Are We Entering a Modern Roaring '20s?

A century ago, the U.S. experienced the Roaring '20s, a time of quick economic growth, booming consumerism, and cultural innovation.

After years of war, there was a spike in household spending, changing everyday life. However, the party ended in 1929 with the onset of the Great Depression.

Fast forward 100 years: Could we be entering a modern "Roaring '20s"? Or are we heading for a different chapter altogether? Let’s dive into history and analyze the current trajectory of the U.S. economy.

Looking Back at the 1920s

The "Roaring 1920s" was a period of deep social and economic change, particularly in Western societies like the United States and parts of Europe.

Marked by economic prosperity, technological innovation, and cultural shifts, the decade reshaped societal norms and laid the foundation for modern societies.

While the decade ended with the Great Depression, its innovations, urbanization, and cultural changes left a lasting impact on the modern world, shaping the societies we live in today.

Cultural and Social Evolution

- Changing Norms and Behaviors: Following the devastation of World War I, the 1920s brought in a spirit of liberation and celebration.

- People sought new ways to enjoy life, evident in parties, the rise of jazz music, and a growing appetite for entertainment.

- Urbanization and Daily Life: The rapid growth of cities turned urban areas into innovation hubs. Young people left rural areas for cities in search of work and modern lifestyles.

Economic Prosperity

- Growth and Consumption: The 1920s witnessed unprecedented economic growth, particularly in the US.

Innovations in production, such as Henry Ford’s assembly line, made consumer goods like automobiles, appliances, and clothing more affordable.

A culture of consumption thrived, fueled by advertising and the expansion of credit, which allowed people to purchase goods on installment plans. This economic boom brought modern conveniences into households, improving the quality of life.

- Technological Innovations: Technological advancements defined the era, with the automobile becoming a staple of daily life and the widespread adoption of electricity transforming homes and industries.

New products like radios, telephones, and household appliances revolutionized communication and domestic life. The decade also marked the rise of commercial aviation, symbolizing the technological achievements of the era.

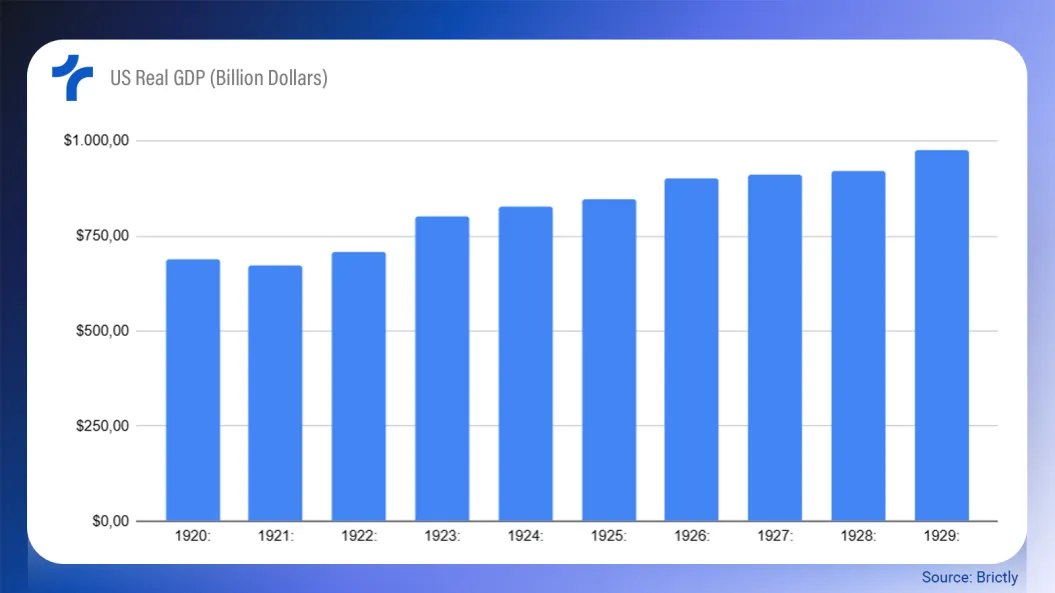

Real GDP

The economy saw over 42% growth during the decade, with GDP rising from $687.7 billion to $977 billion.

Much of this growth can be attributed to increased productivity and the restructuring of supply chains in the post-war period, which led to price stability and an improvement in quality of life.

It was a remarkable period for the industry, which managed to reach the masses and sell a wide variety of products while simultaneously making production more efficient through advanced manufacturing techniques.

Stock Market

The stock market experienced even more impressive growth leading up to 1929. The Dow Jones rose from 1,170.48 in December 1920 to 6,938.36 in August 1929, representing a 492% gain in less than a decade.

Of course, the subsequent recession was catastrophic, with the Dow Jones dropping to below 1,000 points by 1932.

Despite the eventual crash, the rapid growth brought optimism. Millions of Americans flocked to Wall Street, convinced that stock prices would keep climbing. Financial speculation was everywhere, with many taking on debt to buy stocks, chasing quick leveraged profits in a booming market.

Purchasing Power

Another aspect is that purchasing power increased significantly during this decade, following a sharp decline during World War I.

Between 1920 and 1922, there was a 20% rise in purchasing power, followed by stabilization throughout the rest of the decade, enabling greater consumption among Americans.

This was driven by rapid industrialization, which brought higher wages alongside a stronger currency.

As a result, quality of life improved considerably, and consumer goods became more accessible to the general population.

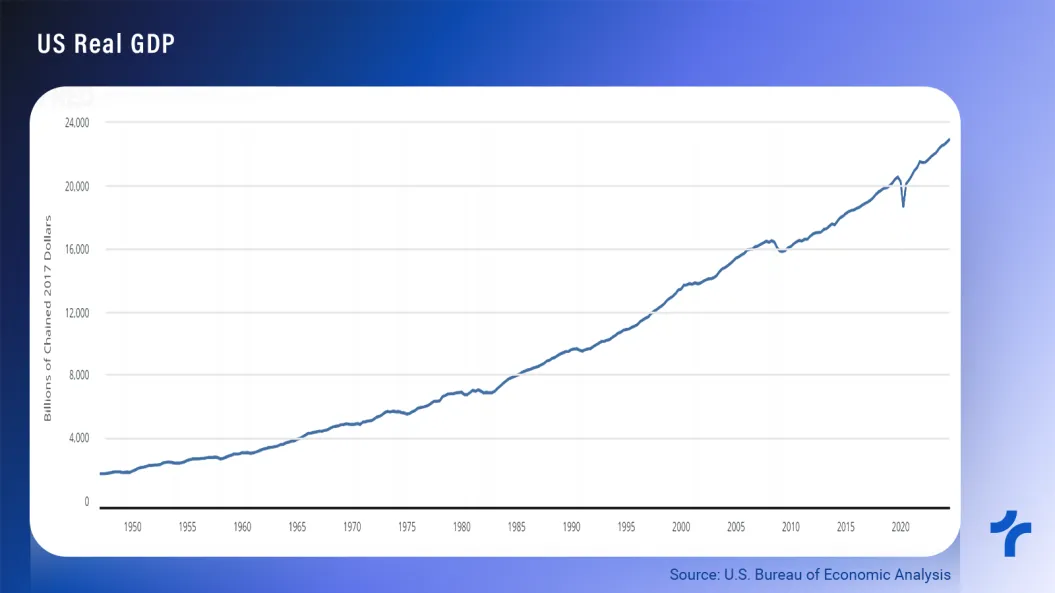

100 years later: the early 2020s

The pandemic marked the beginning of the decade, and while there was a V-shaped recovery, there were significant changes in economic dynamics.

It is important to note that in the short term, there was a disruption in supply chains, which required reorganization.

Additionally, there was significant government spending during this period, leading to an increase in the debt-to-GDP ratio and, most notably, a monetary expansion that resulted in inflation levels not seen since the subprime crisis.

However, beyond the numbers, there was a surge in the digitalization of the economy, driving more capital to the technology sector.

This is important because significant periods of economic growth are often marked by technological expansion, which frequently leads to productivity gains.

Overall, the beginning of the decade was characterized by the return of inflation, increased public spending, and economic recovery.

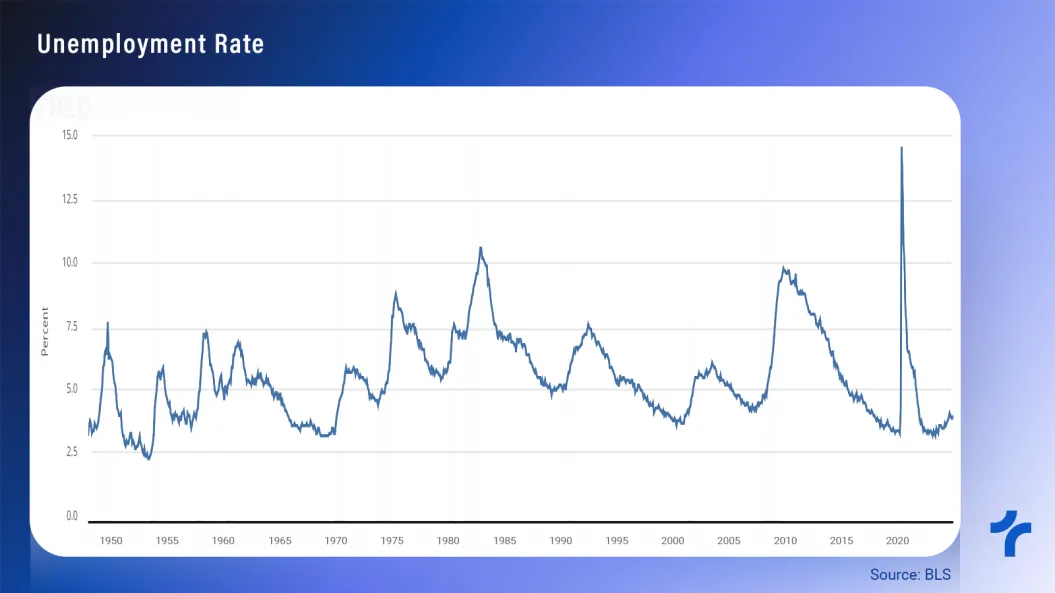

Unemployment and Workforce

One of the most important indicators is the unemployment rate. Over the past three years, it has remained at low levels, ranging between 2.5% and 5%. These numbers indicate an economy close to full employment.

Additionally, workforce participation has shown signs of recovery following the pandemic, reflecting increased worker confidence and the expansion of opportunities.

The rise in professional retraining programs has also boosted the competitiveness of the American workforce. The major challenge is maintaining a low unemployment rate without creating inflationary pressure.

While the current situation is positive, historically, unemployment has rarely stayed at such low levels for long. However, if the next peak remains between 5% and 6%, it would still be excellent news, representing a near-full employment scenario even during an "unfavorable period".

Monetary Policy: Balancing Growth and Inflation

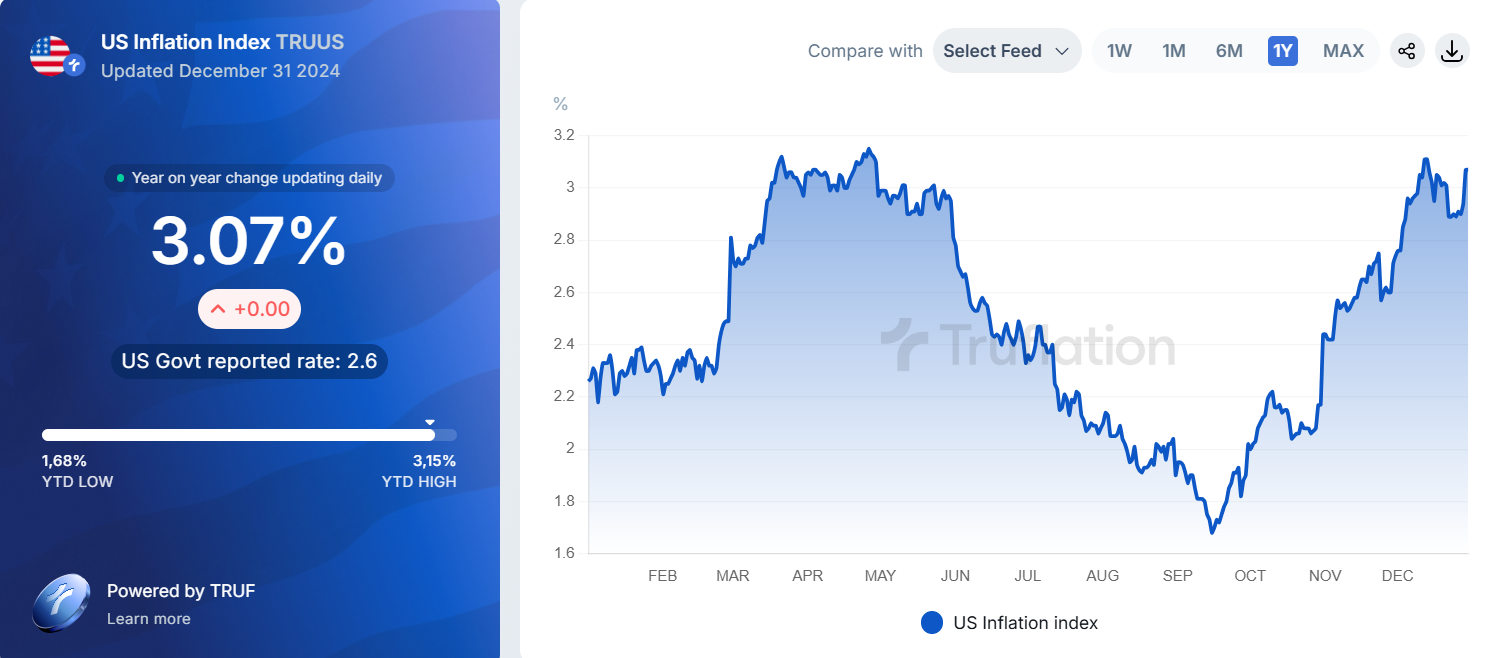

Inflation has become one of the primary challenges for the U.S. economy, driven by the expansion of the monetary base and increased government spending. The Consumer Price Index (CPI) reached 8.9% year-over-year (YoY) in 2022, a level not seen since 1981.

From January 2020 to December 2024, the CPI recorded inflation of 22.3%, while the Truflation data showed 26.02%. This is an extremely high number, equating to nearly 5% inflation per year.

Although restrictive monetary policy shifted the course of inflation toward the target, recent months have reignited concerns about inflationary pressures. By the end of 2024, the annual inflation rate registered by Truflation stood at 3.07%.

This resurgence of inflation is likely to slow the pace at which the Federal Reserve reduces interest rates. Addressing this issue is crucial for the economy to achieve sustainable growth.

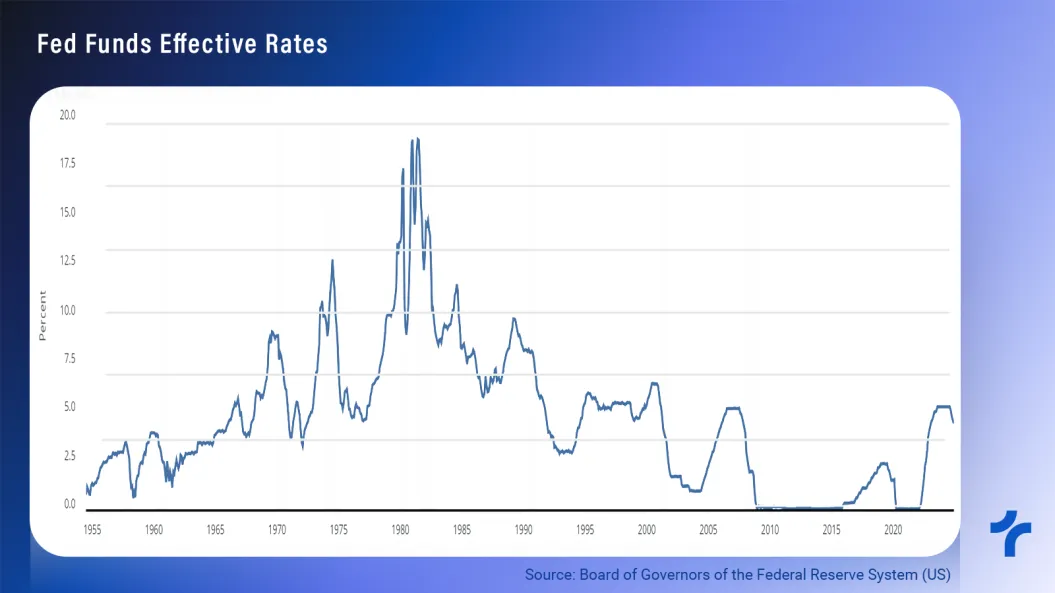

In terms of monetary policy, the Federal Funds Rate has been adjusted to balance growth and inflation control, with a clear priority on attempting a soft landing rather than a rapid containment of inflation.

Following a period of extremely low rates during the pandemic, policy saw a sharp increase to curb inflation. The Federal Funds Effective Rate rose from 0.05% to 5.33% in a short period.

This new social paradigm raises some questions: Is this level of monetary policy restrictive enough to bring inflation back to the target? And if so, how long will it take?

Since the first interest rate cut by the Fed, U.S. bond yields have risen, indicating that investors are uneasy about inflation and the level of public debt.

While the Fed implements restrictive monetary policies, the government is pursuing fiscal expansionism. These opposing approaches significantly impact the dynamics of inflation.

The debt has surged by approximately 400% since 2004 and doubled since 2014, pushing the current debt-to-GDP ratio to 120%. This highlights the urgent need for greater fiscal responsibility to prevent further escalation.

The rapid growth in government spending outpacing GDP growth is particularly concerning, as it drives the debt to accelerate at an unsustainable rate. With such high debt levels, a substantial portion of public funds is directed toward interest payments.

Stock Market

Indices like the S&P 500 and NASDAQ continue to deliver positive long-term returns, driven by sectors such as technology, healthcare, and clean energy. The presence of innovative and disruptive companies ensures that the U.S. maintains its leadership in global capital markets.

Looking at the stock market, while December was not a strong month for most assets, 2024 saw significant gains for the S&P 500.

Projections from major institutions expect the S&P 500 to reach around 6,600 points by the end of 2025. Although not a staggering increase, it is a solid growth forecast.

Factors likely to drive this market include the gradual easing of restrictive monetary policy and improved debt control.

The rise in stock prices can stimulate consumption through the Wealth Effect: as stock values increase, household net worth grows, potentially boosting consumption even if current income remains unchanged.

This effect can occur in two ways: either through asset sales to fund consumption or by redirecting new investments toward consumption.

Optimism indicators: CSI & High Yield Spread

The University of Michigan's Consumer Sentiment Index (CSI) shows that consumer confidence is recovering, reaching 74 points in December 2024.

This marks a significant improvement, considering the index stood at 50 points in June 2022, but it remains well below the 101 points recorded in February 2020, just before the pandemic.

Higher consumer confidence is crucial for economic growth, as it raises expectations of future income and tends to increase current spending.

Of course, consumer confidence alone does not account for all economic dynamics, as various other factors influence the economy. However, it remains a key indicator.

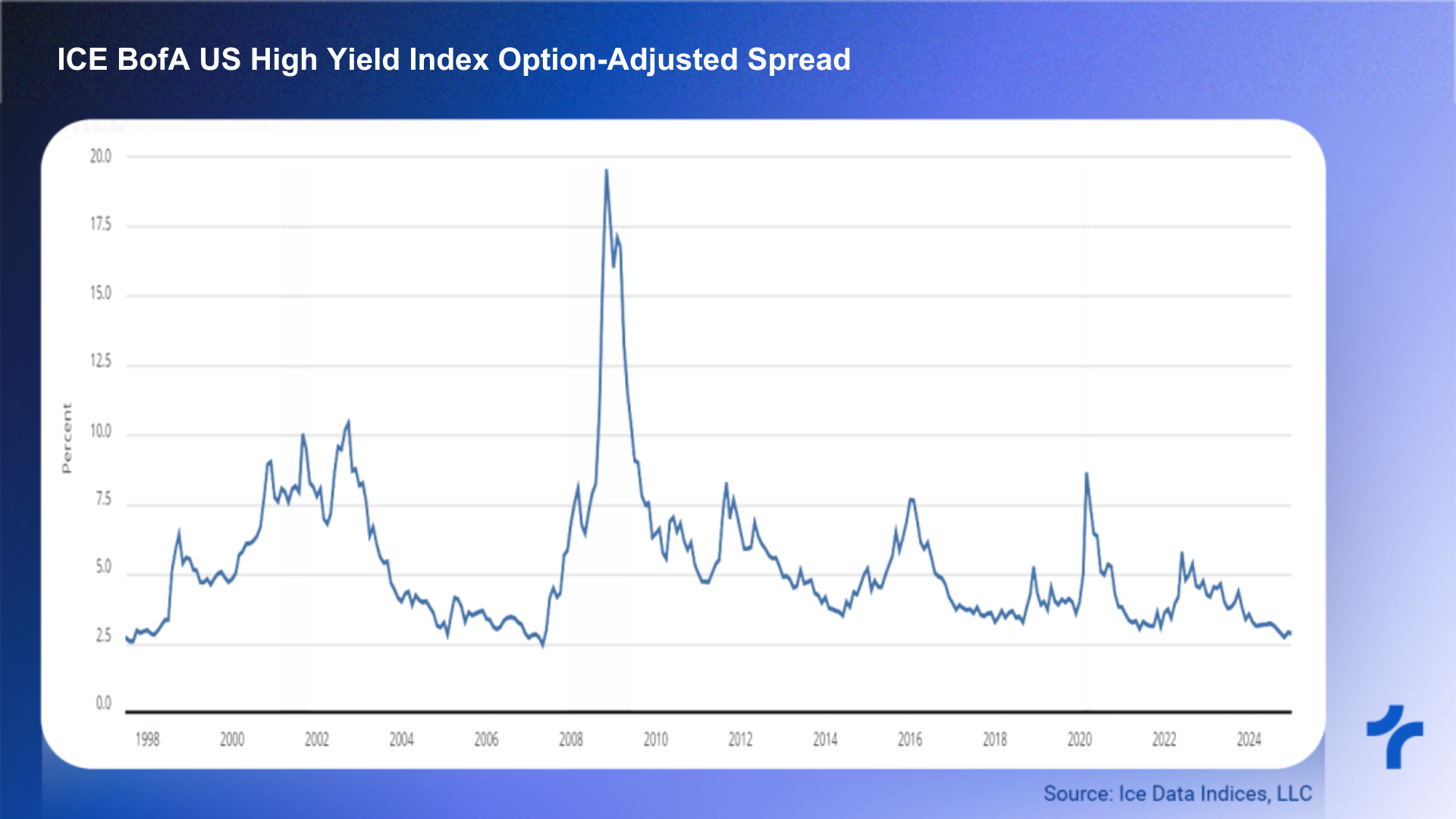

Another important measure of economic optimism is the the ICE BofA US High Yield Index Option-Adjusted Spread which is below 3 as of early January, signaling reduced risk perceptions and economic optimism.

Low spreads indicate an optimistic economy. When the risk premium decreases, it suggests either that investors are more willing to take risks or that they perceive a low probability of default.

This perception is a result of expectations that the majority of companies will remain operational in the coming years.

Innovation and Artificial Intelligence

Large economic growth over a short period is often driven by major technological advancements that rapidly enhance productivity. This increase in productivity brings sustainable growth, which is self-sustaining and compounding over the long term.

This concept aligns with Schumpeter’s idea that economic growth does not occur linearly but in leaps. Historical examples of such transformative leaps include the steam engine, electricity, and the internet.

Today, one such transformative evolution may be unfolding before our eyes: Artificial Intelligence (AI).

The use of AI technology is already impacting a wide range of sectors by making processes far more efficient and saving time and resources throughout production cycles.

Masayoshi Son projects that infrastructure for AI will require investments between $9 trillion and $12 trillion in the coming years.

A study by Cognizant in collaboration with Oxford Economics revealed:

- Dramatic Growth in AI Adoption: Businesses are currently in the experimental phase of adopting AI capabilities. Adoption rates are expected to surge from 13% to 31% within just four to eight years.

- Economic Boost: Generative AI technology could increase U.S. productivity by 1.7–3.5% and add between $477 billion and $1 trillion annually to the U.S. GDP over the next decade, based on business adoption rates.

- Labor Market Disruption: It is estimated that half of all jobs will undergo significant changes as generative AI integrates to automate work tasks. Approximately 9% of the current U.S. workforce may be displaced as a result.

The rise of AI represents one of the greatest opportunities in history to accelerate economic growth sustainably and achieve new heights. The U.S. stands at the epicenter of this technological revolution, poised to shape its trajectory and reap its benefits.

The recent case of DeepSeek and Prime Minister Starmer’s announcement about the UK's AI push shows that there is competition entering the sector and it can develop quickly.

How the decades intertwine

The presented data makes it possible to observe some similarities between the two periods. In both cases, we see a recovery from a major global shock. In the last century, it was WWI, and in this century, the pandemic.

These two events brought high inflationary pressure, which was controlled in the 1920s but remains a challenge for current economies.

A third important point is the increase in productivity, which was first achieved through the implementation of industrial techniques like Fordism, and now through the intensive use of AI.

Optimism in the economy is also a strong factor seen in both decades, driving consumption considerably.

Final Thoughts

Just like in the 1920s, we might be in a very promising decade. The increase in productivity driven by the advancement of new technologies is essential to leading economic growth.

On the other hand, controlling inflation and public debt are major challenges for the U.S. government.

Through Truflation, you can track daily updates on inflation and the AI Index.

Stay updated on economic news to see if we’ll experience another roaring '20s.

Truflation Website | TRUF.Network | X | Linkedin | Discord | Telegram | Github| YouTube