Elections, Prediction Markets, and the Case for Decentralized Data: What We Learned in 2024

The 2024 U.S. elections were marked by the rise of prediction markets, which saw a trading volume of $3.7 billion on the presidential outcome and over $5 billion across the entire election market. Donald Trump was elected with a solid margin of electoral votes, which differs from traditional media polls' predictions.

Major news outlets portrayed a closely contested election, generally favoring Kamala Harris and forecasting that she would win the popular vote by a considerable margin

This underscores that centralized institutions are more susceptible to errors, whether due to human mistakes or potential conflicts of interest, a phenomenon not limited to elections alone. New tools and methodologies are needed to provide greater efficiency in data collection while significantly reducing the possibility of human error.

We will explore the predictions surrounding the U.S. elections, discuss why the media may exhibit bias, examine the importance of decentralized systems for the economy, and take a closer look at Truflation and its reliable inflation data.

What Were the Predictions for the 2024 Elections?

Polls fluctuated significantly in the weeks leading up to the election, but in most of them, Kamala Harris appeared as the favorite to win, holding a lead of over 5 percentage points at certain times.

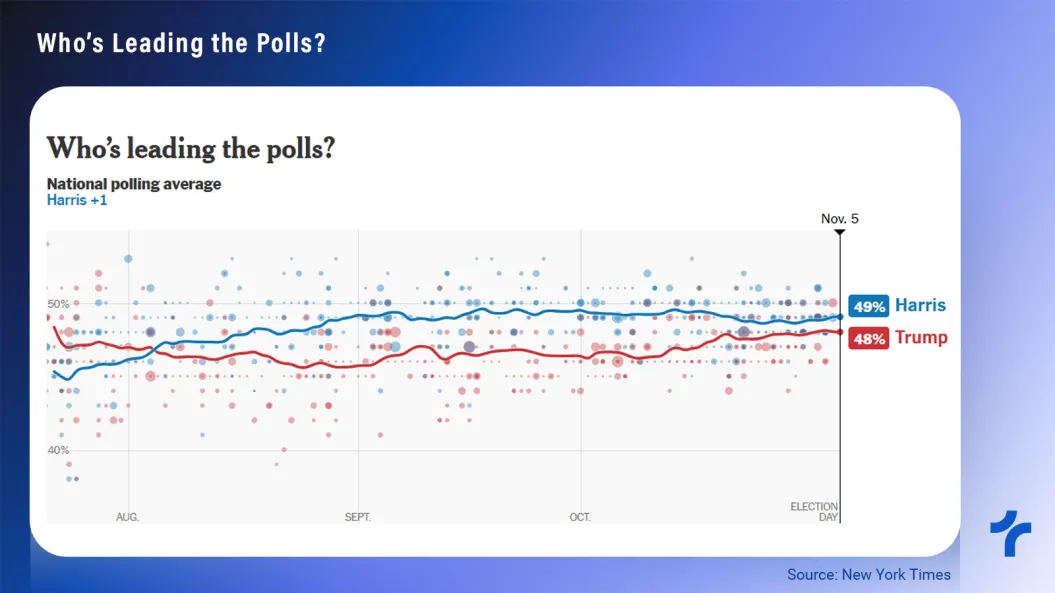

The following image from The New York Times shows that since August 5, when Kamala Harris overtook Donald Trump in the polls, she remained in the lead.

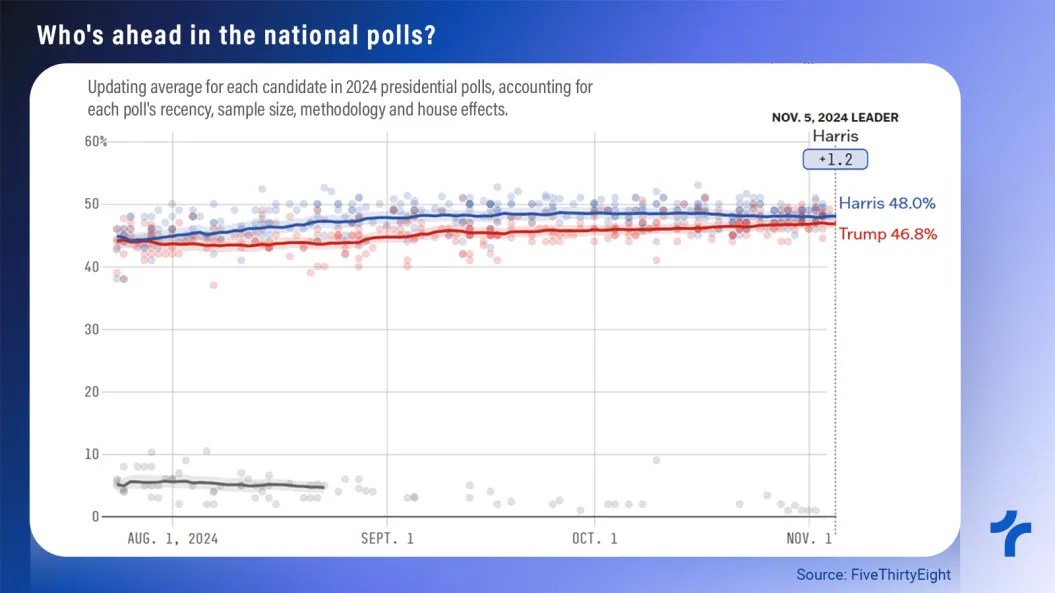

A very similar situation was observed on FiveThirtyEight.

In the final weeks, the polls most favorable to Trump gave him a lead of up to 3 percentage points (such as those from TWJ, AtlasIntel, and DailyMail.com), while Harris was shown to have a lead of up to 7 points in a poll by Big Village and frequently led by 4 points in others.

This trend was also reflected across various media outlets, it wasn’t an isolated case. The major anomaly was the significant margin by which Donald Trump won, creating a strong contrast with the numbers presented in the polls. This undoubtedly affects the credibility of polls—how can the public trust these surveys after repeated errors?

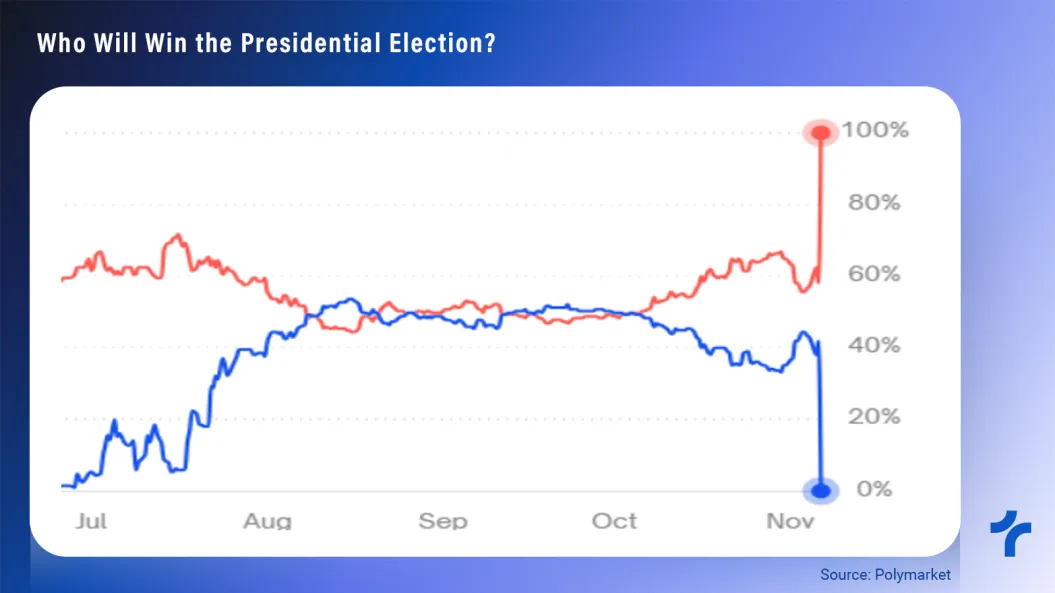

On the other hand, predictions from decentralized markets were far more accurate, providing real-time probability updates. For instance, on Polymarket, where prices fluctuate constantly, the chances of Trump winning were around 60% right before the vote count.

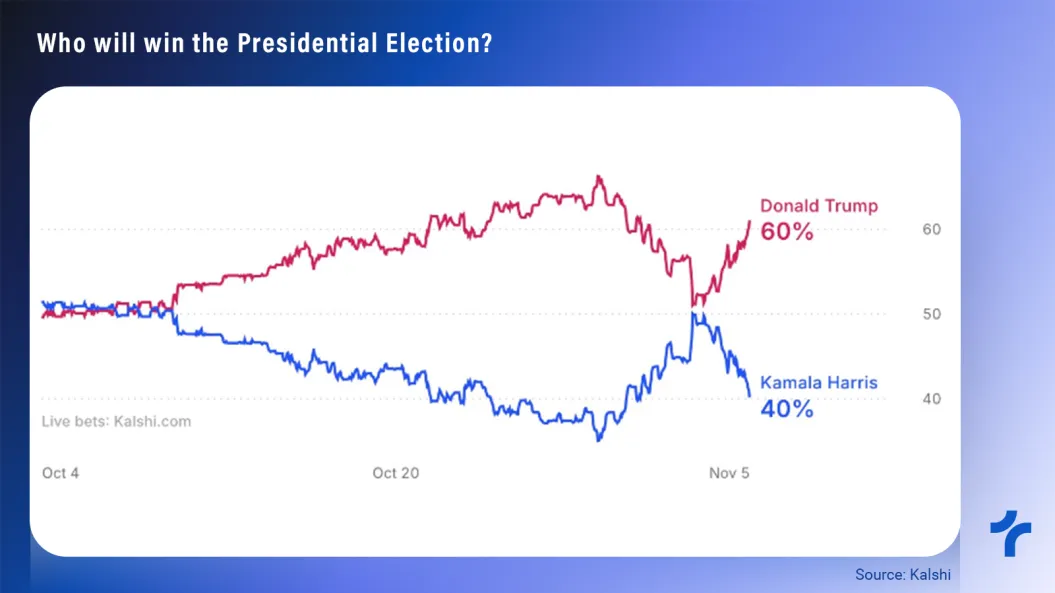

A similar trend was observed on Kalshi, which, while less decentralized than Polymarket, reported comparable numbers.

The information presented on the platform was not restricted to just the total election results, but also what would happen in the Swing States and the results showed that Polymarket and Kalshi brought much more accurate information than the electoral polls.

Why Were the Media Polls Wrong?

Were the errors accidental or due to conflicts of interest? According to a study by the Newhouse School of Public Communications at Syracuse University, approximately 36.4% of journalists in the United States identify as Democrats, while only 3.4% align with the Republican Party.

This bias extends into reporting: the Media Research Center (MRC) analyzed coverage by ABC, CBS, and NBC on the presidential candidates. The study found that 78% of reports on Vice President Kamala Harris were positive, while 85% of stories about former President Donald Trump carried a negative tone. Something very similar was seen in a Lifenews study, as shown in the image below.

Furthermore, donations from the Communications/Electronics sector totaled $125 million for Kamala Harris compared to only $8.8 million for Donald Trump, representing 88.3% of donations from the sector going to Democrats and just 9.9% to Republicans, according to data from OpenSecrets.

This indicates a vested media interest in Harris’s success. Although it doesn’t necessarily explain why the polls were flawed, conflicts of interest are always problematic. Fortunately, the rise of decentralized platforms reduces human influence and limits conflicts of interest—a significant step forward, not just for elections.

The Importance of Decentralized Systems for Economies

Now that we understand the problem, let's outline the solutions, which aren’t limited to election polling but apply to any data collection that requires accuracy and reliability.

The rise of decentralized technologies has opened the door to innovative data collection strategies that are faster and more efficient. Blockchain-based platforms, for example, enhance transparency and security, minimizing human influence and reducing biases or conflicts of interest in data gathering and analysis.

Here are 3 benefits of decentralized networks:

- Security/Resilience: There is no single point of failure. This makes the network less vulnerable to both attacks and human error.

- Censorship Resistance: Since there is no central authority, it is rare for anyone to hold enough power to disrupt information flows.

- Transparency: Anyone can access and verify information. Everyone has access to true information; any change in data is visible throughout the network, promoting information's veracity.

Decentralized systems are essential for an efficient and reliable economy. Whether for peer-to-peer resource and information transactions or the provision of data.

Replacing central entities with technology reduces the possibility of human error and corruption. In addition, it generates incentives for the users of these networks.

When it comes to predicting future events, prediction markets are often the best choice (when liquid), as financial stakes tend to closely reflect reality. However, if the focus is on economic data, what’s the best option? Truflation.

Truflation: Efficient and True Economic Data

When it comes to economic data (especially inflation and indexes), Truflation leverages decentralized technology to deliver faster, more accurate, and up-to-date results.

Truflation provides independent, transparent, real-time financial data with a comprehensive index tracking over 20 million items, offering a censorship-resistant data infrastructure, and driving systemic advancements within the DeFi economy.

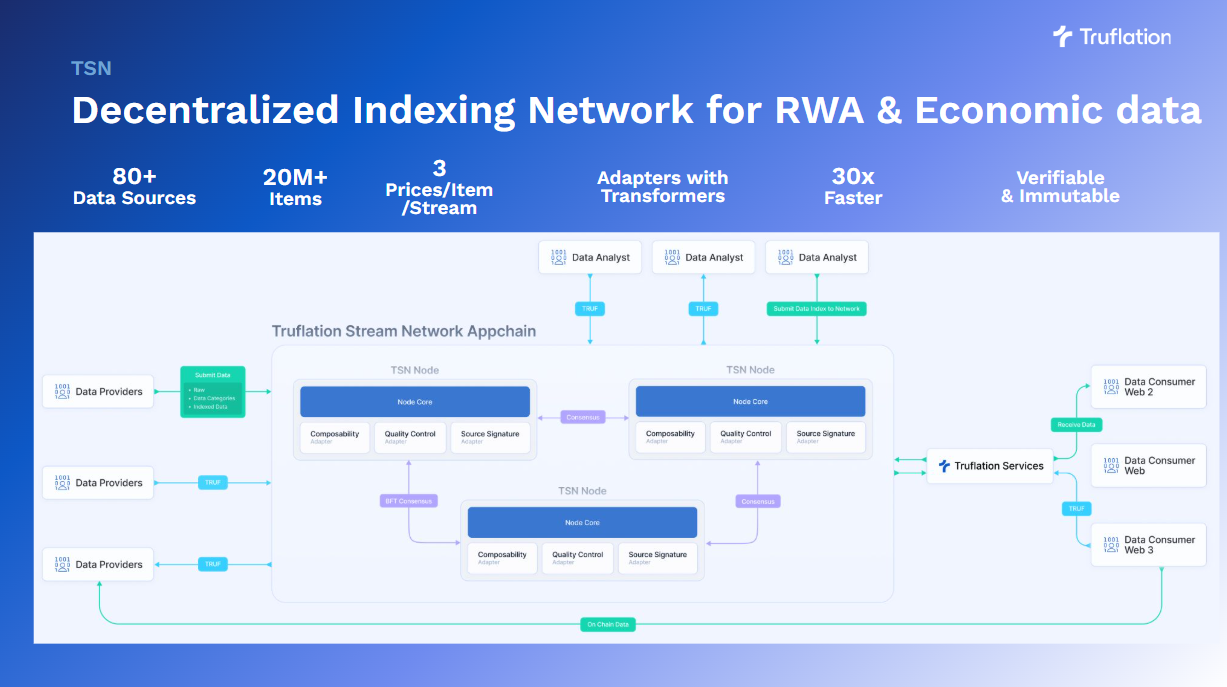

The TRUF Network

The TRUF Network was developed to introduce real-world data into blockchains or EVM-compatible systems, such as Ethereum, Base, Avalanche, Arbitrum, BSC, Polygon, and Fantom.

It is formed by a committee of consensus-driven nodes that collect and process real-world data for distribution in the form of data streams to various programmable environments.

This makes it possible to build databases in a decentralized manner, valuing the authenticity of information and also transparency among network members.

Truflation Indexes

On the Truflation website, you can find various indexes. When it comes to inflation, data is available for the US, UK, and Argentina, updated daily. Additionally, the famous Big Mac Index is available for multiple countries, allowing users to see price changes in this segment.

There is also a range of indexes to measure assets, including the Electric Vehicle Commodity Index, GameFI Index, AI Index, Meme Coin Index, Deadlift Index, and the Hedge Index.

This stands in stark contrast to traditional systems, which rely on outdated methodologies and often produce data that doesn't fully align with real-world experiences. If you've ever calculated inflation yourself, you might have noticed it has risen more than what the CPI suggests in recent years.

We are entering a new era, and it makes no sense to cling to outdated methodologies. It's time to leverage technology for the benefit of society, especially as recent events have shown that it’s wiser to trust technology over centralized entities or individuals.

Conclusion

The data presented in this article underscores the existence of conflicts of interest and the obsolescence of centralized systems. The recent elections and prediction markets provided an excellent example of how decentralized networks can deliver information with greater speed, precision, and reliability.

This progress comes with technological advancements, as new solutions emerge and continue to be developed. We’re entering a new era—an era of decentralized networks where the power of information is no longer concentrated in the hands of a few institutions.

At Truflation, we place the individual at the center of the economy, offering true, real-time information. This is what we believe in, and it’s what we’ll continue to work toward.