New Year, Is the US Entering a New Golden Age or Heading for the Next Recession?

The Nasdaq Composite, DIA, and S&P 500 hit record highs in November, fueled by economic growth and the outcomes of the presidential elections. But the big question is: Is the U.S. on the verge of a new golden age like the 1950s, or is this just speculation and it’s a long way down from here?

This is a complex question to answer. There is significant potential for growth, but there are also challenges that must be overcome and pitfalls to navigate.

Let’s begin by understanding what fueled the golden age of the 1950s so we can compare it to the current economic landscape.

1950s: The Golden Decade

After World War II, the United States experienced a period of prosperity, especially during the 1950s, characterized by:

- Increased investment in infrastructure: There was significant expansion in energy and water resource sectors, urban infrastructure, airport construction, housing, and most notably, the beginning of the Interstate Highway System. This project required over $25 billion at the time (equivalent to more than $260 billion in today’s value).

- Technological and industrial advancements: The first commercial computer was launched in 1951. By the end of the decade, more than 50 million households had access to television. The period also saw the creation of commercial aircraft and the mass production of automobiles.

- Expansion of the middle class: The manufacturing industry provided stable jobs, while mass production techniques in construction made suburban homes accessible to middle-class families. Education saw advancements, benefiting both war veterans and the general population through improvements in basic education.

- Rise of consumer culture: Products like cars, household appliances, and televisions became symbols of the middle class. Radio and, especially, television popularized consumption ideals and reinforced middle-class values. Additionally, the use of credit to finance consumer goods grew significantly, making high-cost items more accessible.

- International leadership: In the 1950s, the U.S. accounted for nearly half of global GDP. It had significant influence over newly established global financial institutions, such as the IMF and the World Bank, which reinforced American economic interests. The Bretton Woods system established the U.S. dollar as the dominant global currency, backed by gold.

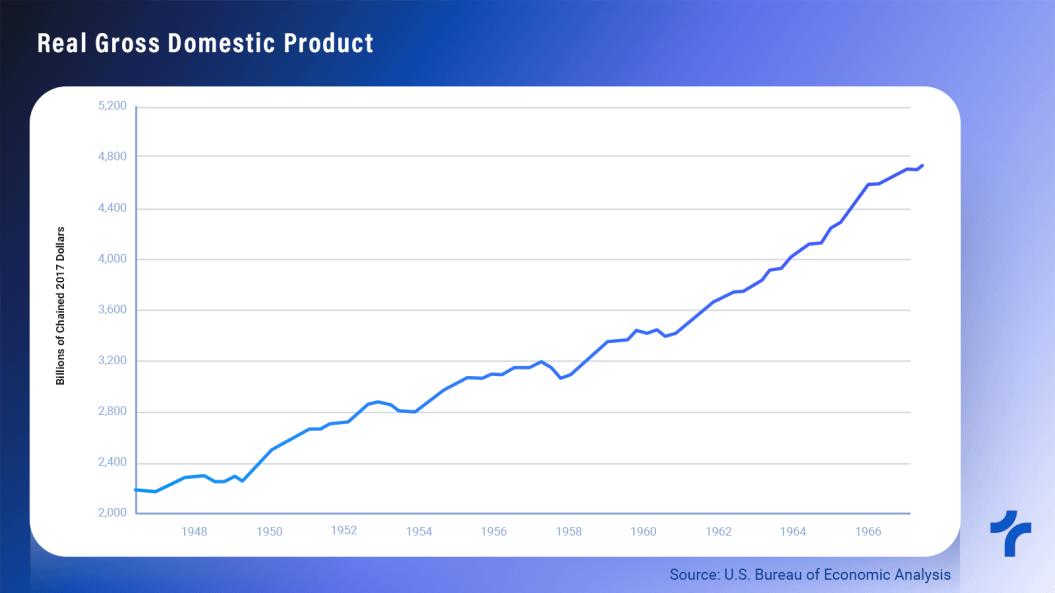

- Economic growth: The GDP grew consistently throughout the decade, reflecting the strength of both industry and domestic consumption.

Economic growth is evident in the data: from the last quarter of 1949 to the last quarter of 1959, real GDP grew by 52.37%, which translates to an average annual growth rate of 4.3%. Stocks also experienced significant gains during this period. The Dow Jones Industrial Average (DJIA) increased by 239.5%, averaging 13% annually.

Stability, both economic and political, was crucial to the success of this era. This applied to domestic affairs as well as the international stage, where a climate of peace and reconstruction prevailed.

What's Happening Now?

The current scenario is very different from what was seen in the 1950s. The challenges are entirely distinct. However, there is a significant opportunity for economic growth.

The potential for substantial development exists, but how the government addresses these challenges to enable the market to drive economic growth will be crucial in determining whether we experience a new golden age or a dark age.

Challenges

Unlike the stabilized scenario observed during the previous golden age, today we are still dealing with the issue of inflation resulting from significant fiscal expansion following the pandemic. The global geopolitical landscape is marked by conflicts rather than reconstruction.

This presents major challenges, which we will explore in greater depth:

Inflation and Interest Rates

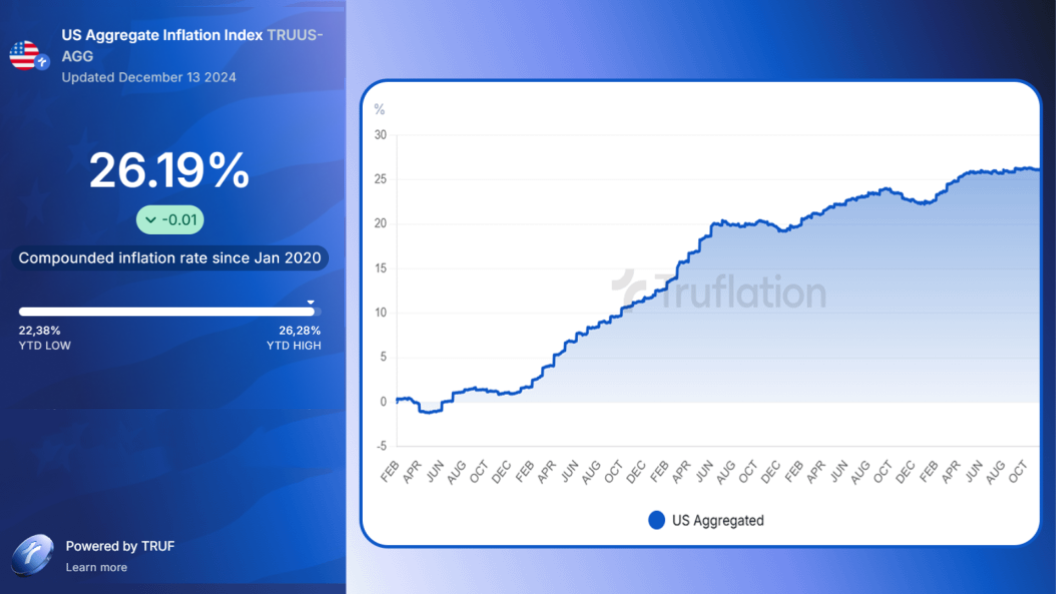

Since the pandemic, public spending has significantly increased to sustain the economy, along with a substantial rise in money supply. This inevitably led to high inflation rates. According to the Truflation Index, purchasing power has declined by more than 26% in less than four years.

This figure is above the usual levels and remains a significant problem, as it necessitates restrictive monetary policies, which, in turn, slow down the economy. Despite a highly restrictive cycle, inflation is still above target, raising questions about whether a soft landing is possible or if the economic impacts will be severe.

Additionally, there is a possibility that the neutral interest rate has increased, a factor that negatively affects the economy. Even as the Federal Reserve reduces the Fed Funds rate, the 10-year U.S. Treasury yield and mortgage rates have risen since the first rate cut, posing yet another challenge for the economy.

Recent data showed an increase in year-over-year inflation for October compared to September. This indicates that the problem is not yet resolved and requires attention to bring inflation sustainably below the 2% target.

This is a critical challenge, as economic theory suggests that an increase in output implies an increased demand for money. If the demand for money grows faster than the economy, a new golden age could face inflationary pressures, necessitating restrictive monetary policies that might inhibit part of the economic growth.

Public Debt

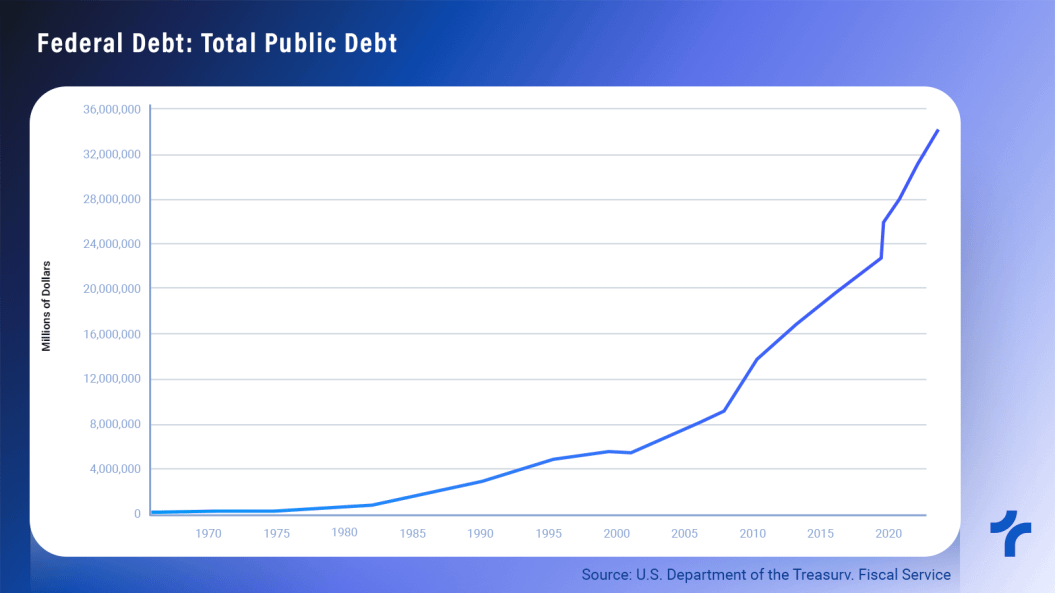

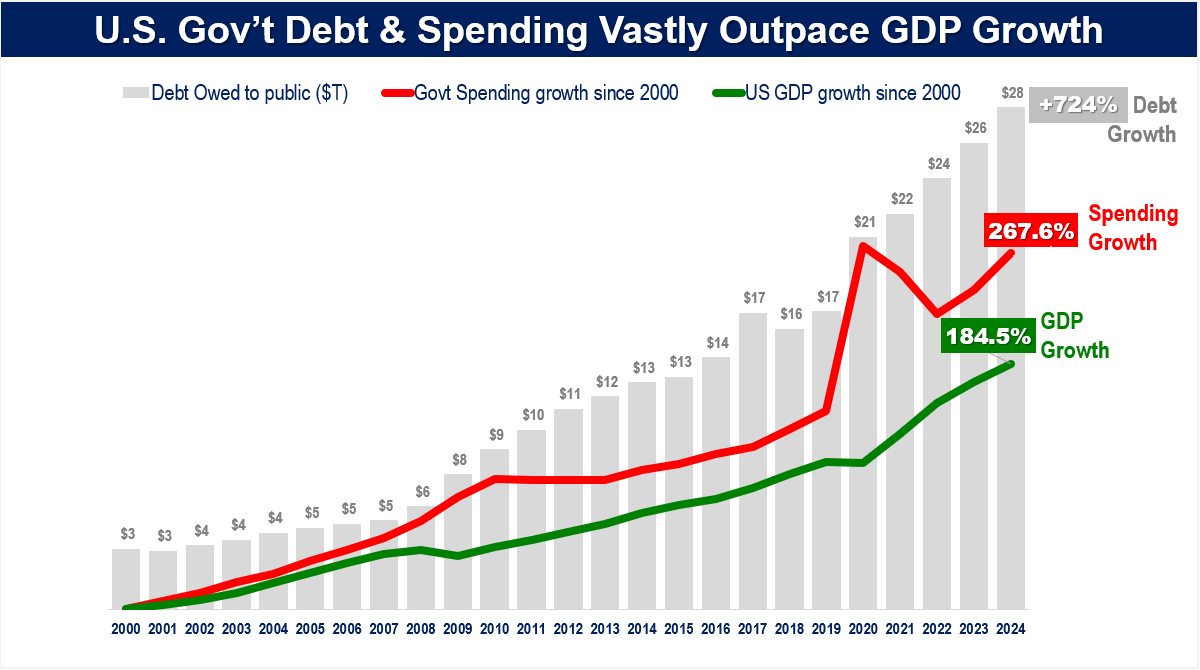

This is another major concern. Government spending is growing at an accelerated pace, and at current levels, the cost of debt is high. The following chart shows that since the 2000s, debt growth has been increasing exponentially.

The debt has increased by about 400% since 2004 and has doubled since 2014, resulting in a current debt-to-GDP ratio of 120%. This demands greater fiscal responsibility from the government to keep the debt under control.

The pace of government spending growth exceeding GDP growth is problematic, as it causes debt to accelerate rapidly. With high debt, a significant portion of funds is allocated to paying interest on the debt, a factor that could completely constrain the public budget in the future.

On the other hand, government spending is driving short-term economic growth. A significant portion of job creation in recent months has come from government employment.

It is worth noting that growth driven by public spending rarely translates into an equivalent increase in quality of life. This is not solely a question of whether the government is efficient or not; it stems from the fact that the government cannot determine individuals' preferences more accurately than individuals themselves.

Geopolitical Conflicts

Very different from the climate of reconstruction in the 1950s, today the world is facing significant geopolitical tensions.

Examples include the ongoing war between Russia and Ukraine, which has lasted over 30 months. The recent use of American missiles in the conflict and the potential involvement of the United Kingdom and France could lead to a significant escalation.

Wars in and around Israel are another critical point. This region, historically marked by military conflicts, is once again experiencing chaos. Although Israel has significant military capabilities, these conflicts tend to be prolonged.

The potential future attempt by China to take control of Taiwan is another pressing issue. On the one hand, China is determined to reclaim the territory, while on the other, there is strong international interest in defending the island, primarily due to its strategic importance as the home of TSMC, a key player in semiconductor production, and vital to technological development.

All of this contributes to increased military spending, financial support for countries through loans, and even trade sanctions. These factors weaken global trade and pose a significant obstacle to commercial prosperity between nations. In 2024, the U.S. Department of Defense's spending reached approximately $2 trillion.

A conflict directly involving the U.S. would have a negative economic impact, especially in the short term. How the government handles these tensions will be crucial.

AI: The Market Is Giving The OPPORTUNITY

Not everything is a challenge. We are living through a historic moment that presents a tremendous opportunity for economic development. The use of artificial intelligence is expected to have a significant impact on income and quality of life.

Masayoshi Son projects:

- The development of AI will necessitate a cumulative capital expenditure of $900 trillion in data centers and specialized chips over time.

- Artificial superintelligence, expected to emerge by 2035, will be 10,000 times more intelligent than the human brain.

- $9-12 trillion in capital expenditure is expected to flow into AI infrastructure.

These mechanisms promote sustainable, long-term growth, paving the way for a new Golden Age. The coming decade could be marked by an unprecedented acceleration in quality-of-life improvements.

Comparing the Two

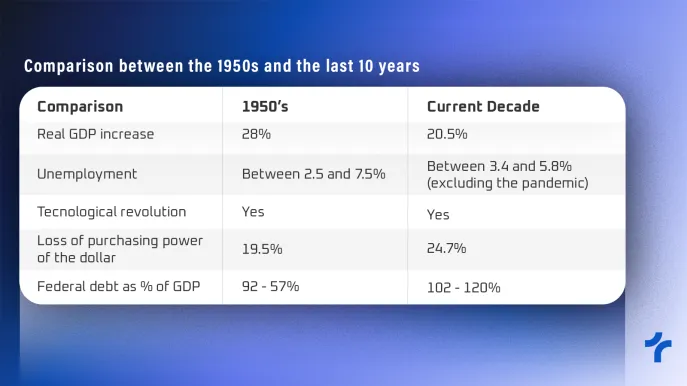

The data shows that, despite the significant changes in the world, there are some similarities, especially when considering the effects of the pandemic on the current economy. Let’s explore some data, analyzing a 10-year period.

- Real GDP growth was higher during the 1950s. However, the pandemic negatively impacted the current period. If the economy continues to grow, the coming years could rival that of the previous golden age.

- Unemployment rates are another important factor. Since October 2014, unemployment has been well-controlled, excluding the pandemic period, this is very similar to what occurred in the 1950s, when a strong economy with growth potential generated significant job creation.

- According to government data, the dollar lost just under 20% of its purchasing power during the golden age, slightly less than the depreciation seen in the past 10 years.

- Federal public debt is a major differentiator. In the earlier period, debt started high, representing 92% of GDP, and by the end of 1959, it had dropped to just 57%. Currently, the trajectory is different: in 2014, public debt represented 102% of GDP, while today it has risen to 120%. This is a critical factor, as it is necessary to control debt trajectory to ensure sustainable growth.

- The 1950s were marked by significant technological advances and the overcoming of a major challenge, World War II. Today, artificial intelligence is driving a technological revolution, and society has also emerged from a challenging period with the pandemic, which drastically disrupted supply chains.

As a result, we could be entering a period of economic renaissance, where many businesses and wealth are created, and quality of life improves. This would be driven by the renewal of knowledge, the productive sector, and, most importantly, the appreciation of individual freedoms, which history has shown to be essential for prosperity.

Conclusion

We observe that there is an endless maze of political and economic challenges that we will face in the coming years. Some will require concessions from the government, while others are not entirely under the control of the U.S.

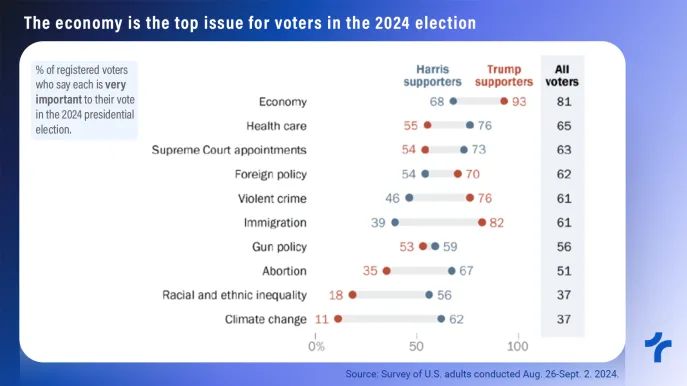

Fortunately, the issues within the U.S.'s control are relatively straightforward, relying more on political goodwill than on complex economic mechanisms. There has recently been a renewed sense of optimism for much of the American population following the election results. According to the Pew Research Center, the economy was the primary factor influencing votes in these presidential elections.

On the other hand, if these issues are resolved, there lies one of the greatest growth challenges and opportunities in history: artificial intelligence. This could not only boost the country’s economy but also lead to a significant improvement in quality of life, similar to what was seen in the 1950s.

The future remains opaque, with both challenges and opportunities. This requires close attention to economic data to understand where we are headed from here. You can track the performance of AI companies through Truflation’s AI Index.

Truflation Website | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube