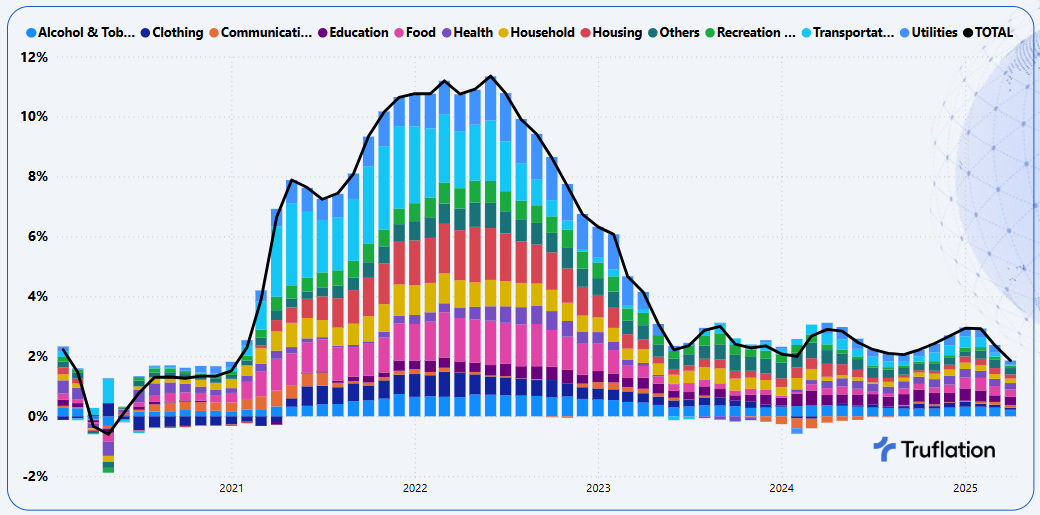

Exhibit 4 – Truflation Category Inflation Drivers

(...)

The above is a public peek at our exclusive monthly Truflation CPI update, available by subscription, here.

Truflation Website | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube