A Close Look at India’s Macroeconomic Landscape

India’s over 1.4 billion inhabitants have recently surpassed China to become the most populous country in the world. This vast population is predominantly concentrated in rural areas, where agriculture is central to the economy and daily life.

Since independence in 1947, India has established itself as the largest democracy in the world, governed by a republican constitution and a parliamentary system.

The country faces the challenge of balancing its agricultural heritage with the growing need for industrialization and urbanization while working to integrate rural communities into broader economic growth. With nearly half of the workforce still engaged in the primary sector, India continues to rely heavily on land and natural resources, even as it modernizes into a more diversified, tech-driven economy.

Truflation has now entered the Indian market to deliver agile and precise economic data, connecting with more than 8 million data points in India.

The efficient use of high-frequency updated data not only supports greater growth for this emerging nation but also enables better decision-making for investors accessing this market.

Economic and Social Aspects

With one of the five largest GDPs globally and one of the fastest growth rates, the Indian economy is characterized by a mix of traditional sectors such as agriculture and modern industries like information technology and financial services.

India's shift towards a more urbanized and digital economy has been driven by reforms since the 1990s, including market liberalization, incentives for foreign investment, and efforts to streamline the regulatory landscape. With a young population and a growing middle class, India has a vast consumer market.

Gross domestic product (GDP)

India has become the fifth-largest economy in the world, trailing only the US, China, Germany, and Japan. As cited earlier, the primary sector plays a significant role in India, employing more than 50% of the population.

- Agriculture, forestry, and fishing account for about 12% of the GDP, with notable agricultural production including sugarcane, rice, corn, bananas, mangoes, guavas, and wheat.

- In terms of natural resources, which are an important source of exports, the dominant resources are: oil, natural gas, coal, diamonds, iron ore, lead, limestone, and bauxite. Mining, quarrying, electricity, gas, and water supply together account for 5% of the GDP.

- Manufacturing (15%) and construction (8%) complement the economic output. According to Fortune India, 4 out of the 5 largest companies in India are in the oil and gas sector.

- Despite having a larger share of workers in the primary sector, it is the service sector that drives the Indian economy, contributing 60% of the GDP. Consequently, a significant portion of the rural population does not have a high standard of living.

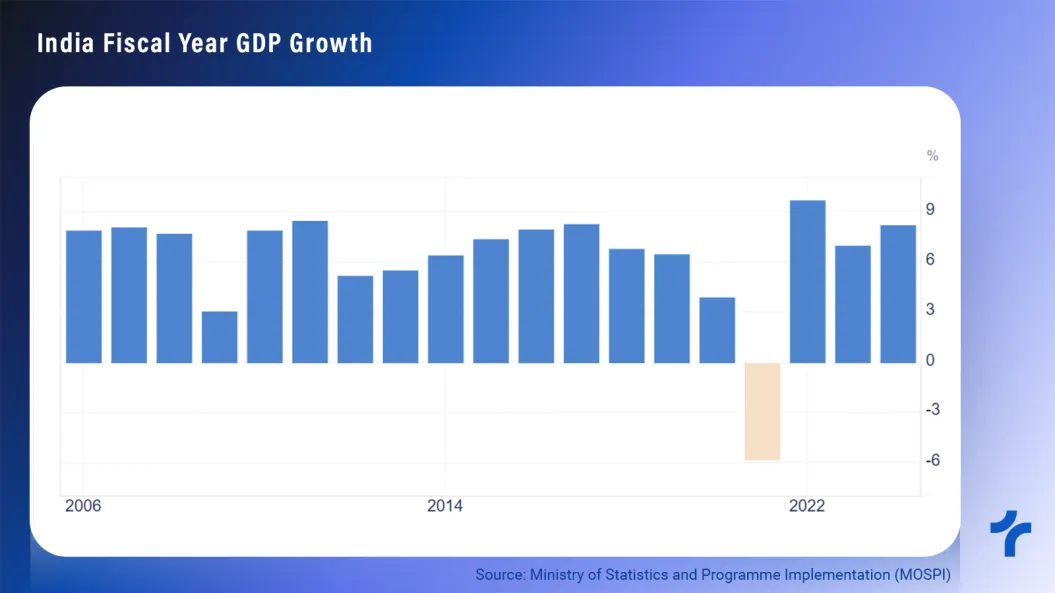

India has shown a strong recovery after the pandemic. In the fiscal year 2021, the Indian economy contracted by 5.8%, following the global trend. However, over the next three years, it experienced a cumulative growth of 27%.

Since the fiscal year 2006, the Indian economy has failed to achieve growth above 5% in only three years (2009, 2020, 2021), all of which were years of global economic challenges. During this period, India's GDP grew by 218%, representing an average growth of 6.27%.

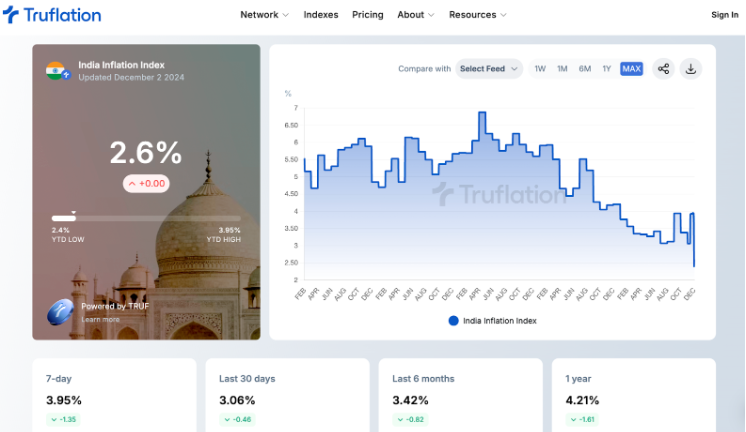

Inflation Rates

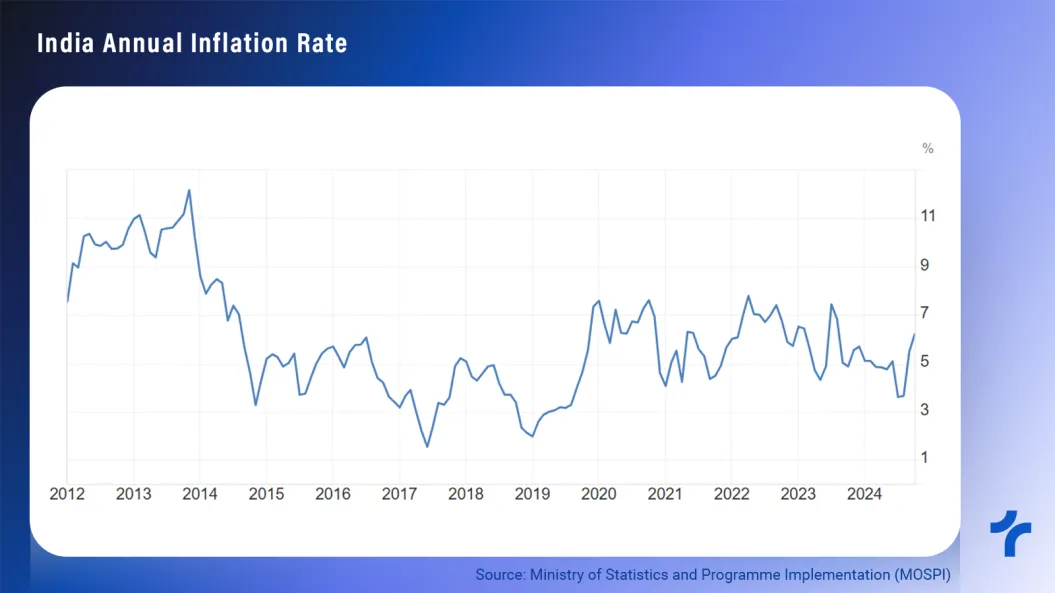

When addressing inflation, it is essential to consider that India is an emerging economy, and therefore, normal inflation levels are higher compared to developed economies. The Reserve Bank of India (RBI) has set an inflation target of 4% per year, with a tolerance range of 2 percentage points.

- From 2015 to 2020, inflation remained within this tolerance range. However, after the pandemic, it frequently exceeded 7%.

- After peaking at 7.44% in July 2023, inflation began to decline, reaching 3.6% a year later. Currently, inflation has risen sharply, surpassing the upper tolerance limit (6%) in October.

- Although inflation has not become a severe issue for India in recent years, the current trajectory is far from comfortable.

However, as shown in the graph, inflation is highly volatile, with changes exceeding 200 basis points from one month to the next. This highlights the need for a system that updates data with high frequency, providing greater clarity for decision-making.

Unemployment

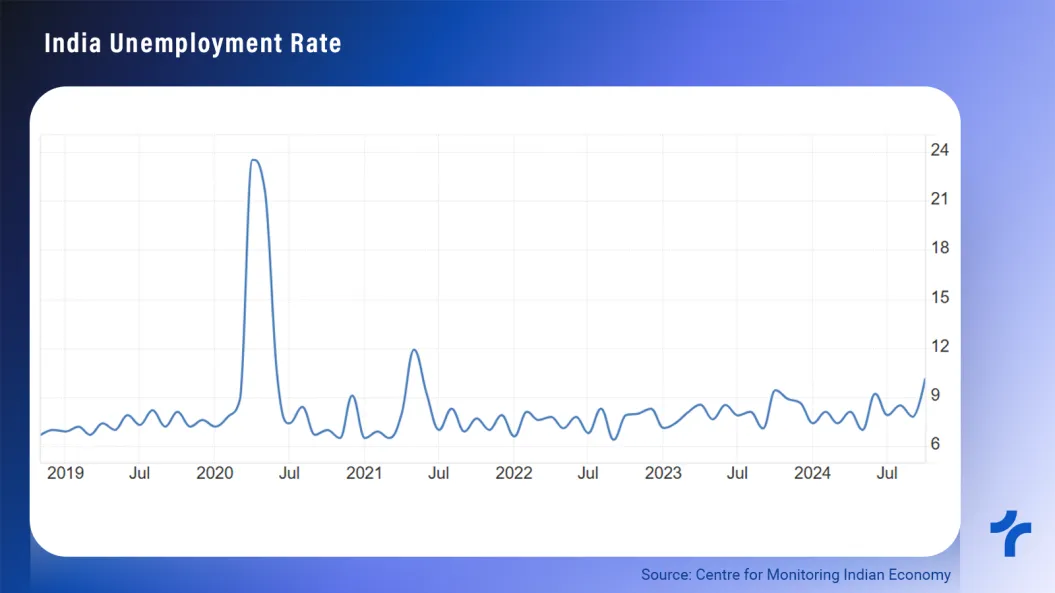

Overall, India's unemployment rate is slightly higher than that of other emerging markets:

- Typically ranging between 7% and 8% since 2019.

- There was a significant spike in unemployment in October, rising from 7.8% to 10.1%.

- On one hand, this indicates that the economy is not utilizing its full potential, with a considerable portion of the workforce idle.

- On the other hand, when these workers are employed, they can boost the economy without exerting strong upward pressure on wages.

Public Debt

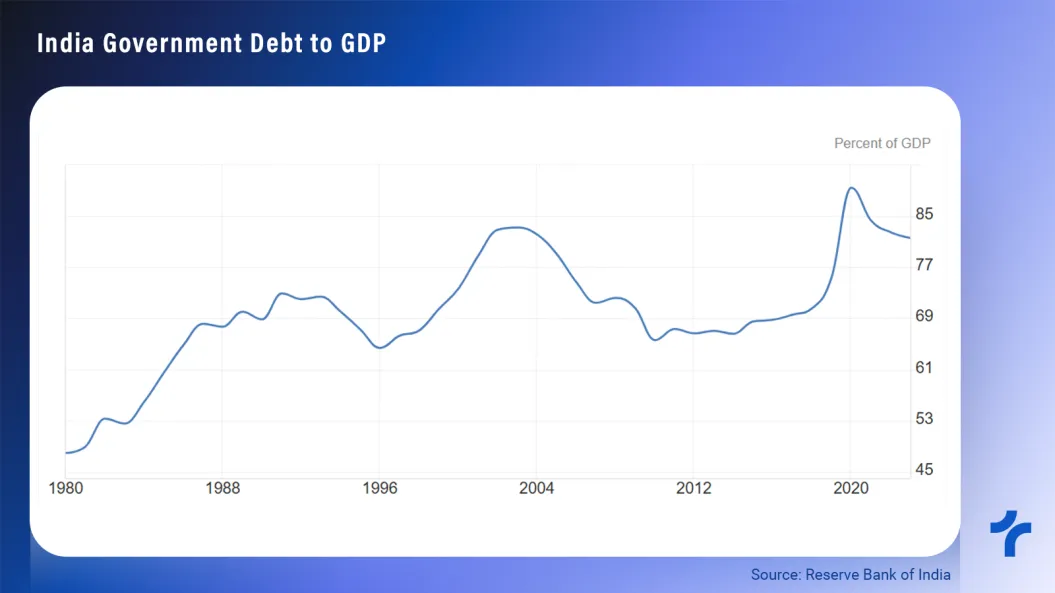

When analyzing India's public debt, it is evident that it has remained relatively controlled in the 21st century, particularly with a decline from 2004 until 2020, when the pandemic demanded increased spending.

In 2020, the debt reached nearly 90% of GDP, but an improvement was observed, ending 2023 at 81.59%.

Despite being under control, this stability is primarily due to the country's high GDP growth, which allows for debt expansion. If economic growth continues, the debt-to-GDP ratio is likely to remain manageable.

Urbanization

Currently, approximately 36% of India’s population lives in urban areas, and the urban population is increasing at an annual rate of 2.2%.

Accelerated urbanization poses challenges, including the need for adequate infrastructure, affordable housing, and efficient urban services.

Megacities like New Delhi and Mumbai are seeing continuous population growth, with each housing more than 20 million people.

Projections indicate that by 2035, 675 million Indians will reside in cities, and by 2050, the urban population will surpass the rural population.

Where is India Heading?

India has shown strong growth in recent years, outpacing many other emerging markets. While its per capita income remains low compared to global standards, the country has made significant progress since 2020, fueling optimism that it could eventually transition into a middle-income nation.

The future progress of India will depend on more efficient labor market allocation and productivity improvements, particularly through technological advancements. This is especially important in agriculture, where a large portion of the workforce is employed.

India Inflation Index

High inflation volatility and data reliability in the Consumer Price Index (CPI) is a growing concern for the country. This has led to a rising demand for accurate, real-time data to support informed financial decision-making.

To meet this demand, Truflation developed the India Inflation Index in collaboration with local agencies to ensure accuracy and transparency. Despite this collaboration, the data remains independently maintained and verified, upholding its integrity and objectivity. The official launch of the Index is set for December 6th.

Using blockchain infrastructure and decentralized oracles, the Truflation India Index tracks more than 8 million price points of goods and services compared to the traditional index, which includes only 25,000 data points.

The list of data providers is continuously expanding. Current partners include (but are not limited to) NielsenIQ, Big Mac Index, Numbeo, Trivago, Kayak, CarDekho, and the Rental Index.

Key Features:

- 30x Faster Updates: Daily inflation data updates compared to traditional tools.

- Comprehensive Data: Utilizes over 30 million data points around the world (8+ million in India) from 80+ providers (10+ in India) for a detailed view.

- Transparent Algorithms: Open-source metrics deliver unbiased insights.

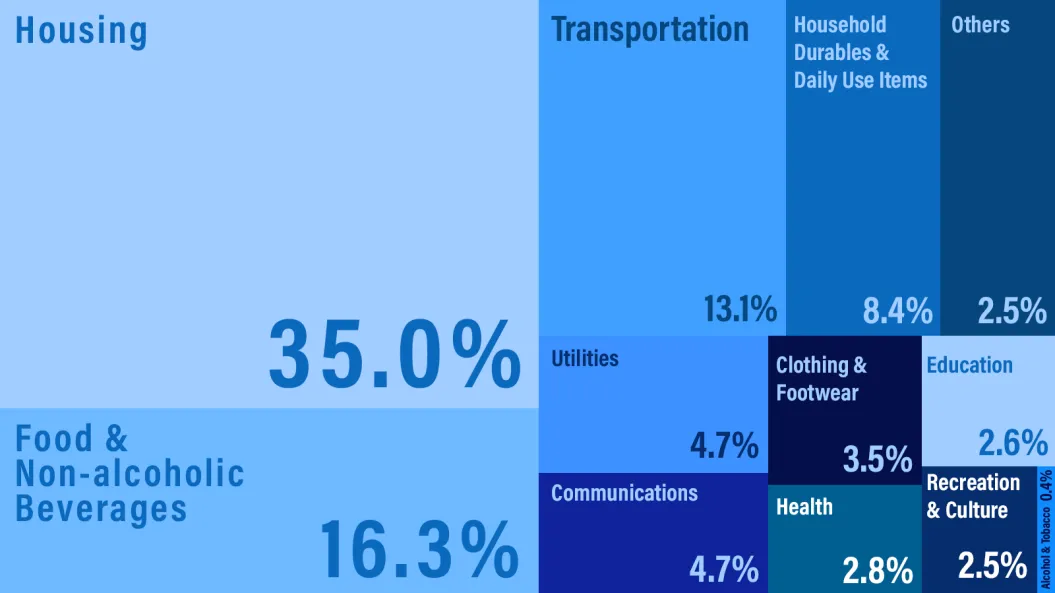

- Real-World Focus: Measures essential expenses, including housing, food, transportation, and energy.

By providing transparent and independent data, Truflation aims to restore trust and offer reliable information for economic planning and decision-making. The India Inflation Tracker empowers consumers and businesses with actionable insights to navigate the complexities of inflation.

Truflation's methodology for calculating inflation uses the same categories across different countries. However, the weight of each category in the inflation calculation depends on each country. In India, the following weights are used:

Final Message

India remains a key player in the global economy, largely due to its size and population. However, its per capita GDP is still relatively low, highlighting ongoing challenges in raising living standards.

While the country has experienced steady economic growth in recent years, along with stable inflation and low-income inequality, it is still far from becoming a developed nation. Economic reforms have improved its position, but there’s a long way to go before India reaches its full potential.

This makes accurate, up-to-date economic data essential—not only for policymakers but also for businesses and consumers adapting to inflationary pressures. Recognizing this need, Truflation is entering the Indian market with its India Inflation Index set to launch on December 6. The tool aims to provide real-time, independent inflation data, offering a more transparent and reliable alternative to traditional methods.

Investors looking to tap into India’s growth must stay informed, and Truflation’s data could be key in navigating this emerging market.