How ERC-3643 Tokens Could Hedge Against RWA Regulation

Buzz, hype abounds regarding break out of Real World Asset (RWA) tokenization. And while it goes through enthusiasm cycles, RWAs appear poised to do something, and soon.

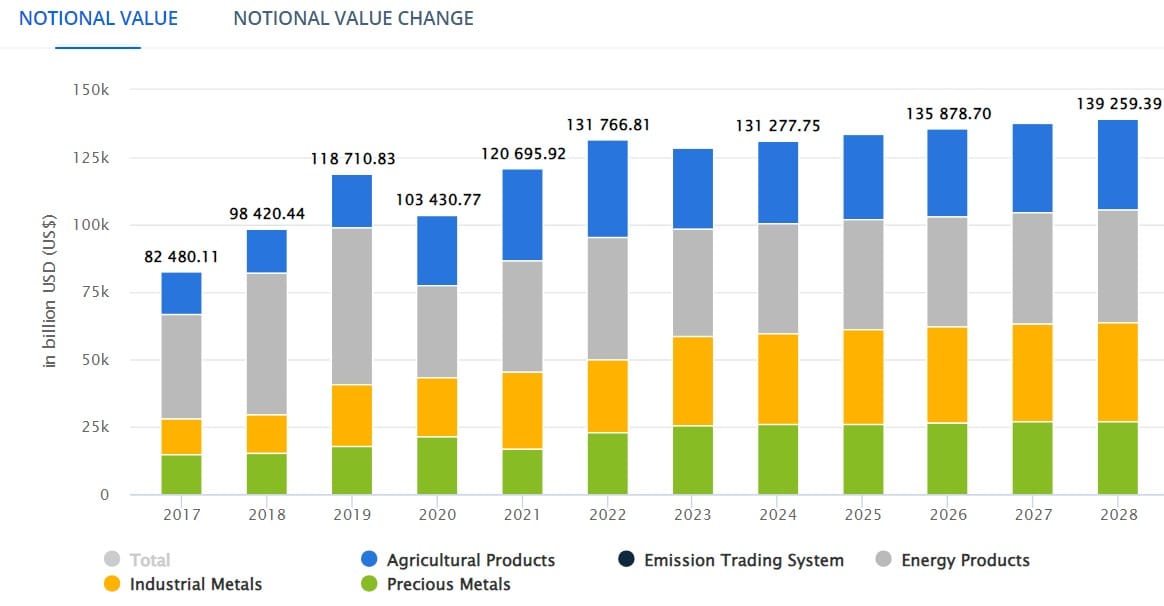

Hundreds of billions in commodities alone appear ripe for digital revolution, an opening of such markets to more liquidity from around the world. RWAs offer that, at least in theory, through especially decentralized finance (DeFi) portals.

Hope-ium within DeFi is to knockdown walled gardens, fire gatekeepers, and retire notions of accredited investors. No more KYC. No more AML. No more teacher's dirty looks.

You get the idea.

Reality Creeps-in

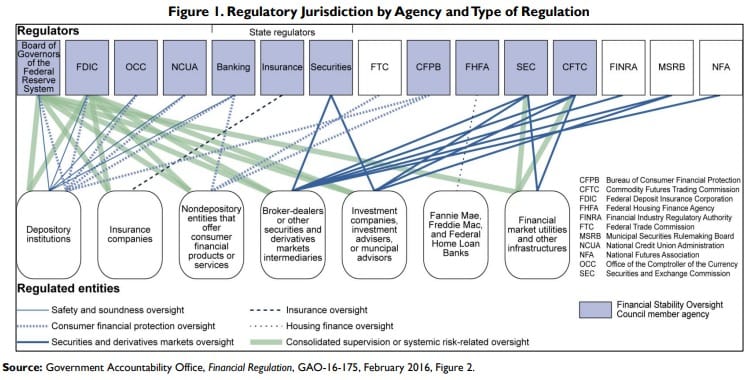

Reality, right about here, tends to creep-in. Financial regulators aren't going anywhere, and penchants for incumbents toward favoring the status quo come-what-might aren't subsiding. They've built up agencies and bureaucrats to keep barriers to entry in their favor. (If you're ever terribly bored, try reading one poor soul's 38-page sorting of it all, titled, Who Regulates Whom? An Overview of the U.S. Financial Regulatory Framework.)

Safe to type: they're not going to cede any ground to your meme coin and ape NFT world without a real fight.

Presumably anticipating the above, advocates for the ERC-3643 standard, the ERC3643 Association, revealed an effort "to bring compliance into the realm of permissionless DeFi, traditionally unsuitable for regulated assets, particularly tokenized securities such as tokenized funds, equity, debt, money market funds, t-bills, and more."

Promising a better user experience and same smooth ERC-20 interoperability, the Association insists updated "ERC-3643 tokens ensure that unauthorized transactions are avoided, ensuring only qualified users can trigger transactions, even in DeFi, as compliance is enforced on-chain at the token smart contract level."

Structured Approach

Standards play a pivotal role in shaping the future of DeFi and asset tokenization. Among the latest advancements, the ERC-3643 standard has emerged as a groundbreaking framework poised to revolutionize the tokenization of RWAs. Developed within the Ethereum community, ERC-3643 offers a structured approach to digitizing tangible assets, opening new avenues for investment and financial inclusion.

At its core, the ERC-3643 standard addresses the challenge of bridging the gap between traditional assets and the blockchain ecosystem. Unlike cryptocurrencies, RWAs encompass a diverse range of physical assets such as real estate, commodities, and securities. These assets, while valuable, often face liquidity constraints and regulatory hurdles, limiting accessibility to a broader investor base. ERC-3643 seeks to democratize access to these assets by enabling their representation as digital tokens on the Ethereum blockchain.

READ Advantages of the ERC-677 Standard in the World of Tokenization

One of the key features of ERC-3643 is its flexibility and adaptability to various asset types. The standard provides a modular framework that allows developers to customize token parameters according to the unique characteristics of each asset class. This flexibility ensures compatibility with existing legal and regulatory frameworks, paving the way for compliant tokenization of assets across jurisdictions.

Robust Mechanisms

Moreover, ERC-3643 introduces robust mechanisms for asset management and ownership rights. Through smart contracts, token issuers can enforce predefined rules governing asset utilization, revenue distribution, and governance rights. This not only enhances transparency and accountability but also enhances the trustworthiness of tokenized assets, thereby attracting institutional investors and fostering market confidence.

One area where ERC-3643 holds significant promise is in unlocking the potential of RWA tokenization. By tokenizing real-world assets such as real estate properties, infrastructure projects, and private equity holdings, ERC-3643 enables fractional ownership and secondary market trading. This fractionalization of assets lowers the barrier to entry for investors, allowing them to participate in lucrative asset classes previously inaccessible to retail investors.

Furthermore, RWA tokenization through ERC-3643 can enhance liquidity and price discovery for illiquid assets. Traditionally, selling or transferring ownership of real estate or private equity holdings involves lengthy processes and high transaction costs. With tokenization, these assets can be divided into smaller, tradable units, enabling instant peer-to-peer transactions on blockchain-based platforms. This liquidity premium not only benefits investors but also facilitates efficient capital allocation and asset utilization.

Want to be part of the data revolution? Join our Telegram to always be in the loop!