Inflation Top Election Concern for 18-29 Year Olds, Harvard Youth Poll Finds

"Only 9% of young Americans say the country is headed in the right direction," and economic concerns are among the leading reasons, according to the 47th edition of the Harvard Kennedy School Institute of Politics Youth Poll (Spring 2024).

The poll was conducted between March 14-21, 2024, and surveyed 2,010 young Americans between 18- and 29 years old nationwide.

READ Stranger Things: 212,000 Jobless Claims Five Weeks in a Row

"Nearly three in five (58%) young Americans believe that the country is 'off on the wrong track,' and only 9% say that things in the nation are 'generally headed in the right direction.' An additional 32% say they are unsure. In the Spring 2020 wave, 21% responded that the nation was headed in the right direction; in the Spring 2016 wave, 15% said the same," the poll contextualized.

Pollsters also found how in "an open-ended question about which national issue concerned them most, we found that about a quarter (27%) of young Americans volunteered something related to the economy."

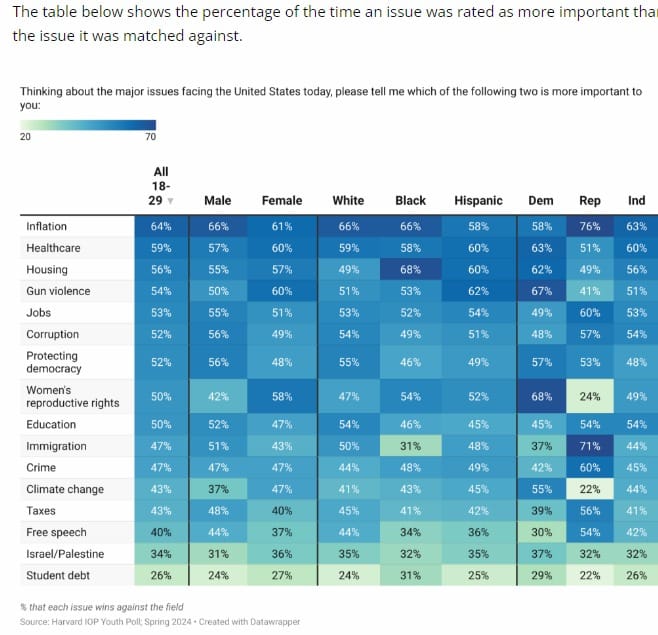

Interestingly, they "identified 16 prominent areas of concern and asked survey respondents in a series of randomized match-ups which one of two paired issues was more important to them." Tellingly, they "found that economic concerns were viewed as more prominent. Inflation, healthcare, housing, and jobs won most match-ups regardless of what they were paired against," Harvard concluded.

Economic Reality

Inflation is an economic reality that affects everyone, but its impact can be especially pronounced for young adults aged 18-29 in the United States. As prices for goods and services continue to rise, this demographic faces unique challenges that can hinder their financial stability and future prospects.

For many young Americans, pursuing higher education is a path to better opportunities and higher earnings. However, the rising cost of education has become a significant burden. Over the past decade, tuition fees at public universities have soared, outpacing both inflation and wage growth. According to the College Board, the average annual tuition and fees at a public four-year institution have increased by over 30% in the last ten years.

READ Israel Responds to Iran: War and Inflation in the 21st Century

This surge in education expenses has left many young adults grappling with student loan debt. With the Federal Reserve indicating that outstanding student loan debt has exceeded $1.7 trillion, the inflationary pressure on education costs is palpable. As prices continue to rise, young graduates face the challenge of managing hefty loan repayments, which can delay major life milestones such as buying a home or starting a family.

Housing Affordability

The dream of homeownership remains elusive for many young adults as inflation pushes housing prices beyond reach. Across the country, the real estate market has witnessed unprecedented growth, with home prices soaring to record highs. The median home price in the U.S. surged by more than 15% in the past year alone, far outpacing wage growth and inflation.

This rapid appreciation in housing costs presents a formidable barrier to entry for young adults seeking to purchase their first homes. With down payments and mortgage payments becoming increasingly burdensome, many find themselves locked out of the housing market or forced to settle for less desirable living arrangements. The result is a generation of renters facing escalating rents and dwindling options, further exacerbating financial strain.

Everyday Expenses

Beyond education and housing, inflation also impacts the everyday expenses of young Americans. From groceries to gasoline, the cost of living continues to rise, stretching budgets thin. Inflationary pressures, compounded by supply chain disruptions and increased demand, have led to higher prices across a range of essential goods and services.

READ Can GameFi Make a Comeback? Exploring its Impact, Examples, and Future in Digital Finance

Long History

From the post-war boom to the turbulent 1970s and beyond, the impact of inflation on this demographic has been profound, shaping their financial prospects and life choices. By examining key historical periods and specific examples, we can gain insight into how inflation has affected young Americans over time.

Post-World War II Boom

Following World War II, the United States experienced a period of unprecedented economic expansion and prosperity. However, this era also saw inflationary pressures as demand for goods and services outstripped supply. In the late 1940s and early 1950s, inflation rates hovered around 8-10% annually, significantly higher than in previous decades.

For young adults entering the workforce during this period, inflation posed challenges in terms of purchasing power and wage growth. While jobs were plentiful, rising prices eroded the value of their earnings, making it difficult to save and invest for the future. Additionally, the post-war housing boom drove up real estate prices, putting homeownership out of reach for many young families.

The 1970s Stagflation Crisis

The 1970s marked a tumultuous period in American economic history, characterized by high inflation, stagnant growth, and rising unemployment—a phenomenon known as stagflation. In response to the oil crisis of 1973-1974, oil prices quadrupled, triggering a wave of inflation that reverberated throughout the economy.

READ Truflation: US Inflation Update March 2024

For young adults coming of age during this period, inflation presented a formidable obstacle to financial stability and upward mobility. With prices soaring and job opportunities scarce, many found themselves struggling to make ends meet. Inflation eroded the value of their wages, making it difficult to afford basic necessities such as food, housing, and transportation.

Recent Decades

In more recent decades, inflation has remained a persistent concern for young Americans, albeit at lower levels compared to previous eras. The 1980s and 1990s saw relatively moderate inflation rates, averaging around 3-5% annually. However, the new millennium brought its own set of challenges, including the Great Recession of 2008 and its aftermath.

The Great Recession dealt a severe blow to the economy, leading to deflationary pressures and a prolonged period of economic stagnation. While inflation remained subdued in the immediate aftermath of the crisis, it began to pick up steam in the years that followed, driven by factors such as loose monetary policy and rising commodity prices.

Inflation's impact on young Americans is one of challenges and resilience. From the post-war boom to the stagflation crisis of the 1970s and beyond, inflation has posed formidable obstacles to financial stability and upward mobility. It lives today, of course, and Harvard tells the story: inflation is THE issue for young voters. That means it's even more critical to have timely, transparent, un-censorable data to keep them informed.

Truflation Blog | Website | X | Discord | Telegram | Github | YouTube