Pennsylvania State University and Truflation Collaboration: Revolutionizing Housing Inflation Measurement

Inflation, particularly in the housing sector, is a critical economic indicator that impacts individuals, businesses, and policymakers alike. Traditional metrics like the Consumer Price Index (CPI) and the Personal Consumption Expenditure Price Index (PCE) have long been relied upon to gauge inflation rates. However, these methods often fall short in accurately capturing the nuances of housing inflation. In response to this challenge, Pennsylvania State University and Truflation have embarked on a groundbreaking research collaboration to propose alternative metrics that provide a more comprehensive understanding of housing inflation in the United States.

Understanding Shelter Inflation

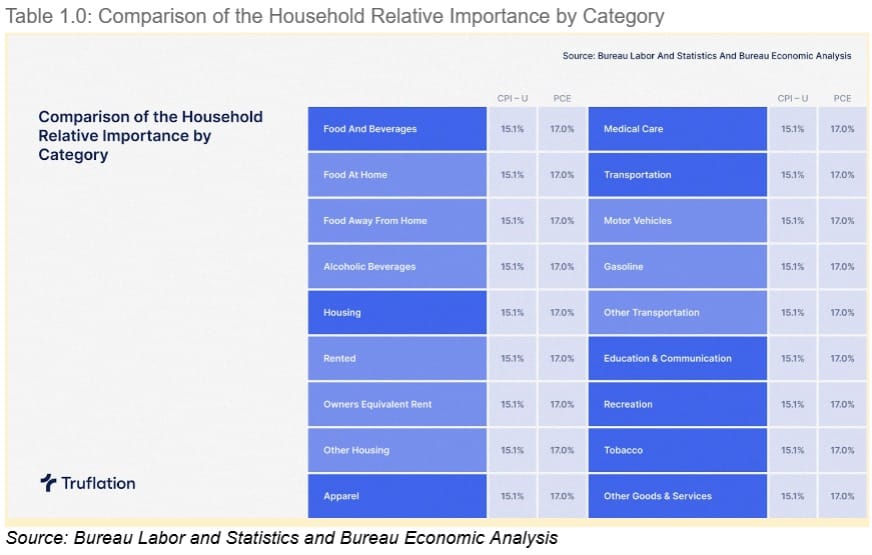

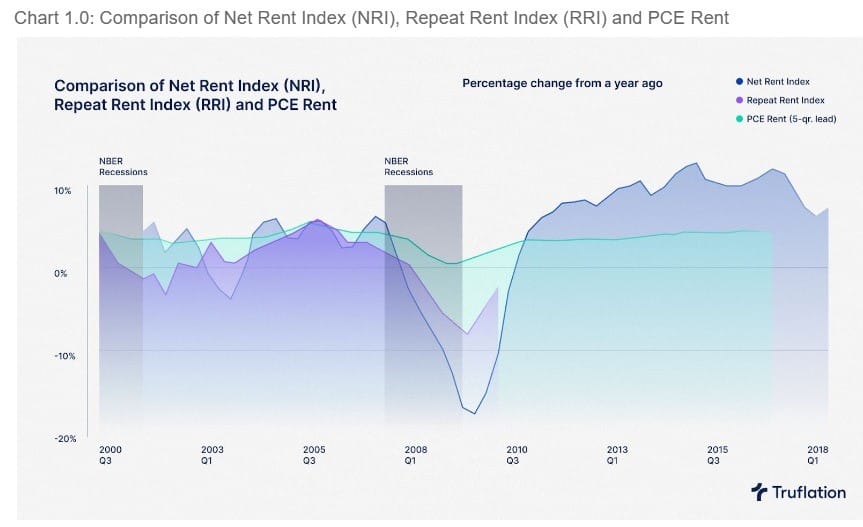

Shelter, encompassing housing costs, plays a significant role in the Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) indexes, accounting for a substantial portion of household expenditures. Despite this, existing methods of measuring housing inflation have shown inconsistencies and limitations. While the CPI has reported consistent increases in shelter prices over recent years, Truflation's housing index has exhibited a more gradual growth trajectory. This disparity raises questions about the accuracy of traditional metrics in reflecting the true dynamics of housing inflation.

READ THE FULL REPORT (FREE) HERE

Proposed Alternative Metrics

In response to the shortcomings of traditional measures, the collaborative research introduces two innovative inflation indexes: the ACY Inflation Index developed by Ambrose and Yoshida at Pennsylvania State University, and the Truflation Index. These alternative metrics aim to provide a more nuanced and accurate depiction of housing inflation by considering a broader range of factors, including mortgage costs, property services, and household maintenance expenditures. By incorporating these additional variables, the alternative indexes offer a more holistic view of the housing market's inflationary pressures.

Data and Methodology

Truflation's methodology for measuring housing inflation is grounded in comprehensive data analysis and rigorous statistical modeling. Leveraging data from household budget allocations, nationally reported expenditure data, and insights from Truflation's Personal Inflation Calculator, the researchers refine their inflation indexes to reflect evolving consumer spending patterns and economic conditions. The weighting of each component is updated annually to ensure relevance and accuracy in capturing housing inflation trends.

READ THE FULL REPORT (FREE) HERE

Significance and Applications

Accurate measurement of housing inflation is crucial for various stakeholders. At the federal level, policymakers rely on inflation data, such as the CPI, to adjust tax brackets and entitlement programs, ensuring equitable taxation and social assistance. For businesses, CPI data informs pricing strategies, wage negotiations, and lease agreements with inflation-adjustment clauses. Economists and financial analysts use inflation metrics for economic forecasting and trend analysis, guiding investment decisions and policy recommendations.

The collaboration between Pennsylvania State University and Truflation represents a significant step forward in advancing the measurement of housing inflation. By introducing alternative metrics that address the limitations of traditional indices, the research offers valuable insights into the complex dynamics of the housing market. Moving forward, these alternative measures hold the potential to enhance decision-making processes for individuals, businesses, and policymakers, contributing to a more informed and resilient economy.

For the full research report, click here: https://subscribepage.io/GelN0g