Inflation is the highest in 30 years and, according to some economists, much higher

Some economists believe inflation is double the published rate.

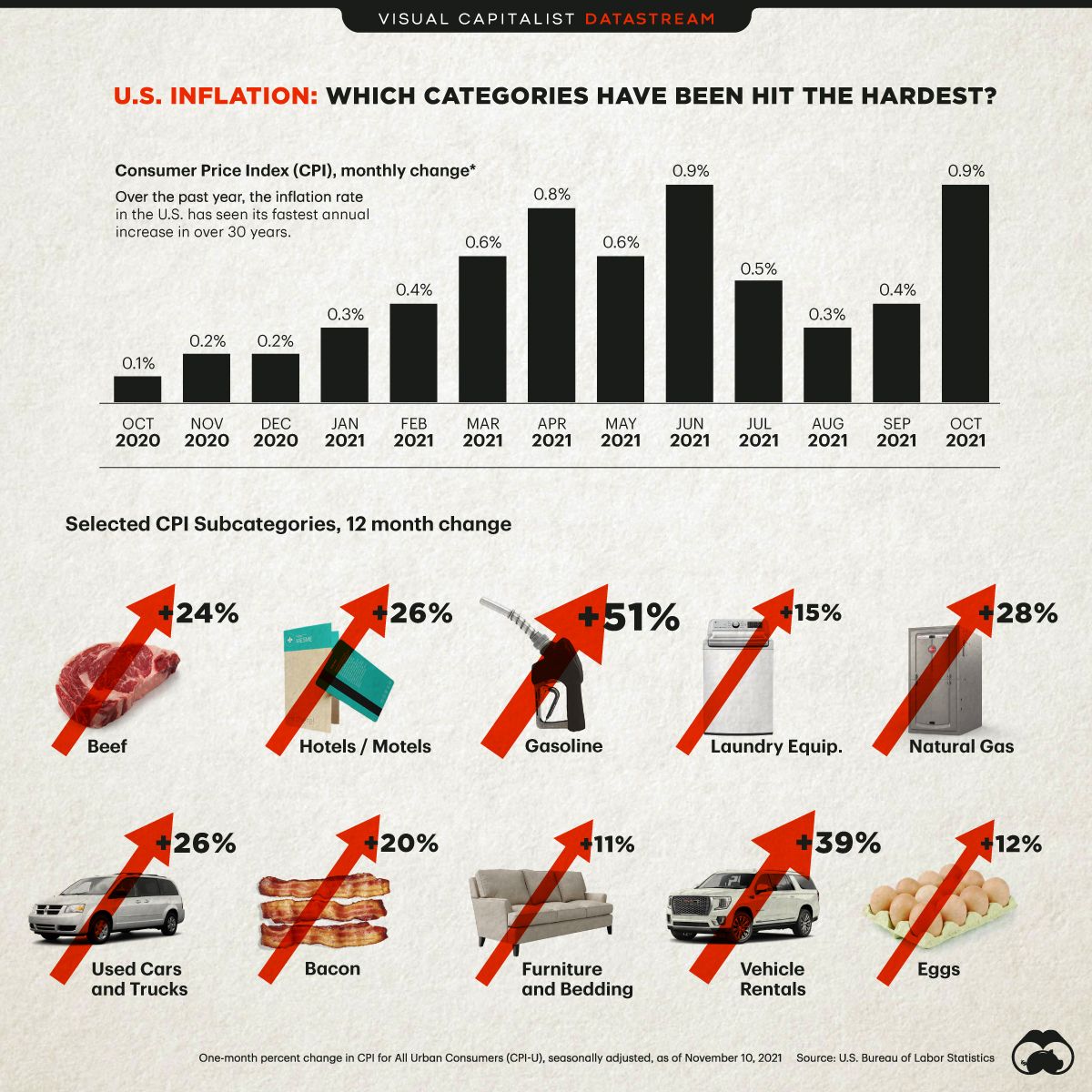

The official US inflation is now the highest in 31 years (6.2%, as of October 2021), but what is the inflation exactly?

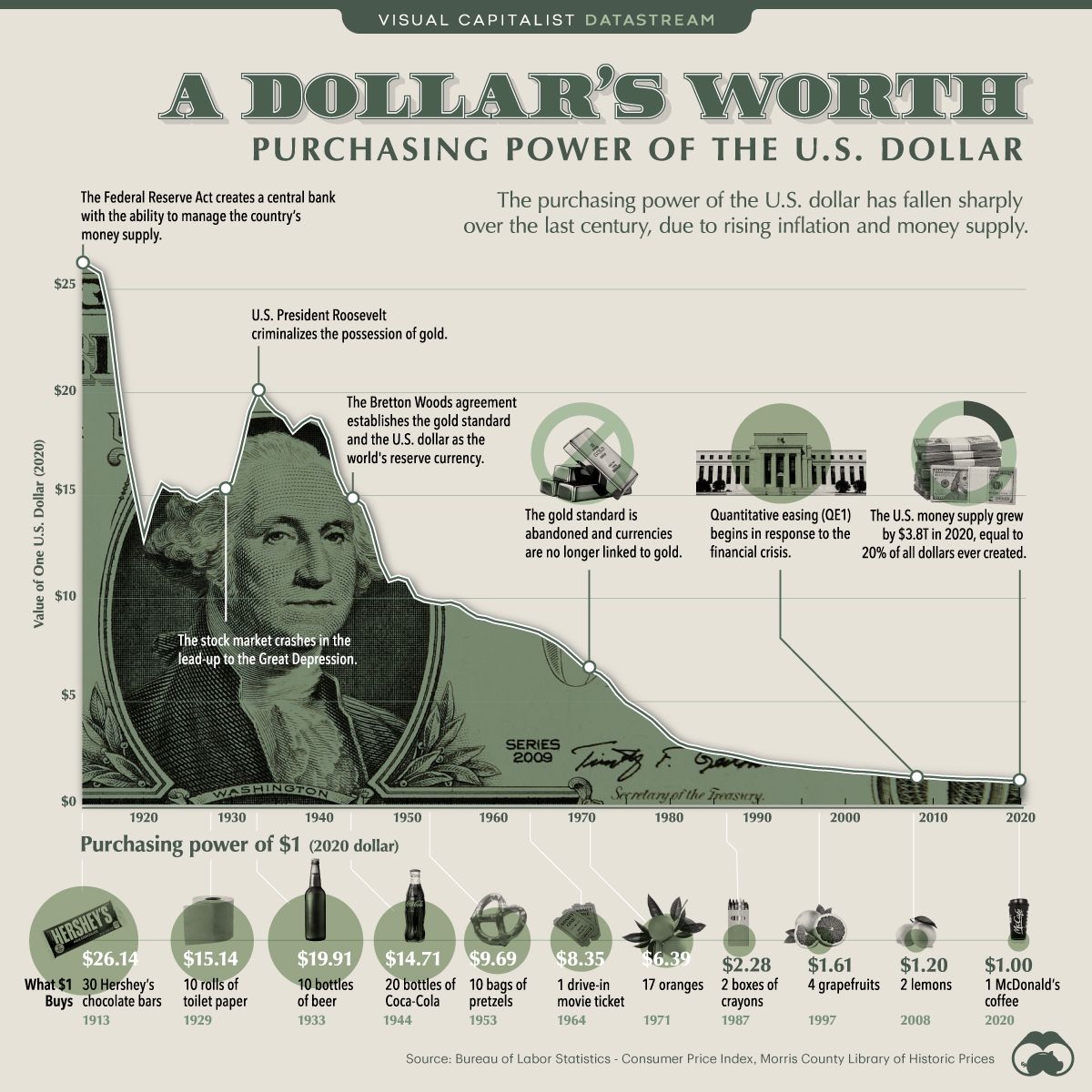

The BLS defines inflation as 'the overall general upward price movement of goods and services in an economy.' The most common metric quoted by media around the world is BLS' CPI (Consumer Price Index). It measures the yearly price change of the basket of chosen goods and services.

The calculation seems pretty straightforward, and yet the BLS and Federal Reserve suffer a lot of criticism from investors and prominent economists who believe the metric is flawed and lacking data transparency.

Over the years, the BLS, under the influence of Congress, the Fed, and various interest groups, altered the way they weigh goods and services. Questionable ways of combining, excluding, and smoothing data and other statistical approaches led to an index that doesn’t reflect current consumer trends or actual price changes in the market.

Some criticism of the CPI and other BLS metrics includes:

- Usages of outdated, subjective survey data (some 2-years old)

- Severe lagging or a delay of the metric in regard to the real-market situation

- Change from COGI (Cost of Goods Index) to COLI (Cost of Living) calculations

- Excluding rural homes, homeless, prisoners, and mentally ill from the main index (Urban CPI)

- Not taking into account customer substitutions for cheaper products

- Biased smoothing of the data

- Frequent calculation changes over the years that lead to lower inflation rates

In fact, some economists are proponents of the older calculation methods from the 90s or even the 80s, according to which the US inflation would currently be at 10% or 14%, respectively.

The older indexes seem closer to the actual market price change. We can currently see that certain goods and services increased dramatically, with oil and gas prices at the forefront (51%, and 28% increase) but essential food products not far behind (beef +24%, bacon +20%, and eggs +12%).

With the CPI being used across the US to correct court payments, corporate contracts, retirement income, social programs, etc. Do we prefer the falsely low inflation rate that makes the country look good but robs us of our currency value? Do we want an institution that has a clear conflict of interest to be the sole source of inflation information? Or do we want to know the truth?

When in doubt, why not consult the independent data.

Join our antiflation revolution and check the Truflation index, available on the blockchain now.

Article written by Natalia Nowakowska