Extraordinary Popular Delusions and the Madness of Crowds

In behavioral economics and market psychology, few works resonate as profoundly as Charles Mackay's "Extraordinary Popular Delusions and the Madness of Crowds." Originally published in 1841, Mackay's seminal work remains a timeless exploration of human folly, irrationality, and the collective madness that often grips societies during periods of speculative mania.

Mackay's narrative spans centuries and continents, chronicling a diverse array of historical episodes where crowds succumbed to irrational beliefs, unfounded rumors, and speculative bubbles. From the Dutch Tulipmania of the 17th century to the South Sea Bubble of the 18th century and the Mississippi Bubble in France, Mackay's vivid accounts offer a compelling insight into the recurring patterns of mass hysteria and financial folly.

One of the enduring themes of Mackay's work is the susceptibility of individuals to herd behavior and the power of social influence in shaping collective decision-making. Through vivid anecdotes and historical vignettes, he illustrates how seemingly rational individuals can be swept up in the frenzy of the crowd, abandoning critical thinking and succumbing to irrational exuberance.

Central to Mackay's thesis is the notion that human nature is inherently prone to folly and susceptible to the influence of prevailing social trends. He argues that crowds possess a collective psychology characterized by irrationality, impulsiveness, and a propensity for speculation. Whether driven by greed, fear, or sheer excitement, the collective behavior of crowds often defies logic and rationality, leading to catastrophic consequences.

Mackay's exploration of financial bubbles and speculative manias serves as a cautionary tale about the perils of unchecked speculation and the dangers of irrational exuberance. He warns against the folly of chasing quick riches and emphasizes the importance of prudence, skepticism, and independent thinking in navigating volatile markets.

Moreover, Mackay's work sheds light on the role of mass media, rumor, and misinformation in fueling speculative bubbles and exacerbating irrational behavior. In an age long before the advent of social media and 24-hour news cycles, Mackay recognized the power of sensationalism and exaggeration in amplifying market sentiments and inflaming investor emotions.

Despite being published over a century and a half ago, "Extraordinary Popular Delusions and the Madness of Crowds" remains as relevant as ever in today's interconnected world. In an era characterized by rapid technological innovation and global financial markets, the lessons gleaned from Mackay's work are perhaps more pertinent than ever before.

Charles Mackay's "Extraordinary Popular Delusions and the Madness of Crowds" stands as a timeless masterpiece that offers profound insights into the irrationalities of human behavior and the dynamics of financial markets. Through captivating storytelling and astute analysis, Mackay illuminates the recurring patterns of speculative manias and collective hysteria that have plagued societies throughout history. As investors navigate the complexities of modern finance, Mackay's work serves as a poignant reminder of the enduring truths about human nature and the dangers of succumbing to the madness of crowds.

Tulipmania: A Historical Tale of Speculation and Economic Folly

Mackay's work endures largely due to his careful study of Tulipmania, a term coined to describe one of the most infamous speculative bubbles in history, serving as a cautionary tale about the perils of irrational exuberance in financial markets.

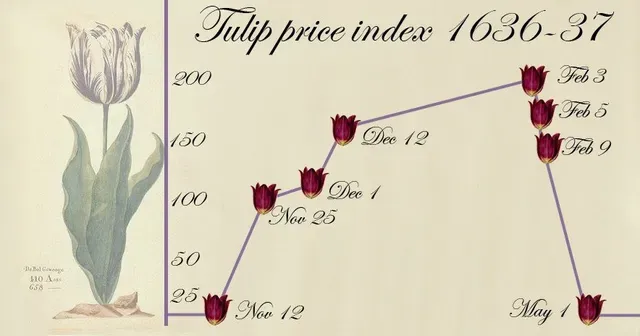

During the Dutch Golden Age in the 17th century, the Netherlands experienced an unprecedented frenzy surrounding tulip bulbs, leading to astronomical prices, frenetic trading, and ultimately, a spectacular crash. This phenomenon, while seemingly confined to the realm of horticulture, offers profound insights into human behavior, market dynamics, and the enduring allure of quick riches.

The origins of Tulipmania can be traced back to the late 16th century when tulips were introduced to the Netherlands from the Ottoman Empire. Initially prized for their vivid colors and unique patterns, tulips gradually gained popularity among the Dutch elite, becoming a status symbol of wealth and sophistication. As demand surged, tulip cultivation became a lucrative industry, with bulbs fetching increasingly exorbitant prices.

Speculative Fervor

The speculative fervor reached its zenith in the early 1630s when a speculative bubble formed around rare tulip varieties, particularly the coveted Semper Augustus. Prices skyrocketed to dizzying heights, with single bulbs trading for the equivalent of a lavish estate or a year's salary for a skilled craftsman. The mania transcended social and economic boundaries, captivating everyone from wealthy merchants to common laborers, who eagerly plunged into the frenzy in pursuit of extraordinary profits.

The tulip market became a frenzied arena where fortunes were made and lost in a matter of days, if not hours. Tulip traders engaged in feverish speculation, leveraging their assets and engaging in risky margin trading to capitalize on the seemingly endless upward trajectory of prices. As tales of overnight wealth spread, rationality gave way to irrational exuberance, and the tulip became synonymous with boundless wealth and prosperity.

Inherent Fragility

However, beneath the veneer of opulence lurked the inherent fragility of speculative bubbles. In February 1637, the tulip market abruptly collapsed, sending shockwaves throughout the Dutch economy. Panic selling ensued as investors scrambled to offload their tulip holdings before prices plummeted further. Overnight, fortunes evaporated, leaving many financially ruined and destitute. The aftermath of Tulipmania left a trail of economic devastation, tarnishing the reputation of tulips and casting a shadow over the Dutch economy for years to come.

The lessons of Tulipmania reverberate through the annals of financial history, serving as a cautionary tale against the dangers of unchecked speculation and irrational exuberance. The allure of quick riches and the fear of missing out can cloud judgment and distort market fundamentals, leading to unsustainable asset bubbles and catastrophic collapses. Tulipmania underscores the importance of prudence, diversification, and a sober assessment of risk in investment decisions.

Sentiment and Perception

Moreover, Tulipmania offers valuable insights into the psychology of market participants and the role of social dynamics in shaping financial markets. The phenomenon was not merely driven by economic factors but also by social emulation, herd behavior, and a collective belief in the intrinsic value of tulips. As Nobel laureate Robert Shiller observed, bubbles are as much a product of human psychology as they are of economic fundamentals, highlighting the profound influence of sentiment and perception on market dynamics.

Tulipmania stands as a poignant reminder of the folly of speculative excess and the fragility of financial markets. While the tulip bubble may seem like a relic of the past, its echoes resonate in contemporary episodes of market euphoria and irrational exuberance. As investors navigate the complexities of modern finance, the cautionary tale of Tulipmania serves as a timeless beacon, reminding us to tread carefully and remain vigilant against the allure of speculative manias.

Want to be part of the data revolution? Join our Telegram to always be in the loop!