How Soft is the US Labor Market?

By Oliver Rust, Head of Product

US employment is on the rise, prompting alarming predictions about an impending job apocalypse. Given the hyperbolic headlines in an increasingly polarized political landscape, it can be hard to know who to believe.

Thankfully, we don’t have to trust talking heads and dime-a-dozen analysts to get the measure of the US labor market. We can consult the data, which provides an unvarnished insight into US employment rates. Digesting the latest figures doesn’t require a Masters in Math – all it takes is an elementary grasp of a simple rule.

The Sahm Rule

The US unemployment rate rose from a low of 3.4% in April 2023 to 4.3% in July 2024, as reported by the Bureau of Labor and Statistics. This suggests that the Sahm Rule has come into effect. If you’ve never previously encountered it, this rule is regarded a reliable indicator of a potential recession.

The Sahm Rule is designed to identify recessionary periods by looking at the significant increases in the unemployment rate. Specifically, it triggers when the three-month average unemployment rate rises by 0.5% or more from its lowest point over the previous 12 months. This rule relies on the assumption that a sharp rise in unemployment is a strong indicator of an economic downturn.

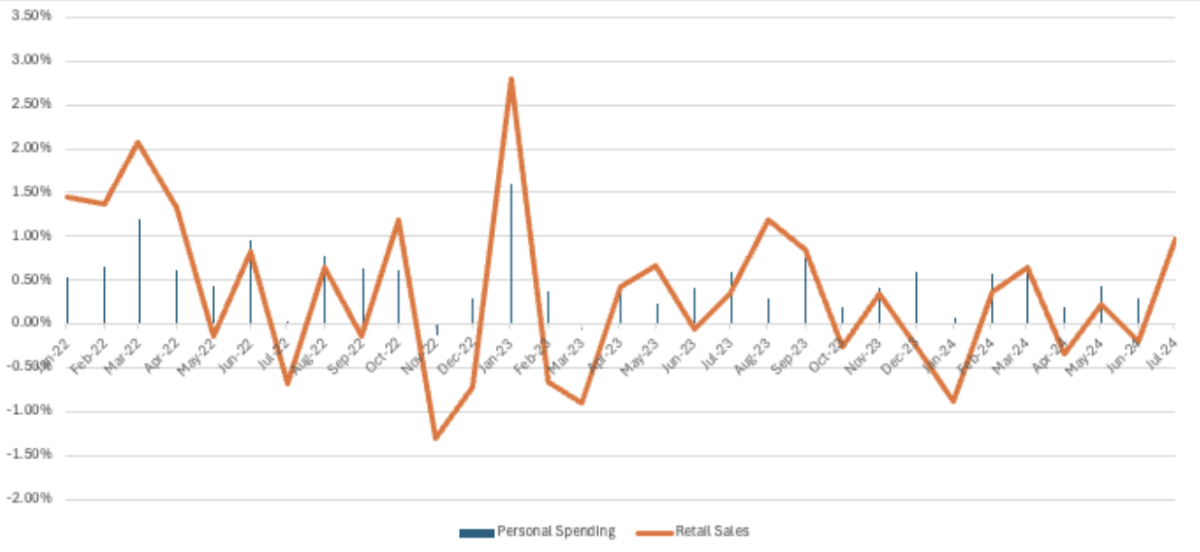

Exhibit 1: Sahm Rule (Current 3 Month Average vs the 12 Month Low)

Source: Bureau of Labor & Statistics

Analyzing the Impact of Increased Labor Supply

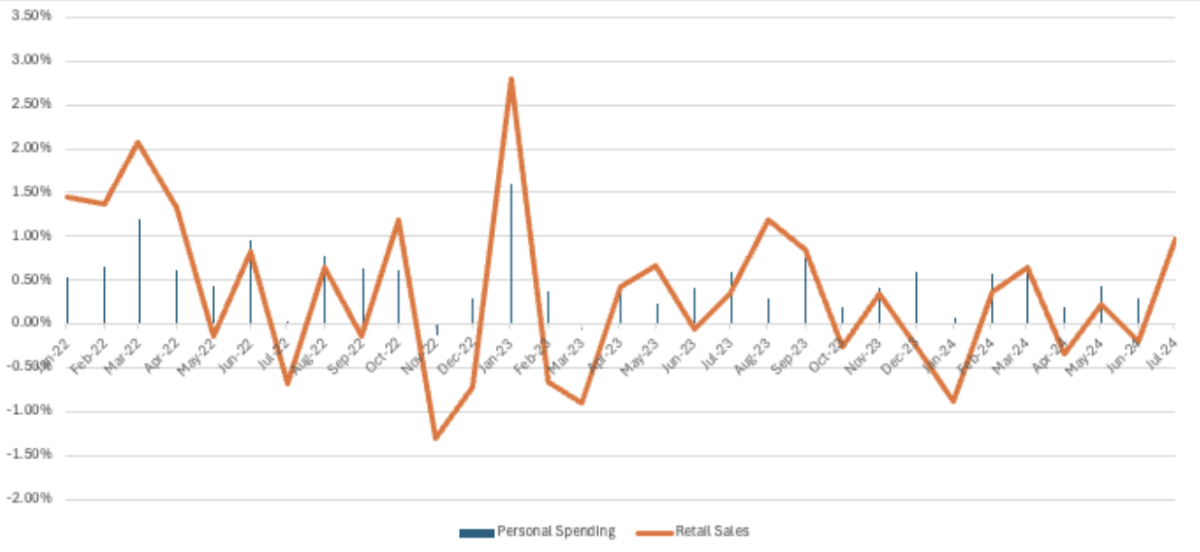

Economists and market analysts have been predicting a softening of demand which is in turn the driver of unemployment slowdown. Yet we haven't seen a slowdown in demand through consumer spending or retail sales.

Retail sales increased 1% in July, aided by a sharp snapback of car sales (after the cyberattack on auto dealerships that led to a drop in June). If we exclude motor vehicles and parts dealers as well as gas stations, sales rose 0.4% month on month, with the increase being widespread across 10 of the 13 categories.

Personal Consumption Expenditures data from the Bureau of Economic Analysis reinforces the notion that strong consumer spending is continuing to fuel GDP growth. June’s 0.3% increase was marginally below May (0.4%) and April (0.2%). On an annualized basis, consumer spending increased 5.2%, 5.3%, and 5.1% year on year in June, May and April respectively.

Exhibit 2: Month on Month Percentage Change of Personal Spending & Retail Sales

Strong results from the largest retailer and a robust monthly sales report has added to the easing concerns about the health of the American consumer. Walmart increased its guidance for the year to 4.75% growth, while indicating shoppers are becoming more selective and seeking value. Which does raise the question of whether Walmart is growing by taking market share from rivals or this a trend we will have with other key retailers who announce their results on the 21st of August; Target, Macy’s, and TJ Maxx.

If consumer spending remains strong and demand holds steady, which present data suggests, a potential cause for the increase in unemployment is the increase in the labor supply through a surge in immigration which the market can’t accommodate. Here’s how this can play out:

Labour Force Participation: An increase in supply of workers, due to immigration or other factors, can lead to a higher unemployment rate if the market can't absorb these new workers immediately. So far this year the US economy has added 1.16 million new entrants to the labor force as defined by the Bureau of Labor & Statistics. The ADP Private Employment numbers – a smaller market – support this as well with an increase of 1.01M since January 2024. Then overlay this with the number of unemployed workers, which has risen by 1.04 million since January (according to the BLS).

Exhibit 3: Labor Participation vs number of individuals unemployed

Historical Employment Trends: A recessionary labor market requires existing workers to lose their jobs and the size of the labor force to stall or contract, which is what we saw in 2001, 2007, and 2020. But right now the opposite is happening with the labor force now at 158.7 million workers and steadily rising.

Job Market Dynamics: The low level of job cuts that we have recently experienced, illustrated by Challenger Gray layoff announcements, has been reported at 461k since January. This suggests that the source of the rise in unemployment is not job cuts but a rise in labor supply. Additionally, the increase in labor supply could put downward pressure on wages or lead to more competition for available jobs, which is also what we are seeing in the average hourly earnings for nonfarm payrolls, which have reduced from 4.4% YoY in January 2024 to 3.6% YoY in July 2024 – the lowest increase since May 2021.

How Weak Is the US Labor Market?

The two most recent jobless claims, which determine if the US economy is going into recession, came in better than expected which is significant. Jobless claims are a leading economic indicator in gauging whether the labor market is weakening . The claims on August 8th reversed the trend to a lower and relatively normal 233,000, which triggered a 50-point jump in the S&P pre-market. In the August 15th report, claims fell further to 227,000 coupled with a continued claims reduction to 1.864 million. This could potentially allay concerns of further deterioration in the labor market.

In addition, as a percentage of the labor force — which is at an all-time high in terms of size – claims look even healthier. At the current levels of around 0.14%, they are at half the range that they were when the 2007, 2001, and early 1990s recessions began. Point being, we need to see claims rise well above 250,000 and stay there into the autumn months before this forms a useful tell that recession is looming. And if the Fed cuts rates in the meantime (as disinflation is giving them room to do), prospects for further job creation should only brighten.

The Rule Ain’t Wrong

While the Sahm Rule is a valuable tool for spotting potential recessions, it's important to consider the broader context. If rising unemployment is driven by an increased labor supply rather than demand, the situation might be as indicative of a recession as the rule alone suggests.

Current data suggests that consumers are holding up despite higher borrowing costs, a cooling labor market and an uncertain economic outlook. With pandemic savings now largely gone and wage growth cooling, many Americans are increasingly resorting to credit cards and other loans to support their purchases – raising questions about the sustainability of consumer spending, especially as more people are falling behind on payments.

Ultimately, though, the weaker jobs data is the key factor in why the Federal Reserve is expected to start cutting interest rates next month. Everything else is just noise.