Introducing the Truflation PCE Index: A Real-Time Alternative to the Fed’s Inflation Benchmark

Understanding inflation is critical for investors, businesses, policymakers, and households alike. At Truflation, we’ve made it our mission to provide independent, real-time insights into the cost of living.

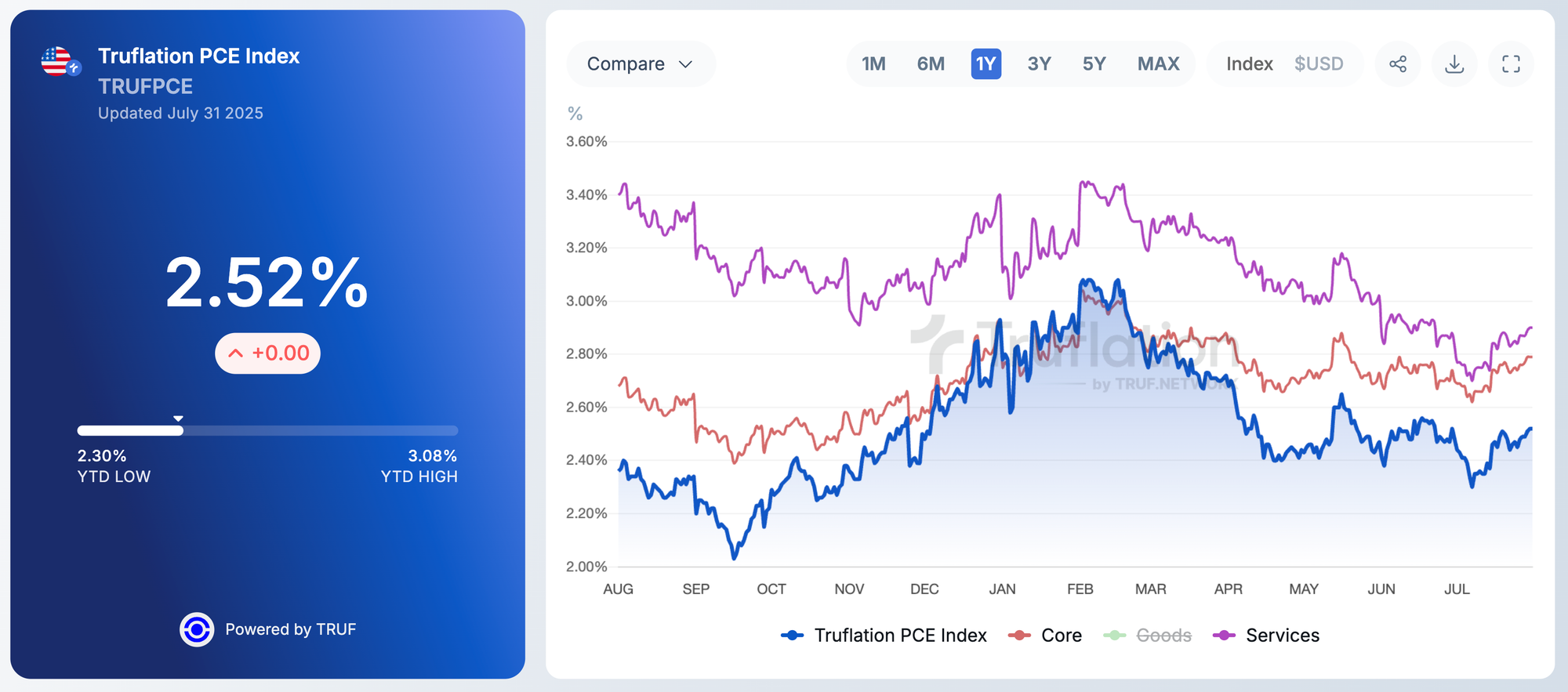

Today, we’re expanding that mission with the launch of the Truflation PCE Index, offering a transparent and timely alternative to the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation measure.

Why the PCE Matters

The PCE Price Index is produced by the Bureau of Economic Analysis (BEA) and serves as the Federal Reserve’s primary inflation barometer. It tracks the prices consumers pay for a broad basket of goods and services, including third-party spending like employer-paid health insurance and government programs. While comprehensive, the PCE suffers from delayed publication, periodic revisions, and reliance on outdated housing metrics.

The PCE is calculated using a chain-type weighting system that reflects consumer behavior shifts over time. Its broad scope includes nonprofit spending, used goods, and purchases abroad, providing a wide-angle view of consumption. But this breadth can come at the cost of precision and timeliness—both critical in fast-moving economic environments.

Truflation’s Approach

Truflation was built to deliver up-to-date, granular economic insights based on independent data. Our real-time US inflation index already leads official CPI by an average of 45 days. Following the success of our Truflation CPI Index, demand has grown for a PCE-aligned version.

The Truflation PCE Index responds to that demand. It leverages over 14 million daily data points from more than 40 independent sources. We align these prices to the product categories and weights used in the BEA’s PCE Price Index, ensuring direct comparability.

The result is a real-time, high-resolution alternative that enables market participants to track inflation trends with much less delay. For analysts forecasting monetary policy or modeling market scenarios, this means gaining a vital time advantage.

How It Compares

Our index shows a remarkable correlation with the official PCE. From January 2010 through May 2025, we compared monthly year-on-year changes in both series. The correlation coefficient was 0.998, while the R-squared value reached 0.997, indicating an almost perfect linear relationship.

This tight relationship confirms that Truflation’s real-time data not only leads the official PCE but also mirrors its trend direction with exceptional accuracy.

While the BEA PCE excludes home purchase prices and relies on owners' equivalent rent from BLS data, Truflation incorporates actual home purchasing costs using mortgage payments. This adjustment makes our index especially relevant for households and investors monitoring real-world affordability and housing-related inflation.

Key Advantages of the Truflation PCE Index

- Real-time updates: Published daily rather than monthly

- Independent sourcing: Over 14 million price points from 40+ data providers

- Category alignment: Matches BEA’s official PCE product hierarchy and weights

- Enhanced housing methodology: Reflects actual housing costs, not proxies

- Forecasting utility: Offers a leading signal for the PCE

Who Should Use This Index

The Truflation PCE Index is designed for economists, asset managers, analysts, and macro strategists who require timely and granular inflation data. It also serves retail investors, policymakers, and Web3 participants seeking a clearer view of real-world economic conditions.

Whether you are positioning for the next Fed decision or monitoring shifts in consumer prices, the Truflation PCE Index provides a sharper tool to navigate today’s inflationary landscape.

Truflation Website | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube| Subscribe to our free Newsletter